Credit Cards

Reflex® Platinum Mastercard® Review: The new double credit!

Reflex® Platinum Mastercard® - build credit quickly! Free monthly credit score access + amazing benefits! Keep reading and learn more!

Advertisement

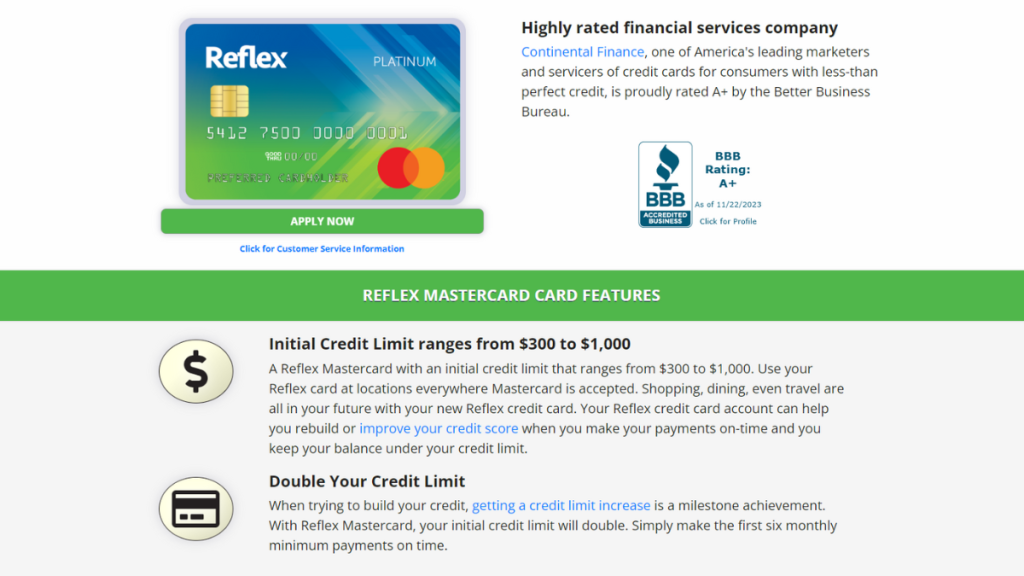

Double your initial limit of up to $1,000

What do you expect when applying for a card is that it is affordable and easy to obtain, right? That’s what the Reflex® Platinum Mastercard® offers.

In this review, we’ll take a look at all the pros and cons of the Reflex® Platinum Mastercard®, so you can decide if it’s right for you.

| Credit Score | Good or bad credit. Average approved score: 580; |

| Annual Fee | $75 to $125 in the 1st year – $99 to $125 after; |

| Purchase APR | 29.99% (variable); |

| Cash Advance APR | 29.99% (variable); |

| Welcome Bonus | None; |

| Rewards | Not available. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Reflex® Platinum Mastercard®

The Reflex® Platinum Mastercard® is a no-deposit credit card that offers approval for people with all credit types.

The card also offers purchase protection and travel insurance. But, indeed, its major features is credit building.

As such, it monthly reports your payments to all three major credit bureuas.

In addition, you can access your credit score every month – and the best part is that it is for free! So you can track your credit easily!

Plus, you can count on an amazing mobile app to help you better manage your card. Isn’t it great?

Reflex® Platinum Mastercard®: is it worth it?

The Reflex® Platinum Mastercard® is a good option for people looking for an affordable credit card with easy approval.

The card also offers purchase protection and travel insurance. However, the card has a high interest rate and an annual fee after an intro period.

Advertisement

Pros

- No-deposit approval: The Reflex® Platinum Mastercard® stands out by offering approval without the need for a down payment, providing access to credit even for those who may not have initial funds;

- Purchase protection and travel insurance: Cardholders enjoy additional security with the inclusion of purchase protection and travel insurance, providing peace of mind on their journeys;

- Access to Mastercard rewards: Allowing users to accumulate benefits and advantages when making qualifying purchases;

- Initial credit limit doubles with time: Standing out even more, the Reflex® Platinum Mastercard® surprises by doubling the initial credit limit.

Cons

- Interest rate can be considered high: One of the things to consider is the significantly high-interest rate associated with the card, which could result in additional costs for cardholders who maintain unpaid balances;

- Annual fee: This card requires a higher annual fee.

Advertisement

Credit score requirements for card application

Continental Finance generally approves applications from people with a credit score of 580 or higher.

It is important to note that this is just one of the factors that will weigh in on whether your application is approved.

That’s why it’s important to fill out your application form carefully and provide all required documentation to get your Reflex® Platinum Mastercard®.

Ready to apply? Here’s how to get the Reflex® Platinum Mastercard®

To apply for the Reflex® Platinum Mastercard®, you can do so online or by phone. You can also apply through the mobile app.

But before you start this process, it’s important to know everything you’ll need, the steps, and how to make this request even simpler.

Follow along below!

Applying for your card: Online

To apply for the Reflex® Platinum Mastercard® online, first visit the Continental Finance website.

The list of cards provided is large, so search for the Reflex® Platinum Mastercard® and then click “Apply for Card.”

Fill out the application form and submit the required documentation.

Then simply wait for your application to be reviewed and, if everything is in order, you’ll be approved!

Applying for your card: App

Use our mobile app to manage your account anytime, anywhere.

You can safely and easily download the app from the major app stores, such as the App Store and Google Play.

The process is similar to filling out an online application.

Reflex® Platinum Mastercard® or Surge® Platinum Mastercard®?

What you expect when applying for a credit card is that it is affordable and easy to obtain, right?

That’s what the Reflex® Platinum Mastercard® from Continental Finance is.

In this review, we’ll take a look at all the pros and cons of the Reflex® Platinum Mastercard®, so you can decide if it’s right for you.

| Reflex® Platinum Mastercard® | Surge® Platinum Mastercard® | |

| Credit Score | Good or bad credit. Average approved score: 580; | Good or bad credit. approved average score: 600; |

| Annual Fee | $75 to $125 in the 1st year – $99 to $125 after; | First year: $75 to $125. Subsequent years: $99 to $125; |

| Purchase APR | 29.99% (variable); | 29.99%; |

| Cash Advance APR | 29.99% (variable); | 29.99% to 35.99%; |

| Welcome Bonus | None; | None; |

| Rewards | Not available. | None. |

That’s why it’s important to understand your needs and how these credit tools can help you.

Apply For Your Surge® Platinum Mastercard®

Find out how to apply for the Surge® Platinum Mastercard® and take the first step toward building your credit!

Trending Topics

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep Reading

Pick Your Credit Card for Fair Credit: Make the Right Decision!

Find your perfect match with our guide on how to choose the best credit card for fair credit, tailored to fit your financial lifestyle.

Keep Reading

How to Save Money: 7 Strategies for Financial Freedom

Discover 7 effective strategies how to save money and build wealth, from creating a budget to establishing an emergency fund.

Keep ReadingYou may also like

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Keep Reading

PenFed Platinum Rewards Visa Review: Earn Extra Cashback Points

Explore our comprehensive PenFed Platinum Rewards Visa Signature® Card Review for an in-depth look at its perks. No annual fee and Cashback!

Keep Reading

Chime® Debit Card Complete Review: No fees, no Hassle!

Unlock the full potential of your finances with our comprehensive Chime® Debit Card Review. Find out with our detailed insights!

Keep Reading