Earn cashback on the Walmart network, live the full experience!

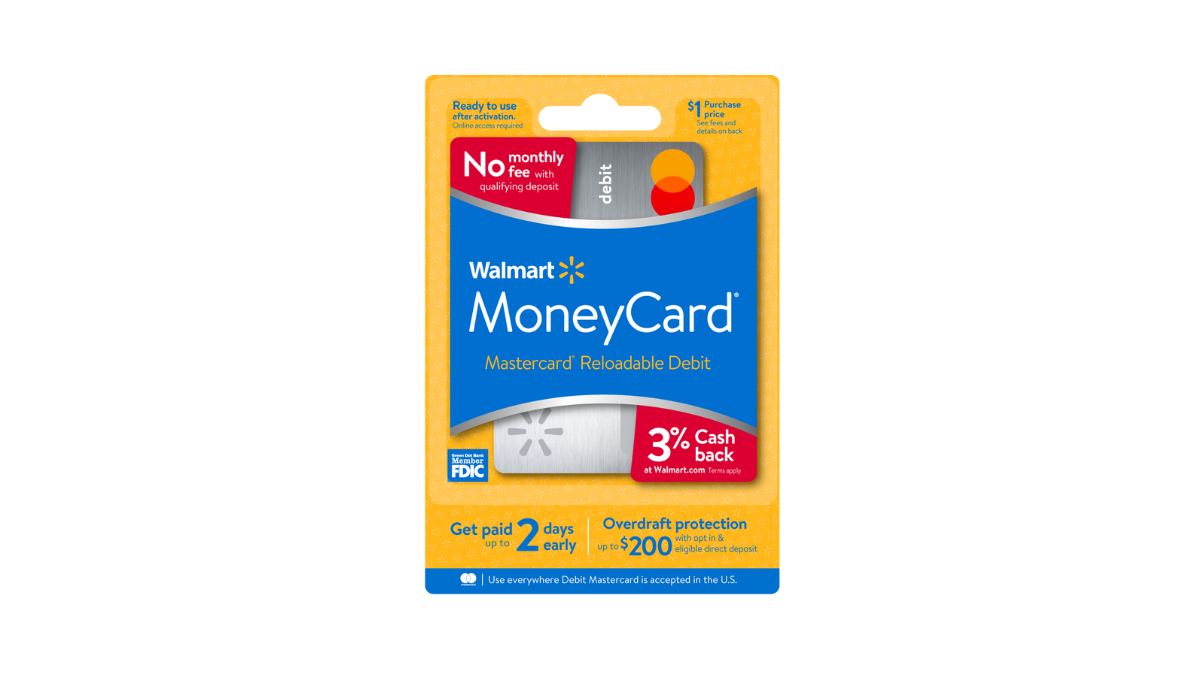

Walmart MoneyCard®: An affordable bank account for everyone

Advertisement

With the Walmart MoneyCard®, you can pay your expenses in a simple and convenient way. The account doesn’t require an initial deposit or maintenance fees and offers a 2% interest rate on savings! The Walmart MoneyCard® is the perfect solution for those seeking a straightforward, accessible, and convenient banking account. Shop anywhere that accepts debit cards, withdraw cash from the MoneyPass network, and even earn special cashback within the Walmart network.

With the Walmart MoneyCard®, you can pay your expenses in a simple and convenient way. The account doesn’t require an initial deposit or maintenance fees and offers a 2% interest rate on savings! The Walmart MoneyCard® is the perfect solution for those seeking a straightforward, accessible, and convenient banking account. Shop anywhere that accepts debit cards, withdraw cash from the MoneyPass network, and even earn special cashback within the Walmart network.

You will remain in the same website

Discover what makes the Walmart MoneyCard® one of the most requested cards in the USA. Each benefit makes you forget that it can be free for you.

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

A Walmart crafted this account after a long journey. It was designed with every aspect of Americans' lives in mind. As a result, it easily adapts to your routine.

Upsides and advantages

- Earn cashback on Walmart purchases: Take note of the highlight in this review. The Walmart MoneyCard® provides a 3% cashback on transactions made through the official Walmart website. Additionally, earn 2% cashback when fueling up at Walmart's fuel network and 1% cashback for every purchase at various Walmart physical stores nationwide.

- Advance Direct Deposit: A valuable perk if you require funds earlier in the month. For example, if you need to settle a bill or make a significant purchase, this feature can be a game-changer. Rely on this option!

- Overdraft protection up to $200 with opt-in: This functionality enables you to withdraw funds from your account even if the balance is insufficient. The Walmart MoneyCard® covers up to $200 in overdraft withdrawals for eligible customers.

- 2% APY on savings: Clients with a Walmart MoneyCard® savings account will earn a 2% interest on their account balance. This interest rate surpasses the average savings interest rate offered by both traditional and digital banks, which typically hovers around 0.06%. This positions you well ahead!

- Possibility of waiving the annual fee: To benefit from this feature, simply make a direct deposit of $500 into your account in the preceding month. Otherwise, a monthly fee of $5.94 will be applied.

Downsides and limitations

- Cash deposit fee: There is a charge of up to $4.95 for each cash deposit made into your checking account.

- Be mindful of certain fees: Each time you utilize overdraft protection, a $15 fee is applied. Additionally, there is a monthly limit for this feature.

- Caution when using your Walmart MoneyCard® outside the U.S: A 3% fee will be imposed on each transaction conducted in foreign currency.

- Card replacement fee: If you need to request a new Walmart MoneyCard®, a $15 fee will be incurred. If you consider this as a payment to continue an existing service, it might be somewhat uncomfortable.

- Initial Deposit Required: When activating an account starter package at a physical Walmart store, a deposit ranging from $20 to $500 is necessary.

- Limited withdrawal options: The Walmart MoneyCard® is only usable at MoneyPass network ATMs, totaling over 55,000 across the United States. However, this network is smaller compared to the ATM network of traditional banks.

So, it's easy to decide, right? Just be aware that there are some financial responsibilities. Knowing this, using the Walmart MoneyCard® should proceed smoothly, bringing various benefits to you and your family.

The Walmart MoneyCard® can be used to make purchases anywhere that accepts Mastercard®. To use the card, simply swipe or insert it at the checkout counter. You can also use the card to withdraw cash from ATMs.

Yes, the Walmart MoneyCard® is FDIC insured up to $250,000. This means that your money is protected in case the bank fails.

You can reload your Walmart MoneyCard® in a variety of ways, including: In-store reload: Reload your card at any Walmart store for a fee of $3.95. Direct deposit: Set up direct deposit from your paycheck or government benefits to your Walmart MoneyCard® account. Wire transfer: Wire money to your Walmart MoneyCard® account for a fee of $15. Money transfer service: Use a money transfer service like Western Union or MoneyGram to send money to your Walmart MoneyCard® account.

You can manage your Walmart MoneyCard® account online or through the Walmart MoneyCard® app. You can use these tools to view your account balance, make transfers, and set up alerts.

Yes, you can use the Walmart MoneyCard® to pay bills online or by phone. You can also use the card to make in-store payments at participating retailers.

Enjoy our top-notch content to make the best choices. Is a debit card too limiting for you? Then, explore the other side of the coin with the Avant Credit Card! Enjoy every line!

Apply for Avant Credit Card

Boost your credit score now! Get the Avant Card: quick approval, no credit score minimum, build real credit!

Trending Topics

The Wells Fargo Reflect® Card Review: Your Financial Freedom

Miss the interest-free introductory period and see everything you need to know in the Wells Fargo Reflect® Card Review

Keep Reading

Boost Platinum Card Review: Purchasing power on your horizon!

Boost Platinum Card. Review of The Horizon Outlet's merchandise card. Qualify with any type of credit score! Quick and simple application!

Keep Reading

Destiny Mastercard® Review: Rebuild Your Credit with Confidence

It’s time to reestablish your finances! Review the Destiny Mastercard® features to see how it can help - build credit quickly!

Keep ReadingYou may also like

PenFed Platinum Rewards Visa Review: Earn Extra Cashback Points

Explore our comprehensive PenFed Platinum Rewards Visa Signature® Card Review for an in-depth look at its perks. No annual fee and Cashback!

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Build credit!

Discover our comprehensive review of the Petal® 1 “No Annual Fee” Visa® Credit Card. It's time to build credit effortlessly!

Keep Reading

FIT Mastercard® Review: Build your credit score on your way!

Explore a FIT Mastercard® Review: Elevate your credit score effortlessly! Embarking on a credit-building journey.

Keep Reading