Credit Cards

Aspire® Cash Back Reward Card Review: Utility Bill Perks

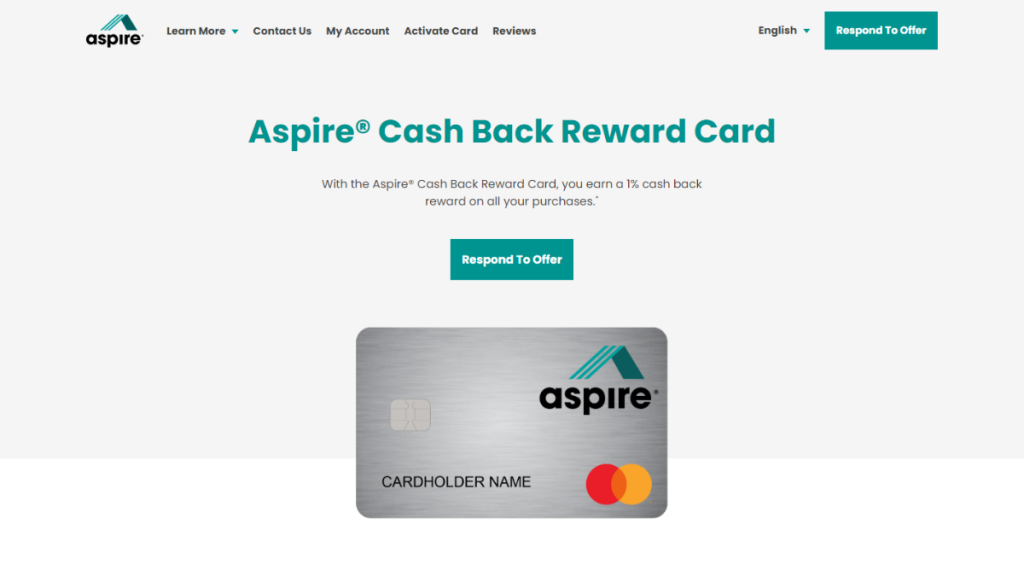

Read our Aspire® Cash Back Reward Card review to discover how earning 1% return on purchases, can enhance your financial journey and improve your credit score.

Advertisement

Enhance your spending experience and watch your cash back grow with every card swipe

In our comprehensive Aspire® Cash Back Reward Card review, we’ll highlight its unique features and benefits, offering insights into how the card can fit into your financial lifestyle.

Read on to uncover the full potential of this credit card and how it can contribute to your financial journey, offering more than just basic credit services.

| Credit Score | Suitable for a range of scores, ideal for fair to good credit; |

| Annual Fee | $49 to $175 in the first year, $0 to $49 thereafter. It will depend on your creditworthiness; |

| Purchase APR | Fixed at either 29.99% or 36%, depending on your current credit standing; |

| Cash Advance APR | In line with industry standards, details specified upon approval; |

| Welcome Bonus | Currently, no welcome bonus is offered; |

| Rewards | Earn 1% cash back on all your purchases! |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Aspire® Cash Back Reward Card

The Aspire® Cash Back Reward is unique thanks to its enticing rewards and exclusive perks. It’s a go-to choice for people looking to maximize their returns on daily purchases.

Moreover, its appeal lies in the generous cash back on essential expenses, as outlined in our review of the Aspire® Cash Back Reward Card. This aspect is especially advantageous.

Designed for users with average credit scores, the Aspire® Card is an accessible financial tool. Additionally, you’ll pay an annual fee ranging from $49 to $175 in the 1st year! After that, $0 to $49!

Following this, the card’s APR adapts to individual profiles, with fixed rates of 29.99% or 36%. This rate underscores the importance of maintaining responsible credit habits.

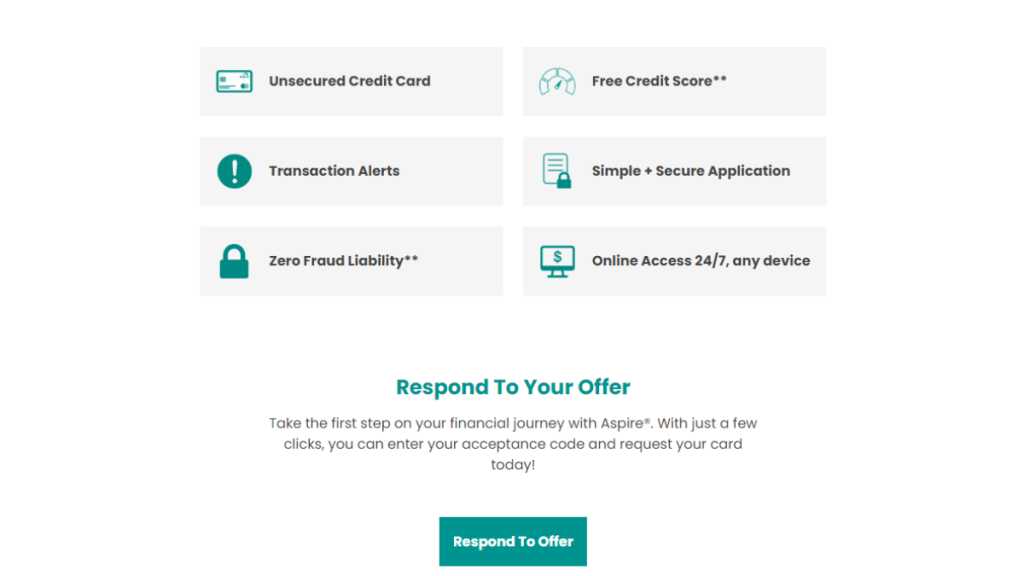

Although lacking a welcome bonus, the Aspire® Card’s consistent perks, like free credit score access, add significant value. Also, its user-friendly nature makes it a reliable tool.

Aspire® Cash Back Reward Card: is it worth it?

Exploring the Aspire® Cash Back Reward Card in our review, it’s vital to consider its advantages and drawbacks for a balanced perspective. Let’s meet them next.

Advertisement

Pros

- 1% cash back on all other eligible purchases;

- Suitable for individuals with fair credit scores;

- No security deposit is required, making it more accessible;

- Free access to credit scores, aiding in financial management.

Cons

- Higher APR starting at 29.99% and up to 36%;

- Annual fee of $85 may deter some potential users;

- Lack of a welcome bonus might be a downside for many;

- Not ideal for those with poor or limited credit history;

- Limited to no benefits in terms of travel rewards.

Advertisement

Credit score requirements for card application

In most cases, having a fair credit score is typically sufficient to qualify for the Aspire® Cash Back Reward Card. This opens the door for applicants who are building or rebuilding credit.

Furthermore, the card’s approval criteria are designed for a broad spectrum of credit profiles. This means that even those with less than perfect credit have a chance at approval.

Ready to apply? Here’s how to get the Aspire® Cash Back Reward Card

Wrapping up our review of the Aspire® Cash Back Reward Card, it’s clear this card brings significant benefits, particularly appealing to individuals with average to fair credit ratings.

If you’re ready to apply for the Aspire® Cash Back Reward Card, the process is as user-friendly as it gets. This guide outlines each step, ensuring a hassle-free application.

Applying for your card: Online

Firstly, visit the Aspire website and find the Aspire® Cash Back Reward Card. Then, click on the “See if you pre-qualify” button to start your application with no harm to your score.

Next, you’ll encounter a simple form. Fill in your personal, contact, residence, and employment information. Be as thorough and accurate as possible.

Read Aspire’s Electronic Disclosures and check the box confirming you agree with them. Following this, click on “See Offer” and wait for the issuer to evaluate your profile.

Subsequently, Aspire should give you prompt feedback as to whether or not you’ve been approved for their credit card. If the answer is yes, you should be able to see its details.

Lastly, you’ll have to sign an electronic agreement to your new Aspire® Cash Back Reward Card and wait for it to arrive in the mail – typically in a few business days.

Requirements

To get this credit card, you must be at least 18 years old or legal age in your location. Also, you’ll need to provide your essential information.

When it comes to credit requirements, you must have fair to good credit. So, it is an accessible card, after all.

Applying for your card: App

Currently, you can’t apply for the Aspire® Cash Back Reward Card through their mobile app, as it is designed solely for account management.

However, the good news is that Aspire’s website is flexible and fully mobile-friendly. You can easily navigate and apply online using your phone or tablet.

Therefore, while the app doesn’t support applications, the website offers a seamless experience. You can complete all the necessary steps with just a few taps on your device.

Aspire® Cash Back Reward Card or Upgrade Cash Rewards Visa®?

The Aspire® Cash Back Reward Card shines with its rewarding benefits, especially on essential spending. It’s a great option for those looking to get rewards routinely.

However, if the Aspire® Card isn’t a fit for you, consider the Upgrade Cash Rewards Visa®. This card offers different perks, making it a solid alternative for those exploring credit options.

The Upgrade Cash Rewards Visa® is known for its amazing cash back rate and $0 annual fee! Compare both cards below!

| Aspire® Cash Back Reward Card | Upgrade Cash Rewards Visa® | |

| Credit Score | Suitable for a range of scores, ideal for fair to good credit. | From 630; |

| Annual Fee | A manageable fee starting as low as $85. | From 14.99% to 29.99%; |

| Purchase APR | Fixed at either 29.99% or 36%, depending on your current credit standing. | 35.99%. |

| Cash Advance APR | In line with industry standards, details specified upon approval. | It depends on factors such as your credit history, credit score, and the amount requested; |

| Welcome Bonus | Currently, no welcome bonus is offered. | $200 when you open a Rewards Checking Plus account and make 3 debit card transactions in the first 60 days; |

| Rewards | A rewards rate between 1 and 3% on essential purchases such as groceries. | 1.5% Cashback. |

Moreover, to discover more about the Upgrade Cash Rewards Visa® and its unique features, including how to apply, follow the link below. It could be the credit solution you’re looking for!

Apply for Upgrade Cash Rewards Visa®

Apply for Upgrade Cash Rewards Visa® and unlock the perfect combination of Cashback rewards with zero annual fees!

Trending Topics

Destiny Mastercard® Review: Rebuild Your Credit with Confidence

It’s time to reestablish your finances! Review the Destiny Mastercard® features to see how it can help - build credit quickly!

Keep Reading

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Keep Reading

Chime® Debit Card Complete Review: No fees, no Hassle!

Unlock the full potential of your finances with our comprehensive Chime® Debit Card Review. Find out with our detailed insights!

Keep ReadingYou may also like

Avant Credit Card Review: Move Forward Towards Perfect Credit!

Meeting your new partner in credit building. Avant Credit Card also has the possibility of a zero annual fee. Check out the full review!

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

Upgrade Life Rewards Visa® review: No annual fee!

Discover the perks and pitfalls of the Upgrade Life Rewards Visa® card in our latest review. Up to 10% cash back + up to $25K credit line!

Keep Reading