Credit Cards

PenFed Platinum Rewards Visa Review: Earn Extra Cashback Points

Embark on a journey through our detailed PenFed Platinum Rewards Visa Signature® Card Review, highlighting the lucrative Cashback program and the absence of an annual fee.

Advertisement

No annual fee, and a solid Cashback program

Lost amid so many options? Don’t worry; there’s something that pleases the crowds here. The concise and functional review of the PenFed Platinum Rewards Visa Signature® Card.

Check out how the rewards program of the PenFed Platinum Rewards Visa Signature® Card works. And find out precisely what Visa is endorsing in this option. All here for you.

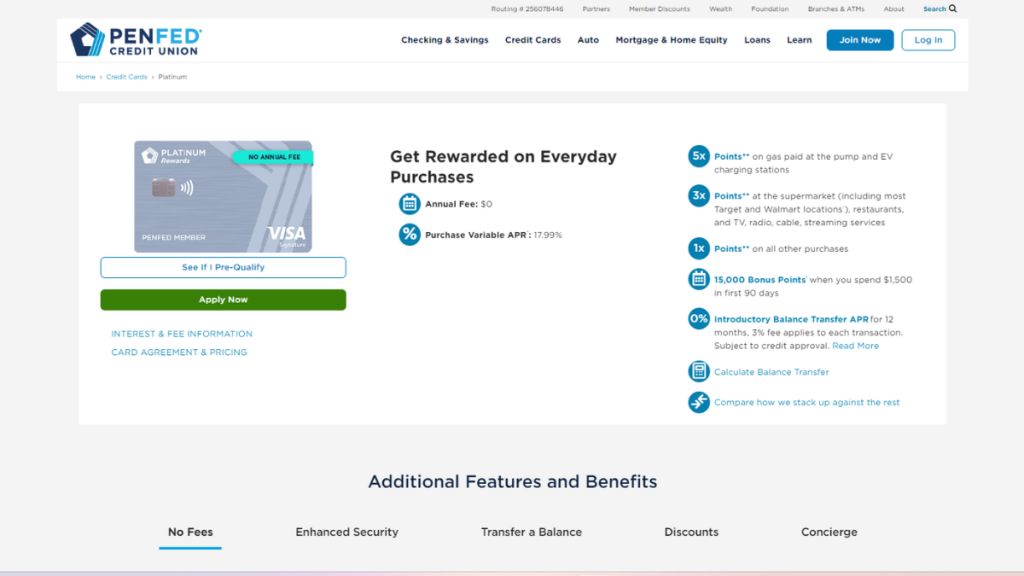

| Credit Score | From 690 (Good); |

| Annual Fee | $0; |

| Purchase APR | 17.99% variable; |

| Cash Advance APR | 17.99%; |

| Welcome Bonus | 15,000 Bonus Pointsƚ when you spend $1,500 in first 90 days; |

| Rewards | Earn up to 5x points on purchases. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the PenFed Platinum Rewards Visa Signature® Card

Count on 88 years of history and dedicated service. For this, choose the PenFed Platinum Rewards Visa Signature® Card to take the front row in your wallet. This review is for you.

PenFed is renowned for its competitive rates and excellent customer service. It was ranked first in the J.D. Power 2022 U.S. Credit Union Member Satisfaction Study.

Furthermore, we’re talking about a Visa Signature®. This provides access to a range of premium benefits. Earn 3 times more cashback for every dollar you spend on groceries and restaurants.

Additionally, the PenFed Platinum Rewards Visa Signature® Card offers 5 points per dollar spent on fueling your vehicle. Here is the essence of the complete card review.

On top of that, you earn 1 point per dollar on all other purchases. The best part is that points can be redeemed for travel, merchandise, gift cards, and even cash.

PenFed Platinum Rewards Visa Signature® Card: is it worth it?

It is indeed an attractive option that should be on your list. Keep the tab of this PenFed Platinum Rewards Visa Signature® Card review open until the end of your research today. I guarantee we’ll be there at the finish, face to face.

Advertisement

Pros

- High bonus category earning rate: Earn up to 5 times more Cashback points;

- No foreign transaction fee: An advantage for those needing to make transactions abroad;

- Introductory 0% APR on balance transfers: A temporary benefit that should be taken advantage of;

- EMV chip for enhanced security: Rely on something that truly makes your transactions secure;

- No annual fee: A recent advantage of the PenFed Platinum Rewards Visa Signature® Card;

- Pay your purchases interest-free: No interest will be charged on purchases if you pay the full balance of your account, including balance transfers and cash advances, by the due date each month.

Cons

- The benefits program is not straightforward to understand. Cashback percentages vary depending on the purchase category;

- High variable APR after the introductory period;

- Pay attention to the balance transfer fee.

Advertisement

Credit score requirements for card application

To access the PenFed Platinum Rewards Visa Signature® Card, you need a score of 690 or higher. In other words, your credit score will need to be at least “Good.”

Ready to apply? Here’s how to get the PenFed Platinum Rewards Visa Signature® Card

Ready? You are now a member of the PenFed Platinum Rewards Visa Signature® Card fan club.

The next step is to enhance your experience further. Learn how to get your own card in just a few minutes. Check out how to apply in the safest and simplest way possible!

Applying for your card: Online

First and foremost, everything happens on the PenFed website. Upon entering the site, look for the credit cards tab. Have your personal and financial documents on hand to ease the application process.

Locate the PenFed Platinum Rewards Visa Signature® Card on the credit cards page and click “Apply Now.”

Now it’s up to you. Fill out the application form with your personal, financial, and contact information. Finally, after reviewing your details, submit your application.

Wait for the response. PenFed will review your application for the PenFed Platinum Rewards Visa Signature® Card and send a response via email within a few days.

If you have questions during the application process, refer to the frequently asked questions section or contact PenFed customer service.

Requirements

To apply for the PenFed Platinum Rewards Visa Signature® Card in the United States, you must first become a member of the PenFed Credit Union.

Your credit history will also be assessed, requiring a favorable credit score. Additionally, you must demonstrate a minimum annual income of $25,000.

The key to access lies in understanding how to become a member of the PenFed Credit Union. Pay attention – you must be an active, retired, or reserve United States Department of Defense member.

If not, qualifying as an employee or member of an eligible organization is still possible. For the general public, residing, working, or attending school in a qualified area is sufficient.

Applying for your card: App

Applying for the PenFed Platinum Rewards Visa Signature® Card through the PenFed app is impossible. The app is solely for checking balances, transactions, and paying bills.

The PenFed app is called “PenFed Mobile” and is available for iOS and Android devices.

PenFed Platinum Rewards Visa Signature® Card or Wells Fargo Active Cash® Card?

Here’s an option if you’re looking for a more straightforward Cashback program. The Wells Fargo Active Cash® Card offers a fixed 2% Cashback on purchases.

| PenFed Platinum Rewards Visa Signature® Card | Wells Fargo Active Cash® Card | |

| Credit Score | From 690 (Good) | From 690 (Good) |

| Annual Fee | $0 | $0 |

| Purchase APR | 17.99% variable | 0% for 15 months, then 20.24%, 25.24% or 29.99% |

| Cash Advance APR | 17.99% | 29.99% |

| Welcome Bonus | 15,000 Bonus Pointsƚ when you spend $1,500 in first 90 days | $200 when spending $500 in purchases in the first 3 months |

| Rewards | Cashback on all purchases | 2% Cashback on all purchases |

A tool with less competitive rates but one that also doesn’t charge an annual fee. It features a truly powerful Cashback program. It’s worth checking out this competition!

Apply for Wells Fargo Active Cash® Card

Unlock real cashback with the Wells Fargo Active Cash® Card! Whether applying online or via the app, it's simple and quick. Explore now!

Trending Topics

Chime® Debit Card Complete Review: No fees, no Hassle!

Unlock the full potential of your finances with our comprehensive Chime® Debit Card Review. Find out with our detailed insights!

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Keep ReadingYou may also like

FIT Mastercard® Review: Build your credit score on your way!

Explore a FIT Mastercard® Review: Elevate your credit score effortlessly! Embarking on a credit-building journey.

Keep Reading

Upgrade Cash Rewards Visa® Review: Radical Cashback, Relaxed Fees

It's time to learn about Upgrade Cash Rewards Visa®. Does not charge an annual fee. See everything in the full review!

Keep Reading

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep Reading