Credit Cards

Avant Credit Card Review: Move Forward Towards Perfect Credit!

In this review, we discuss every aspect of the Avant Credit Card. The illuminated side and also the possible shadows of this card. Check it out now without leaving home.

Advertisement

Totally adaptable, but the goal is one: Credit!

A review to help you reach your Goals. Do you dream of a life where you can relax in the sun with a cold drink in your hand? The Avant Credit Card can help you get there.

The Avant Credit Card is designed for people who are looking to build their credit. With variable costs based on your profile, it’s a great way to improve your credit score.

| Credit Score | Fair; |

| Annual Fee | Variable membership fee from $0 to $75; |

| Purchase APR | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Cash Advance APR | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Welcome Bonus | N/A; |

| Rewards | N/A. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Avant Credit Card

The Avant Credit Card, as well as other Avant credit products, are issued by WebBank. This review is against Avant Credit Card, the family builder.

More to the point, your limit might not change your life, okay? I say this because the Avant Credit Card’s credit limit ranges between $300 and $3,000. But it’s designed for more than shopping.

The truth is that the Avant Credit Card reports your payment histories, which helps you improve your credit and is actually very transparent about its costs.

By the way. an important detail about the costs of the Avant Credit Card. There is a variation in prices. These differences occur based on offers provided by some specific channels.

If you have been awarded a mailed offer, it will certainly have some specific terms. It’s worth the attention.

Avant Credit Card: is it worth it?

Yes, you just need to know how to use the Avant Credit Card. There is even a way to make purchases without paying interest.

Simply pay the full balance of your bill and remain on time for payment.

Advertisement

Pros

- A card designed to improve your score: Simply correctly using the Avant Credit Card is enough;

- Quick and easy registration process;

- Your account will be periodically reviewed based on your transactions and payments with a view to increasing your credit line;

- The good news is that apart from the fees described in the list below, there are no undesirable surprises when using your Avant Credit Card;

- Just follow the tips for using this review to enjoy a healthy relationship with the Avant Credit Card.

Cons

- If your annual fee is not zero, it will be deducted from your credit limit. Once your annual fee is assessed, the amount will be reduced from your initially available credit limit;

- Pay attention to the late fee, which can reach up to $39.

Advertisement

Ready to apply? Here’s how to get the Avant Credit Card

We reached the end of the review with few doubts about the potential of the Avant Credit Card.

You may be wondering how to put one of these in your wallet. Let’s see it!

Applying for your card: Online

There is an important detail to consider when applying online. According to the official website, specific terms exist for those who apply this way.

Click on it and fill in your information. At this point, you will be asked for personal data, Social Security Number and phone number.

Then, you will create your login. It is also at this time that you will inform, if applicable, your promotional code. Then, simply agree and submit.

It is also important to note that when opening your account, you may be asked to see your driver’s license or other identification document.

Requirements

As previously mentioned, your standard identification documents will be requested.

Besides that, the card does not specify a minimum credit score for application.

However, for a card of this standard, we can assure you that a fair score is all that is required. In other words, a score of 580 or above, according to FICO.

Applying for your card: App

When using your Avant Credit Card, you will have access to the mobile app’s features.

However, to request your Avant Credit Card, you must complete the process via the official website.

Avant Credit Card or Surge® Platinum Mastercard®?

If you got here, you’ve come a long way. You have achieved a positive credit score and want to know your range of options.

We bring you another excellent credit builder. You can call it the Surge® Platinum Mastercard®.

| Avant Credit Card | Surge® Platinum Mastercard® | |

| Credit Score | Fair; | Good or bad credit. approved average score: 600; |

| Annual Fee | Variable membership fee from $0 to $75; | First year: $75 to $125. Subsequent years: $99 to $125; |

| Purchase APR | From 29.24% to 35.24% Variable based on the Prime Rate; | 29.99%; |

| Cash Advance APR | From 29.24% to 35.24%Variable based on the Prime Rate; | 29.99% to 35.99%; |

| Welcome Bonus | N/A; | N/A; |

| Rewards | N/A. | N/A. |

Both cards have similar fees and are designed for those who need to improve their credit score.

If you are willing to give up rewards programs for the responsibility of building your future, this is what you need!

Apply For Your Surge® Platinum Mastercard®

Find out how to apply for the Surge® Platinum Mastercard® and take the first step toward building your credit!

Trending Topics

650 Credit Score: Is It Good? A Guide to Credit Health

Find out if 650 is a good credit score and what type of loans and credit cards you can get with this three-digit number in your hands!

Keep Reading

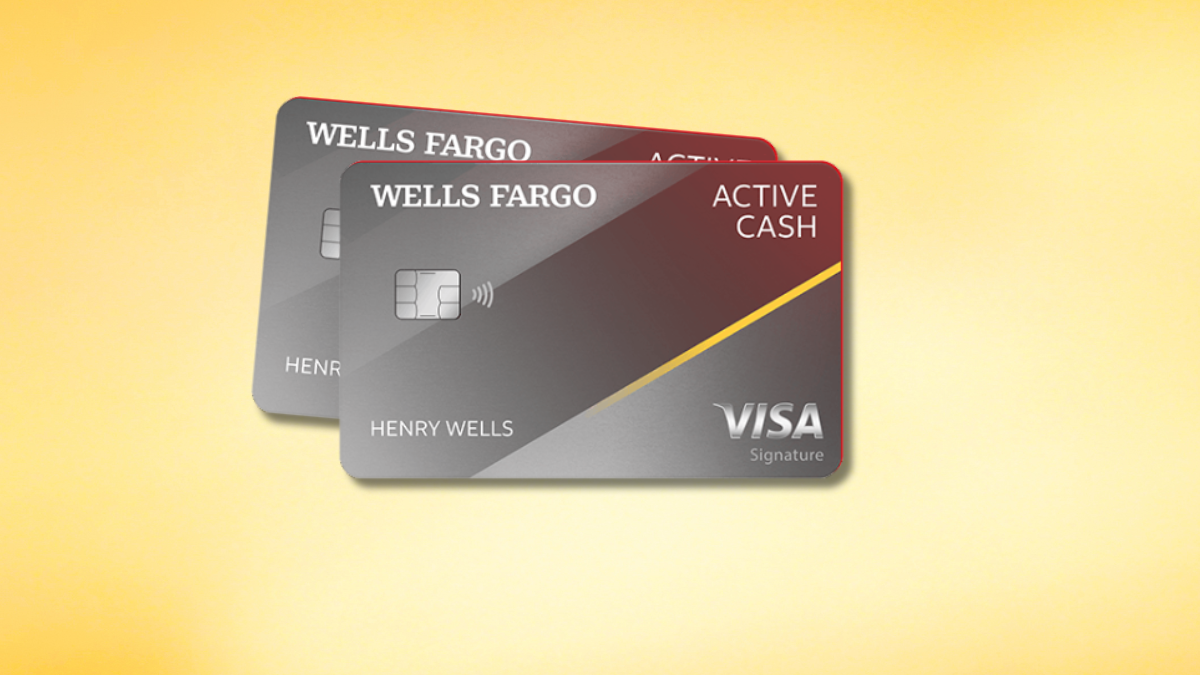

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Unlock the power of rewards with the Wells Fargo Active Cash® Card! Dive into our review and explore the world of real Cashback.

Keep Reading

Walmart MoneyCard® Review: Cashback is in the house!

Unlock cashback rewards and potential fee waivers with the Walmart MoneyCard®! Dive into our comprehensive review to discover it!

Keep ReadingYou may also like

First Access Visa® Card Review: A Gateway to Credit Accessibility

First Access Visa® Card Review: Explore a pathway to credit accessibility with 1% cashback rewards. Is it worth it? Discover it!

Keep Reading

Revvi Card Review: Earn 1% cash back

Revvi Card: Cashback and points for those with bad credit! Low requirements are required, but pay attention to interest

Keep Reading

FIT Mastercard® Review: Build your credit score on your way!

Explore a FIT Mastercard® Review: Elevate your credit score effortlessly! Embarking on a credit-building journey.

Keep Reading