Credit Cards

Boost Platinum Card Review: Purchasing power on your horizon!

Clear all your doubts about the Boost Platinum Card, from its costs to key benefits. The Horizon Outlet merchandise card.

Advertisement

Where your bad score means nothing

Don’t think that your low credit will close all doors. Here’s a review to redefine your lack of credit. Get to know the Boost Platinum Card and buy again.

We’ve analyzed every point of attention in the Boost Platinum Card, also the benefits that will come along with this card from The Horizon Outlet.

| Credit Score | Bad score; |

| Annual Fee | Annual Membership Fee $177.24; |

| Purchase APR | N/A; |

| Cash Advance APR | N/A; |

| Welcome Bonus | N/A; |

| Rewards | N/A. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

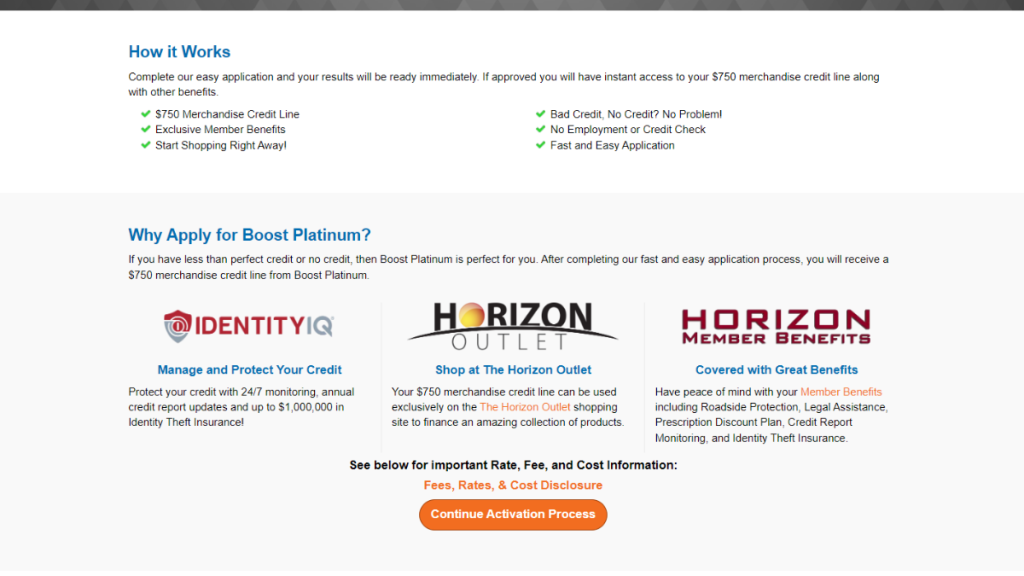

The ins and outs of the Boost Platinum Card

Here’s an option that doesn’t have much to hide. The Boost Platinum Card is simple and here in this review, you will become an expert on the subject of The Horizon Outlet.

Firstly, you must know that you can apply for this card with any type of credit score. Allowing you to empower your finances quickly!

Their application process is simple and quick, and once approved, you’ll get a $750 merchandise credit line!

In addition, enjoy amazing benefits at Horizon Outlet, including Roadside Protection, Legal Assistance, a Prescription Discount Plan, and much more!

Boost Platinum Card: is it worth it?

The Boost Platinum Card surprises those looking for “just a merchandise card”.

This is because it comes with some benefits and advantages that can be very useful.

See this without forgetting to pay attention to the fine print when purchasing the Boost Platinum Card.

The menu with special selections from The Horizon Outlet awaits you after this review.

Advertisement

Pros

- No credit check: This is the place for those needing a guiding light at the end of the tunnel; to apply for your Boost Platinum Card, a good credit score is not required;

- No security deposit: Unlock up to $750 in credit limit;

- No activation fee: Your Boost Platinum Card has arrived by mail? Fantastic! You won’t pay anything to activate it;

- 7 days to change your mind: After applying for the Boost Platinum Card, you’ll have a week to cancel your request;

- No payment requirements for purchases on The Horizon Outlet website;

- No employment requirements or restrictions for those with a history of past bankruptcies.

Cons

- You cannot use the Boost Platinum Account to cover shipping fees for your purchases;

- Your application may be denied without reason: On the official website, the company reserves the right to reject any application for any reason or without apparent cause;

- Beware of hidden fees: The company may charge fees for message delivery and data usage, for example. Therefore, be vigilant, as you can modify these conditions by contacting customer service.

Advertisement

Credit score requirements for card application

Great news for those without a good credit score or with no credit at all. The exciting part is that to get a Boost Platinum Card, your credit score will not be checked.

You just need to have a functional credit or debit card to link to pay Boost Platinum Card fees.

This shows that your score supports the minimum payment condition.

Ready to apply? Here’s how to get the Boost Platinum Card

Even with a low credit score, you can apply for the Boost Platinum Card and make the habit of buying again a reality for you and your family.

However, it’s always good to be attentive to the costs involved. This way, you can determine if the Boost Platinum Card is truly a good option for you.

Applying for your card: Online

The official website of the Boost Platinum Card is simple and straight to the point. At their website, enter your email address, and you’re ready to go.

You will now be in the application process for your Boost Platinum Card. Next, you’ll move on to the section to fill in your details.

Most importantly, pay attention when completing your financial information, as this will determine whether your card is approved or not.

During this process, towards the end, you can indicate whether you would like to receive any salary or government benefits into your new account, which can be an extra benefit.

To conclude, double-check that all information is correct. Submit the application and keep your fingers crossed for approval. You will be notified about the status of your application.

Requirements

To become a member of The Horizon Outlet group with your Boost Platinum Card, you’ll need to meet certain requirements.

For obvious reasons, you must be at least 18 years old.

Before applying for the Boost Platinum Card, you’ll need to already have an active and valid credit or debit card within the USA, as it will be linked to your account.

Applying for your card: App

Unfortunately, it will not be possible to apply for your Boost Platinum Card via the mobile app.

Boost Platinum Card or FIT Mastercard®?

In the great sea of credit options in America, there are types of cards.

As we have seen, the Boost Platinum Card is not a credit card and does not help you build credit.

We know that your intention may be to improve your score and buy in installments.

So here is the FIT Mastercard®. A bad score will not be an obstacle, and he reports his score to the 3 main agencies in the country.

| Boost Platinum Card | FIT Mastercard® | |

| Credit Score | Bad score; | Bad score; |

| Annual Fee | Annual Membership Fee $177.24; | $99; |

| Purchase APR | N/A; | 22,99%; |

| Cash Advance APR | N/A; | 25,99%; |

| Welcome Bonus | N/A; | N/A; |

| Rewards | N/A. | N/A. |

We have prepared a complete article about the FIT Mastercard® for this purpose. Yes, our content guides you on this journey at all times.

Apply for the FIT Mastercard®

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Trending Topics

PenFed Pathfinder® Rewards Visa Signature® Card Review: Earn more

Discover the ultimate travel companion with our PenFed Pathfinder® Rewards Visa Signature® Card Review! Up to 4x points on purchases!

Keep Reading

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep Reading

750 Credit Score: Is It Good?

Is 750 a good credit score? It can open doors to the best financial opportunities. Learn how to transform your creditworthiness!

Keep ReadingYou may also like

Reflex® Platinum Mastercard® Review: The new double credit!

Discover the power of the Reflex® Platinum Mastercard® - the new double credit! Get the credit you want, even with bad credit

Keep Reading

Destiny Mastercard® Review: Rebuild Your Credit with Confidence

It’s time to reestablish your finances! Review the Destiny Mastercard® features to see how it can help - build credit quickly!

Keep Reading

Walmart MoneyCard® Review: Cashback is in the house!

Unlock cashback rewards and potential fee waivers with the Walmart MoneyCard®! Dive into our comprehensive review to discover it!

Keep Reading