Credit Cards

FIT Mastercard® Review: Build your credit score on your way!

Dive into the FIT Mastercard® universe! This review dissects the card's pros and cons, providing insights into its credit-building features.

Advertisement

Discover the world of credit with the FIT Mastercard®!

Checking out the card universe? If you’re sailing uncharted waters and your credit isn’t a perfect symphony, this FIT Mastercard® review is for you!

Our analysis goes beyond the numbers to tell you if this card is like a gentle serenade for your financial journey or just a discordant beat.

| FIT Mastercard® | |

| Credit Score | The FIT Mastercard® does not require a minimum credit score for approval; |

| Annual Fee | $99 annual fee; |

| Purchase APR | 22.99%; |

| Cash Advance APR | 25.99%; |

| Welcome Bonus | None; |

| Rewards | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the FIT Mastercard®

Let’s explore the details of the FIT Mastercard®! From its modest starting limit of $400 to the tricks for doubling that limit.

Indeed, this is a credit builder card, so you can raise your credit score quickly. Also, you’ll get free monthly credit score, so you can track it closely.

On the other hand, cardholders must pay an annual fee of $99, and also deal with an APR of 22.99%.

Cardholders can also enjoy Zero Liability Protection and an amazing mobile app to better manage their cards!

FIT Mastercard®: is it worth it?

The big question: is it worth having the FIT Mastercard® in your wallet?

Let’s analyze the pros the cons and decide if this card is a worthy partner for your financial journey. Spoiler: it might involve a little humor!

Advertisement

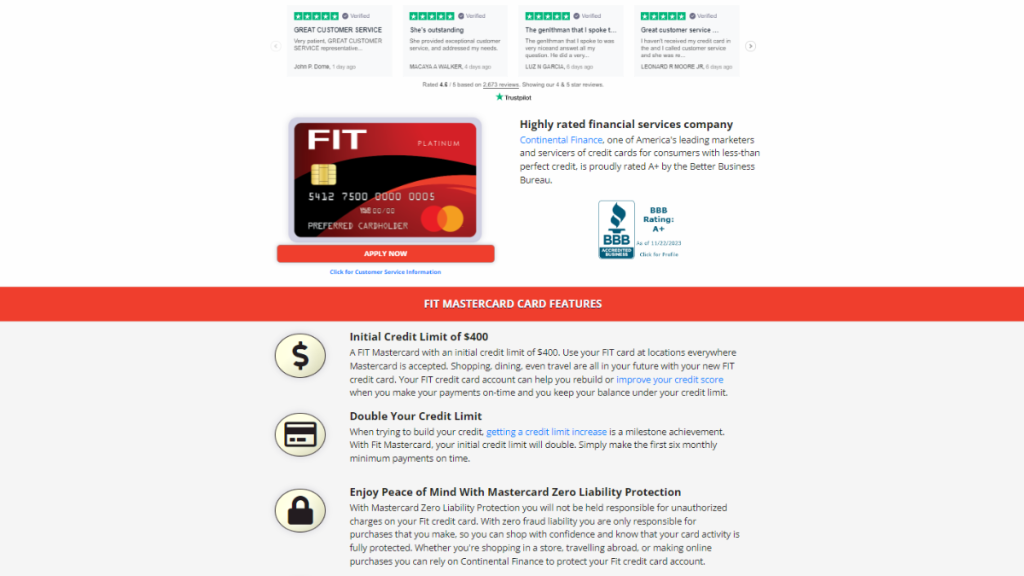

Pros

- Generous Initial Credit Limit: The FIT Mastercard® offers a strong foundation with a generous initial credit limit. With a substantial limit, you have room to manage your finances in a more holistic way;

- Opportunity to Double Your Limit After Six Months: A unique feature of the FIT Mastercard® is the opportunity to double your limit after six months of responsible use;

- Mastercard Fraud Protection: Security is a priority, and the FIT Mastercard® offers fraud protection from the renowned Mastercard;

- Monthly Reports to Major Credit Bureaus: When using the FIT Mastercard®, your payments are reported monthly to the three major credit bureaus (TransUnion, Experian, Equifax). This means that every on-time payment contributes to the positive building of your credit history.

Cons

- Annual Interest Rate of 22.99%: A notable drawback is the 22.99% annual interest rate, which is above average. It is crucial to consider this factor when deciding if the FIT Mastercard® is the best option for your financial needs. Maintaining a healthy balance between cost and benefits is essential;

- Annual fee: Cardholders will have to pay an annual fee of $99.

Advertisement

Ready to apply? Here’s how to get the FIT Mastercard®

Ready to take a step into the world of credit with the FIT Mastercard®?

Learn how to apply without complications and embark on this financial journey with a touch of humor.

After all, credit doesn’t have to be boring, right?

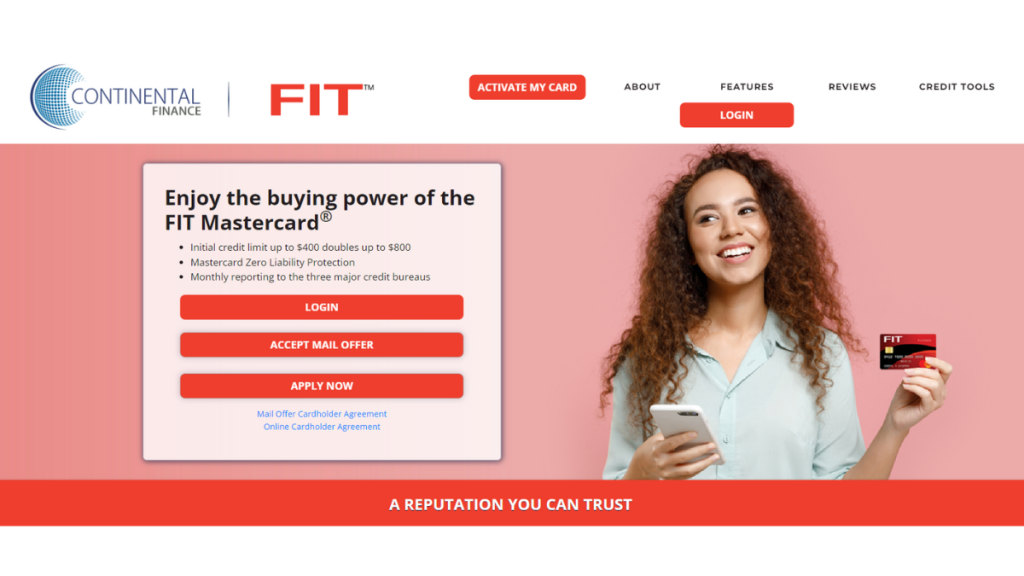

Applying for your card: Online

Tired of paperwork and bureaucracy? Discover how to apply for the FIT Mastercard® online, hassle-free.

We’ll walk you through a quick and easy process to get this card in your wallet. So firstly, access the FIT Mastercard® website.

Next, hit the “Apply Now” button to and fill out the application form. There, you must provide you personal and financial information.

Further, check the application to see if the information is correct and submit it. Once done, you’ll receive your application result.

If approved, your FIT Mastercard® will arrive at the informed address within a few business days!

Requirements

Before taking the first step, it’s good to know what’s needed, right?

Learn the requirements to ensure you’re ready to claim your FIT Mastercard®. Spoiler: it’s no puzzle!

The information provided indicates that the FIT Mastercard® accepts people with less-than-perfect credit, suggesting that a high credit score is not required to apply.

Applying for your card: App

Convenience at your fingertips! Discover how to apply for the FIT Mastercard® through our mobile app.

Ease, agility, and, of course, a touch of humor throughout the process!

FIT Mastercard® or Wells Fargo Reflect® Card?

Choosing between credit cards can be a dilemma.

Let’s compare the FIT Mastercard® with the Wells Fargo Reflect® Card to help you make the right decision for your financial needs.

| FIT Mastercard® | Wells Fargo Reflect® Card | |

| Credit Score | The FIT Mastercard® does not require a minimum credit score for approval | Varia – Geralmente para crédito médio a excelente |

| Annual Fee | Free | Free |

| Purchase APR | 22,99% | 0% for 21 months, thereafter 18.24%, 24.74%, or 29.99% variable based on the U.S. Prime Rate |

| Cash Advance APR | 25,99% | 29.99% variable based on the U.S. Prime Rate |

| Welcome Bonus | $100 when spending$500 in purchases in the first month | Not specified |

| Rewards | 1 FIT point for every US$1 spent on purchases | Varies – May offer rewards depending on card version |

At the end of this analysis, it becomes clear that both the FIT Mastercard® and the Wells Fargo Reflect® Card have their strengths and distinct features.

So if you’re interested in another option, check the Wells Fargo Reflect® Card below!

Apply for Wells Fargo Reflect® Card: 0% intro APR

Here's what you need to get 21 months of 0% interest; find out how to apply for your Wells Fargo Reflect® Card. The article is fresh!

Trending Topics

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep ReadingYou may also like

Milestone Mastercard® Review: for any type of credit!

Explore the ins and outs of the Milestone Mastercard® with our comprehensive review. Navigate the credit-building journey!

Keep Reading

GO2bank Secured Visa® Credit Card Review: $0 annual fee

Check this review to learn how GO2bank Secured Visa® Credit Card will boost your credit score with outstanding support!

Keep Reading

Apply for Mission Lane Visa® Credit Card: for all types of credit

Learn how to apply for your Mission Lane Visa® Credit Card without fear of credit checks! We’ll tell you how to do it in this post!

Keep Reading