Debit Cards

Chime® Debit Card Complete Review: No fees, no Hassle!

Explore the Chime® Debit Card through our in-depth review. With no annual fees, a vast ATM network, and innovative features like RoundUps, this card offers a hassle-free financial experience.

Advertisement

10 years in the digital market made this card

Looking for something that won’t give you a headache? You’ve found the right product review. Get to know the Chime® Debit Card up close. It’s a straightforward option.

It doesn’t charge maintenance fees and even brings some pleasant surprises. Explore every aspect of this debit card in this comprehensive review. Access the complete information!

| Credit Score | Not required; |

| Annual Fee | $0; |

| Purchase APR | 0%; |

| Cash Advance APR | 0%; |

| Welcome Bonus | SpotMe: Up to $200 revolving credit |

| Rewards | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Chime® Debit Card

A debit card by itself already has a logical limitation. With it, you won’t be able to carry out operations on credit. But that doesn’t mean there are no advantages.

In addition to the Chime® Debit Card not charging an annual fee, there are also no maintenance fees or anything of the sort included. This is an advantage that makes a difference.

Chime® Debit Card: is it worth it?

See it with your own eyes. And using our review makes this process even better. Once you get to know the Chime® Debit Card inside out, you’ll know if it suits you!

Advertisement

Pros

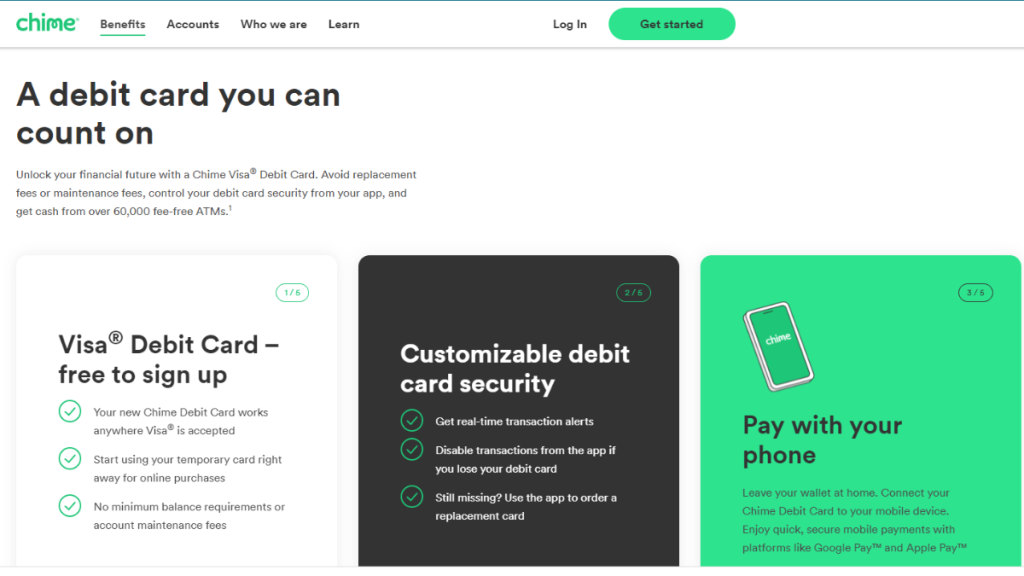

- No annual fee: Get rid of monthly or yearly maintenance fees. Use the Chime® Debit Card without worrying about it.

- Satisfaction when withdrawing cash: Enjoy a vast network with over 60,000 ATMs. And make your withdrawal without fees!

- Security and financial control: Chime provides alerts to ensure you always have control over your transactions. This happens in real time, without surprises.

- Instant temporary card: Until your Chime® Debit Card is ready and arrives at your home, it may take a few days. In the meantime, you’ll already have an immediate digital version ready right after opening your account.

- No minimum balance requirement: Besides not charging anything for account maintenance, there’s no need to keep a stagnant amount in your account.

- Technology at your service: Use your Google or Apple accounts to sync the Chime® Debit Card. This way, you can “forget” your wallet at home!

Cons

- Temporary card for online purchases only: You won’t be able to use your Chime temporary card in stores, even if they accept contactless payments.

- No phone customer support: Chime provides customer support solely through email and chat.

- No access to credit lines: Chime doesn’t offer credit lines, which may pose a challenge for some individuals.

Advertisement

Credit score requirements for card application

According to our research, Chime does not require a credit score to apply for a Chime® Debit Card. The company even states that “anyone can apply.”

However, it’s important to note that having a positive credit score can increase your chances of approval for the card.

Therefore, if you have a high credit score, you are more likely to be approved for a Chime® Debit Card.

Ready to apply? Here’s how to get the Chime® Debit Card

The website where you will apply for the Chime® Debit Card is simple and easy to navigate. But that doesn’t mean you can’t approach it better prepared. Be armed with insider tips beforehand!

Applying for your card: Online

All of this is done online and really quickly. The sign-up process can be completed in just a few minutes. Before you know it, you’ll eagerly await your Chime® Debit Card in the mail.

To apply, you must provide your name, address, date of birth, and social security number. After that, simply click proceed, and your account will be ready.

Afterward, you can jump into the app or continue through the website. Following along here? Let’s go together. Set up your account or link it to an existing checking account.

Shortly after approval, you can start using your Chime® Debit Card. That’s because, even before it arrives in the mail, a temporary online version will be available.

The physical and final version of the Chime® Debit Card will arrive within 10 days. And then you can proudly show it off in your wallet. See how easy it is to apply for the Chime® Debit Card?

Requirements

According to Chime’s information, the requirements to apply for a Chime® Debit Card are straightforward. You just need to be a U.S. citizen or resident.

The minimum age is 18, and you must provide your Social Security Number (SSN). All of this is to ensure it’s not a fraudulent application. It’s for your safety!

In addition to these requirements, Chime may also request additional information, such as proof of income or proof of residence. Therefore, have this information readily available.

Applying for your card: App

As mentioned earlier, after completing your registration, you can choose between the website or the app. In other words, you can apply for the Chime® Debit Card with complete convenience.

The basic documentation should be submitted as usual. Then, simply monitor your account, transactions, and other financial activities. All at your fingertips!

Chime® Debit Card or Avant Credit Card?

Now, let’s talk about another type of card. An option for those who need to build their credit score and make purchases on credit. Move a step forward in the financial game with this.

| Chime® Debit Card | Avant Credit Card | |

| Credit Score | Not required | 580; |

| Annual Fee | $0; | Variable membership fee from $0 to $75; |

| Purchase APR | 0%; | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Cash Advance APR | 0%; | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Welcome Bonus | SpotMe: Up to $200 revolving credit; | N/A; |

| Rewards | None. | N/A. |

It gives you the opportunity to eliminate the annual fee. All you need to do to avoid unpleasant surprises is to use the Avant Credit Card, paying attention to the APR interest rates.

Apply for Avant Credit Card

Boost your credit score now! Get the Avant Card: quick approval, no credit score minimum, build real credit!

Trending Topics

Reflex® Platinum Mastercard® Review: The new double credit!

Discover the power of the Reflex® Platinum Mastercard® - the new double credit! Get the credit you want, even with bad credit

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

First Digital Mastercard® Review: Cashback all over the country!

Dive into our comprehensive First Digital Mastercard® Review for insights on cashback rewards, credit building, and easy application!

Keep ReadingYou may also like

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep Reading

How to Apply for the First Access Visa® Card: Fast and powerful!

Apply First Access Visa® Card: Rebuild your credit with fast, user-friendly approval. Start your journey to financial improvement today!

Keep Reading

How to Build Credit: 5 Tips for Fast Results

Discover how to build credit quickly with 5 practical tips. Learn how to use credit cards wisely to boost your credit history!

Keep Reading