Credit Cards

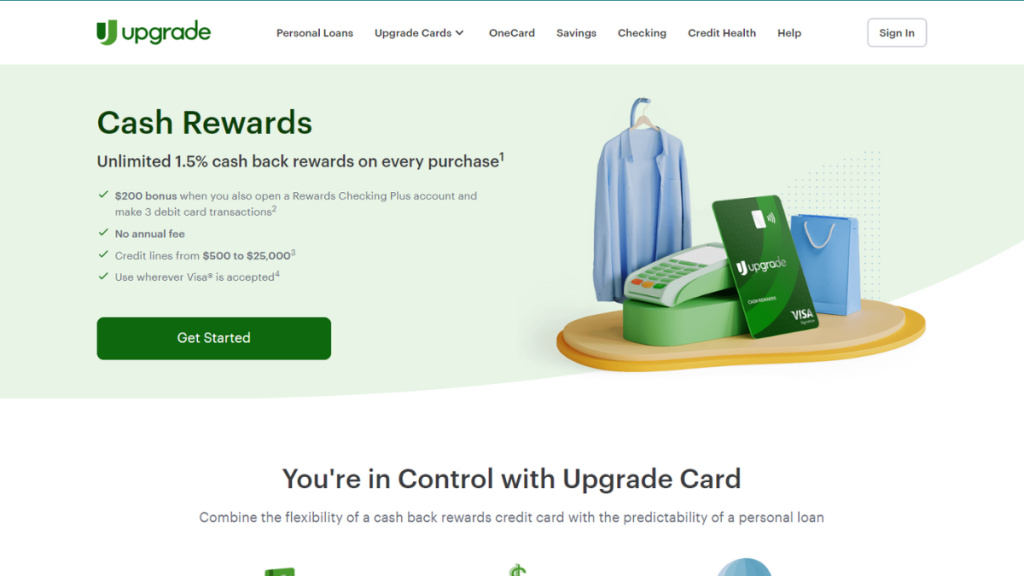

Upgrade Cash Rewards Visa® Review: Radical Cashback, Relaxed Fees

Find out everything about Upgrade Cash Rewards Visa®. Guarantee a special welcome bonus of $200 and no more annual fees. And the 1.5% Cashback is unlimited!

Advertisement

The best cash rewards without paying fees

Ensuring the best that Cashback can offer without incurring exorbitant fees for it. This review tackles something unique that fits into these seemingly distinct perspectives.

You seek this versatility in your shopping routine. Indeed, this is something we don’t compromise on. So fasten your seatbelts and enjoy the full review of the Upgrade Cash Rewards Visa®.

| Credit Score | From 630; |

| Annual Fee | $0; |

| Purchase APR | From 14.99% to 29.99%; |

| Cash Advance APR | They depend on factors such as your credit history, credit score, and the amount requested; |

| Welcome Bonus | $200 when you open a Rewards Checking Plus account and make 3 debit card transactions in the first 60 days; |

| Rewards | 1.5% Cashback. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Upgrade Cash Rewards Visa®

With the Upgrade Cash Rewards Visa®, you unlock a minimum limit of $500. On the other hand, the maximum limit reaches up to $25,000, which can be considered high.

Therefore, the Upgrade Cash Rewards Visa® is indeed a very versatile card option.

Another interesting point about the Upgrade Cash Rewards Visa® is that it provides access to a special category of closed-end loans.

These transactions can be accessed through purchases with the Upgrade Cash Rewards Visa®. They are loans that must be repaid in full by the end of the term on a specified date.

The loan payment includes all the interest and financial charges agreed upon at the signing of the credit contract. As you repay your balance, additional credit may become available to you.

For these reasons and others, the versatility of the Upgrade Cash Rewards Visa® is its major differentiator. Now, take a look at an analysis of the card’s pros and cons.

Upgrade Cash Rewards Visa®: is it worth it?

The purpose of this review is to answer that for you. And here’s a spoiler: It works very well. See below what makes the Upgrade Cash Rewards Visa® a smart choice.

Advertisement

Pros

- High acceptability: Upgrade Cash Rewards Visa® is a member of the Visa circuit, so it will never be a problem to find establishments that accept it for your purchases;

- Control and organization: Do not break the limits of your personal budget using the payment method with installments pre-established in the contract;

- Ensure that you do not pay unnecessary fees: Establish a fixed monthly payment and do not run the risk of paying late fees, for example;

- Completely zero annual fee.

Cons

- You will not be able to use your Cash Rewards Visa® Upgrade at ATMs;

- It is not a card for those with a bad score.

Advertisement

Credit score requirements for card application

To take advantage of these exclusive Upgrade Cash Rewards Visa® benefits, you will need a credit score of 630 or higher. Considered Average.

Ready to apply? Here’s how to get the Upgrade Cash Rewards Visa®

Throughout the special review, you saw the good side and the shadows of the Upgrade Cash Rewards Visa®. Now, there’s only one way out: You want the Upgrade Cash Rewards Visa®, right?

So, with that in mind, go to the official website to apply for yours, but first, be equipped with everything you will need, and the details are all explained right here.

Applying for your card: Online

Attention: This is the main way to apply for your Cash Rewards Visa® Upgrade. The first step is to access the official Upgrade website. Then, locate Upgrade Cash Rewards Visa®.

Then, fill out the registration form with your personal information. Basic data is full name, full address, telephone number, and date of birth.

Additionally, you will be required to provide your Social Security Number (SSN). Annual income information and your current employment status will also be required.

An important detail is that you will be asked some questions about your credit history and spending habits. Pay attention to the information, review your application, and submit it.

After approval, which may take a few days, your Cash Rewards Visa® Upgrade will arrive at your home within a few days.

Requirements

To have a Cash Rewards Visa® Upgrade, you must be at least 18 years old. You will need to demonstrate an annual income of at least $25,000.

Obviously, you will need to have an average credit score. The Upgrade Cash Rewards Visa® generally requires a credit score of at least 630 points.

Applying for your card: App

Currently, it is impossible to request the Cash Rewards Visa® Upgrade through the app. The app is only used to manage your account after card approval.

After your card is approved, you can download the app and create your account.

Upgrade Cash Rewards Visa® or Wells Fargo Active Cash® Card?

We already understand that you cannot give up fair and efficient Cashback. That’s why we brought another excellent option to the shelf. Have you seen the Wells Fargo Active Cash® Card?

| Upgrade Cash Rewards Visa® | Wells Fargo Active Cash® Card | |

| Credit Score | From 630; | From 690; |

| Annual Fee | $0; | $0; |

| Purchase APR | From 14.99% to 29.99%; | 0% for 15 months, then 20.24%, 25.24% or 29.99%; |

| Cash Advance APR | They depend on factors such as your credit history, credit score, and the amount requested; | 29.99%; |

| Welcome Bonus | $200 when you open a Rewards Checking Plus account and make 3 debit card transactions in the first 60 days; | $200 when spending $500 in purchases in the first 3 months; |

| Rewards | 1.5% Cashback. | 2% Cashback. |

This contest is a tough one. That’s why you might want to open two vacancies in your portfolio.

Both have a good Cashback program and do not charge annual fees. Do you have the right score?

Apply for Wells Fargo Active Cash® Card

Unlock real cashback with the Wells Fargo Active Cash® Card! Whether applying online or via the app, it's simple and quick. Explore now!

Trending Topics

Milestone Mastercard® Review: for any type of credit!

Explore the ins and outs of the Milestone Mastercard® with our comprehensive review. Navigate the credit-building journey!

Keep Reading

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Unlock the power of rewards with the Wells Fargo Active Cash® Card! Dive into our review and explore the world of real Cashback.

Keep Reading

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep ReadingYou may also like

Pick Your Credit Card for Fair Credit: Make the Right Decision!

Find your perfect match with our guide on how to choose the best credit card for fair credit, tailored to fit your financial lifestyle.

Keep Reading

PenFed Platinum Rewards Visa Review: Earn Extra Cashback Points

Explore our comprehensive PenFed Platinum Rewards Visa Signature® Card Review for an in-depth look at its perks. No annual fee and Cashback!

Keep Reading

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep Reading