Here, your bad score is nothing but a thing of the past. Meet your new friend!

Reflex® Platinum Mastercard®: affordable credit for everyone

Advertisement

A really affordable credit card. Get access to credit without an initial deposit with approval for all scores and build credit quickly! Enjoy free monthly credit score access plus a wide range of benefits to help you achieve your financial goals! So yes, the Reflex® Platinum Mastercard® is for you!

A really affordable credit card. Get access to credit without an initial deposit with approval for all scores and build credit quickly! Enjoy free monthly credit score access plus a wide range of benefits to help you achieve your financial goals! So yes, the Reflex® Platinum Mastercard® is for you!

You will remain in the same website

If you're looking for an affordable credit card with easy approval, check out the Reflex® Platinum Mastercard®!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

The Reflex® Platinum Mastercard® is an attractive option for those looking for an affordable and easy-to-approve credit card.

This card from Continental Finance offers a variety of benefits, but as with any financial decision, it is important to consider both the pros and cons carefully.

Upsides and advantages

- Approval without a deposit: The most notable feature of the Reflex® Platinum Mastercard® is its approval policy without requiring a deposit. By eliminating the deposit barrier, the card stands out as an affordable option for a variety of credit profiles, providing opportunities for building and rebuilding financial health;

- Purchase protection: The Reflex® Platinum Mastercard® goes beyond the traditional, offering cardholders a more secure experience in everyday transactions.

- Ability to double the initial credit limit: A notable advantage of the Reflex® Platinum Mastercard® is the opportunity to double the initial credit limit. This possibility allows cardholders to significantly increase their purchasing power from the start, providing financial flexibility. This feature stands out as an additional incentive for those seeking a quick and substantial increase in their spending capacity;

- Access to Mastercard rewards: Access to this rewards program adds an attractive component to the card, providing cardholders with the opportunity to be rewarded for their everyday spending, contributing to a more rewarding financial experience.

Downsides and limitations

- Relatively high-interest rate: This can result in additional costs for those who carry unpaid balances;

- Annual fee: It is important to be aware of the fees that may apply for this credit card.

Overall, the Reflex® Platinum Mastercard® is a viable option for those looking to build or rebuild credit. The ease of approval, combined with benefits such as purchase protection, offers an attractive proposition.

However, it is essential to carefully evaluate the interest rate and annual fee, ensuring that they align with your financial needs and spending habits.

When considering all aspects, the Reflex® Platinum Mastercard® remains an affordable choice for many, providing a valuable opportunity to move towards better financial health.

To log in to your Reflex® Mastercard® online account, simply visit the Continental Finance website and enter your credentials. You can manage your transactions, balances, and payments with ease.

Yes, the Reflex® Platinum Mastercard® is a versatile Mastercard that can be used to make online purchases. Enjoy the convenience and security of making transactions online with this credit card.

Yes, you can log in to your Reflex® Mastercard® account using the mobile app. Download it safely from the App Store or Google Play and have convenient access to account management at any time.

Yes, the Reflex® Platinum Mastercard® is a full-featured Mastercard credit card that offers the brand's traditional features, such as global acceptance and security, while also providing opportunities to build credit.

The Reflex® Platinum Mastercard® offers approval without a deposit, but it is important to know the fees, such as the interest rate and annual fee after the introductory period. Please refer to the details for a complete understanding of the terms and conditions.

Apply for Reflex® Platinum Mastercard®

Discover how to apply for the Reflex® Platinum Mastercard® and double your credit! Don't miss your chance - read now!

If you're looking for a credit card with more rewards, the Surge® Platinum Mastercard® may be a good option. This card offers points rewards that can be redeemed for cash, merchandise, or travel.

Compare the Surge® Platinum Mastercard® with the Reflex® Platinum Mastercard® in our review article to see which card is the best fit for you.

Apply For Your Surge® Platinum Mastercard®

Find out how to apply for the Surge® Platinum Mastercard® and take the first step toward building your credit!

Trending Topics

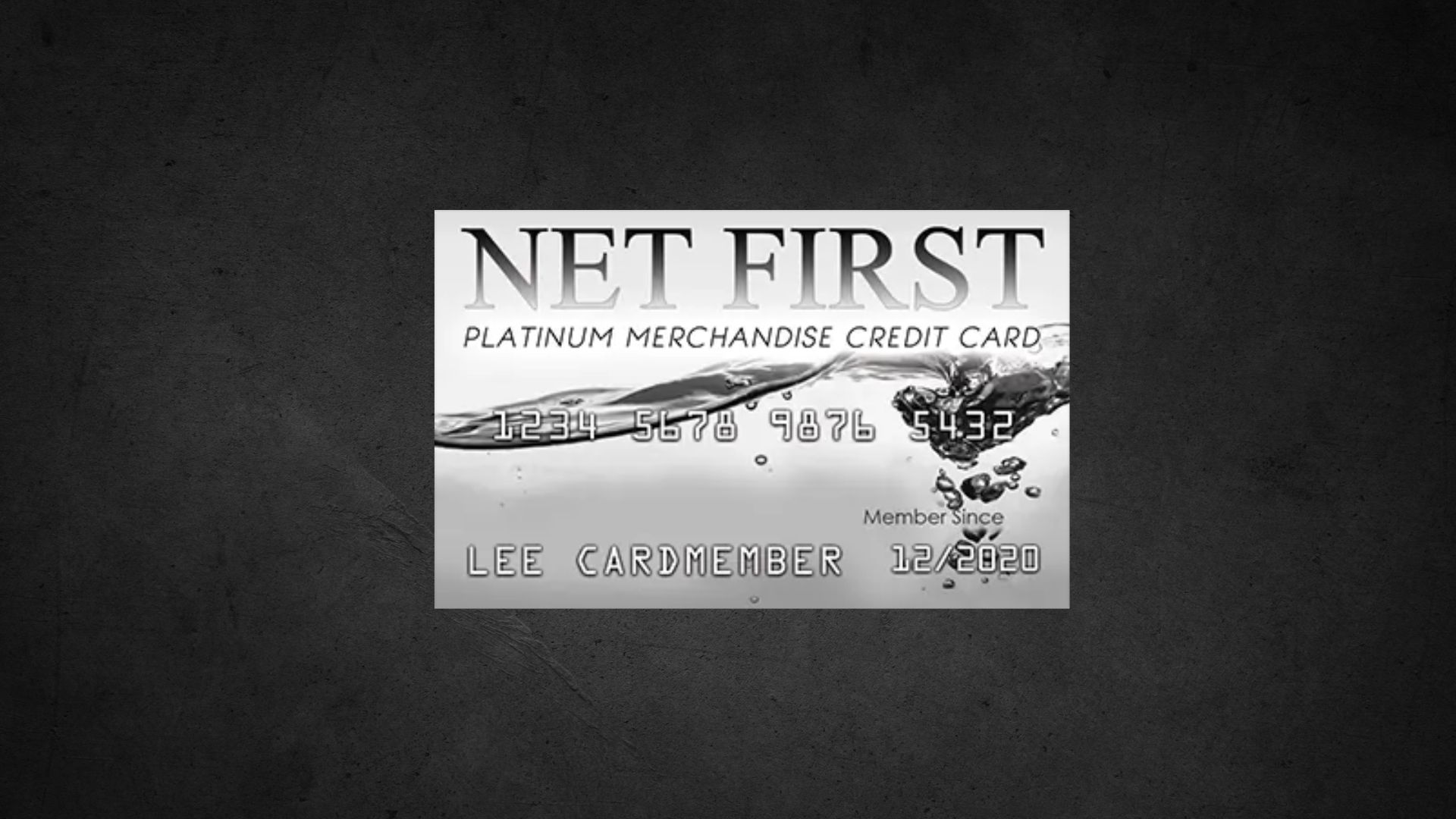

Net First Platinum Review: Financial Freedom at Your Fingertips

Discover in the Net First Platinum Review how this card offers $750 in credit without credit or employment checks

Keep Reading

Choose Your Credit Card Wisely: Make The Smart Choice!

Make the smart choice in choosing your credit card! Dive into the world of advantages and drawbacks, rewards and risks!

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep ReadingYou may also like

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep Reading

Boost Platinum Card Review: Purchasing power on your horizon!

Boost Platinum Card. Review of The Horizon Outlet's merchandise card. Qualify with any type of credit score! Quick and simple application!

Keep Reading

Freedom Gold Card Review: Plus $750 to your monthly budget

Discover the card that can save your monthly budget. In this review, we bring every nuance of the Freedom Gold Card!

Keep Reading