Credit Cards

Revvi Card Review: Earn 1% cash back

The Revvi Card is a credit card for those who want to build or improve their score. It has 1% cashback, but pay attention to interest and fees!

Advertisement

Enjoy Cashback while your credit score turns green

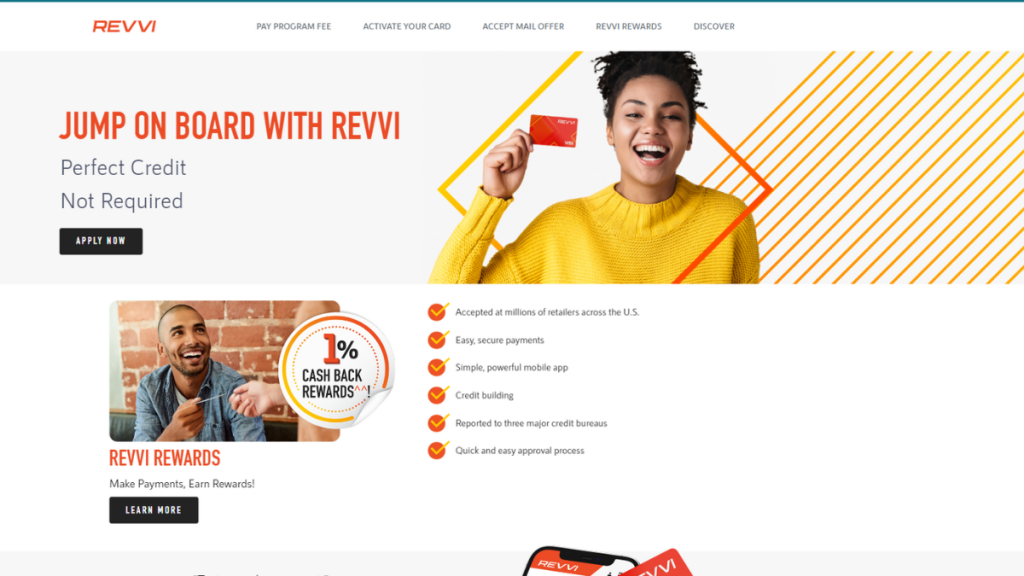

Today we will discuss the Revvi Card, a credit card issued by MRV Banks. This is a review of a card that is great for people who are looking to build credit.

In addition, you’ll get access to 1% cashback on your purchases made with the Revvi Card, which can be a great way to get an immediate return.

| Credit Score | Fair score credit. Average approved score: 580; |

| Annual Fee | $75.00 for first year. After that, $48.00 annually. Plus others fees; |

| Purchase APR | 35.99%; |

| Cash Advance APR | 35.99%; |

| Welcome Bonus | None; |

| Rewards | Earn 1% cash back rewards on purchases! |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Revvi Card

The Revvi Card has a low starting credit limit of just $300. The good news is that it’s perfect for someone who needs to improve their credit score.

In addition, you can earn 1% cash back on purchases made with this card. Which makes your credit-building journey even more rewarding.

Revvi Card also brings an amazing mobile app to help you manage your credit card. So, through it, you can make payments, view transactions, and more!

Plus, it is widely accepted by millions of retailers across the country! And you can even choose your card’s design!

Revvi Card: is it worth it?

Yes, the Revvi Card is a good option for people looking to build credit.

It is true that the interest rate can be considered high and that the annuity is not cheap either.

Ultimately, you need to put everything on the scale and see what you need from a credit card given the current situation of your credit score.

Therefore, take a closer look at the Revvi Card.

Advertisement

Pros

- Low minimum credit score required;

- The card provides reward points;

- You won’t pay a fee for cash withdrawals in the first year;

- Your credit will be monitored by the TransUnion credit agency, meaning there will be; reports of your new payment history, which will help improve your score!

Cons

- The purchase interest rate may be considered above average;

- A monthly service fee is charged after the first year of exemption;

- A program fee is charged; you only make this payment once;

- Annual fee of $75 for the first year;

- A cash withdrawal interest rate of 35.99% can be considered high.

Advertisement

Credit score requirements for card application

With a credit score of 580, you can likely apply for a Revvi Card.

Ready to apply? Here’s how to get the Revvi Card

If you are interested in the Revvi Card, you can apply online. But before you start that application, see what we’ve separated about the process.

The official Revvi Card website promises that you can do this process in seconds. But in such a short time, it is possible that you will miss something. Not here!

Applying for your card: Online

The Revvi Card website is designed for a quick and secure experience. Buckle up and see how your journey will be.

When you access the website, you will be greeted by the application form. Fill it out carefully and pay attention to all the information.

A one-time, upfront program fee of US$ 95.00 will be required.

It must be paid in full within 60 days of your application approval and before your account is opened.

Requirements

To be approved for the Revvi Card, you must meet the following basic requirements.

In addition to being over 18 years old and having a United States address, you must provide your SSN, and your credit history will be verified.

Applying for your card: App

There is also another way to apply for your Revvi Card, through the mobile app.

The steps are very simple and intuitive. You have certainly done this step-by-step more than once.

Download the app, locate the Revvi Card and follow the instructions on the screen.

To apply for the card through the app, you will need to provide the same information that you would provide if you were applying for the card online.

In addition, you will need to take a photo of your face and a photo of your ID.

Revvi Card or Reflex® Platinum Mastercard®?

Just because you don’t have the best possible credit score doesn’t mean the credit card market doesn’t have options for you. On the contrary.

Many tools are designed exclusively to help you on your credit score journey. Check out the comparison of two excellent options.

| Revvi Card | Reflex® Platinum Mastercard® | |

| Credit Score | Fair score credit. Average approved score: 580; | Good or bad credit. Average approved score: 580; |

| Annual Fee | $75.00 for first year. After that, $48.00 annually. Plus other fees; | $75 to $125 in the 1st year – $99 to $125 after; |

| Purchase APR | 35.99%; | 29.99% (variable); |

| Cash Advance APR | 35.99%; | 29.99% (variable); |

| Welcome Bonus | None; | None; |

| Rewards | Earn 1% cash back rewards on purchases! | Not available. |

It’s important to know what’s out there before you fill out forms. With this in mind, we created our materials. Check out this grouping of useful information.

Apply for Reflex® Platinum Mastercard®

Discover how to apply for the Reflex® Platinum Mastercard® and double your credit! Don't miss your chance – read now!

Trending Topics

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep Reading

650 Credit Score: Is It Good? A Guide to Credit Health

Find out if 650 is a good credit score and what type of loans and credit cards you can get with this three-digit number in your hands!

Keep Reading

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep ReadingYou may also like

Choose Your Credit Card Wisely: Make The Smart Choice!

Make the smart choice in choosing your credit card! Dive into the world of advantages and drawbacks, rewards and risks!

Keep Reading

Upgrade Cash Rewards Visa® Review: Radical Cashback, Relaxed Fees

It's time to learn about Upgrade Cash Rewards Visa®. Does not charge an annual fee. See everything in the full review!

Keep Reading

Apply for Mission Lane Visa® Credit Card: for all types of credit

Learn how to apply for your Mission Lane Visa® Credit Card without fear of credit checks! We’ll tell you how to do it in this post!

Keep Reading