Credit Cards

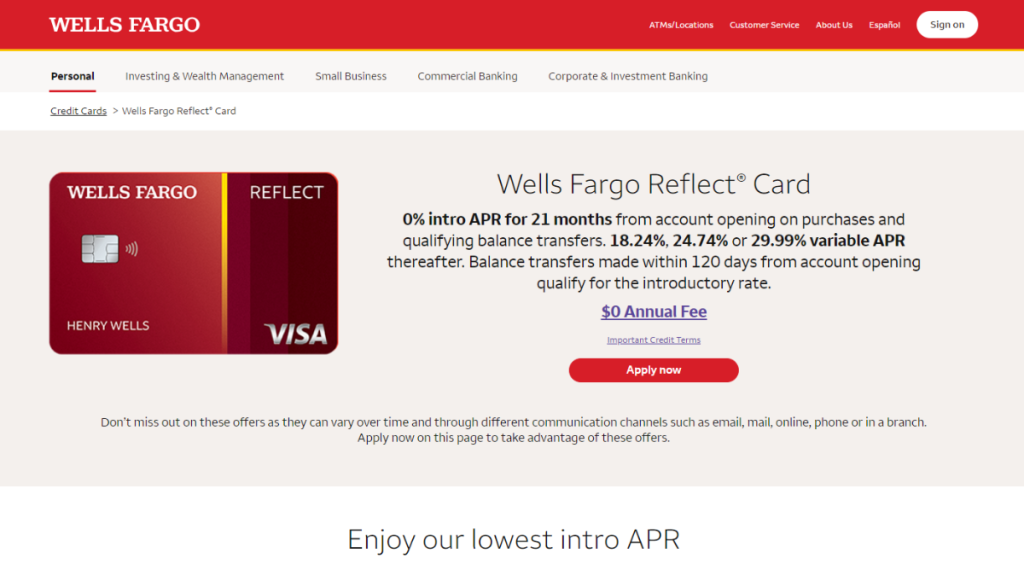

The Wells Fargo Reflect® Card Review: Your Financial Freedom

Complete analysis of the card that has unbeatable interest rates and does not charge an annual fee.

Advertisement

0% intro APR for 21 months!

Wells Fargo Reflect® Card: A comprehensive review of the card that offers almost two years of interest-free, something not yet seen in the market.

In this review, we will analyze the pros and cons of the Wells Fargo Reflect® Card so you can decide if this card is the best option for you.

| Credit Score | 660 or higher; |

| Annual Fee | No annual fee; |

| Purchase APR | 0% for 21 months, thereafter 18.24%, 24.74%, or 29.99% variable based on the U.S. Prime Rate; |

| Cash Advance APR | 29.99% variable based on the U.S. Prime Rate; |

| Welcome Bonus | None; |

| Rewards | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Wells Fargo Reflect® Card

The most striking thing about the Wells Fargo Reflect® Card review is, of course, its 0% introductory APR for 21 months on purchases and balance transfers.

This is a truly unique feature. Additionally, you get phone protection and security on your phone purchases.

It’s likely that the lack of a rewards program will be something you consider, but the Wells Fargo Reflect® Card is certainly a reward in itself.

Wells Fargo Reflect® Card: is it worth it?

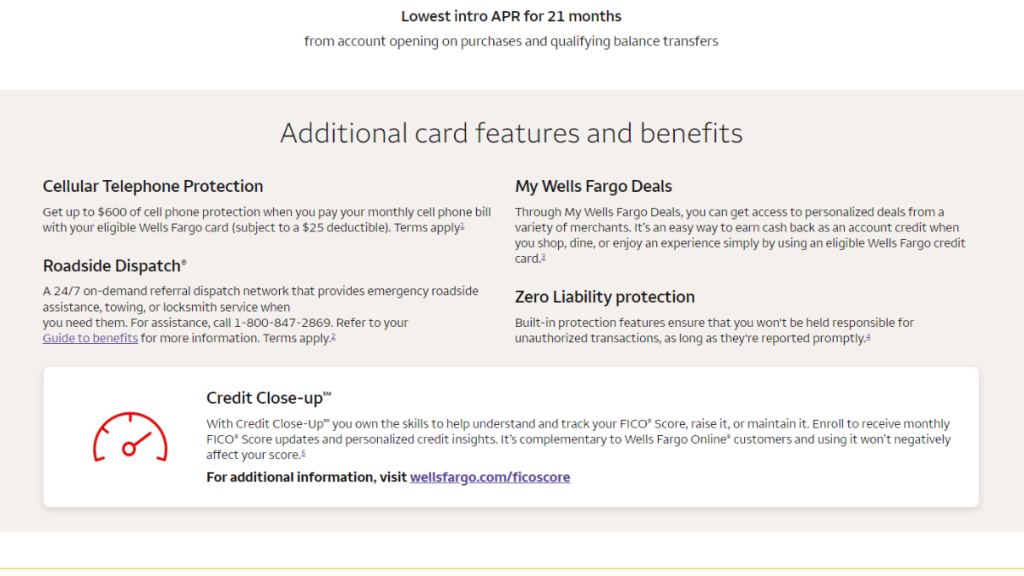

All card users are looking for rewards programs, and the My Wells Fargo Deals program more than compensates for the lack of these features.

As a result, the card with its 21 months of no APR is almost perfect.

Advertisement

Pros

- 0% APR for 21 months: After that, your APR will be 18.24%, 24.74%, or 29.99%, depending on your creditworthiness. This APR will vary with the market based on the U.S. Prime Rate;

- No annual fee: You won’t pay anything to use your Wells Fargo Reflect® Card;

- Purchase protection: Coverage in case of theft, loss, or damage. Extended warranty for products purchased with the Wells Fargo Reflect® Card;

- Security and protection: Phone insurance up to $600 against damage or theft. In addition, the Wells Fargo Reflect® Card guarantees that you will not be liable for unauthorized transactions;

- My Wells Fargo Deals: The Program offers Wells Fargo credit cardholders discounts and special offers at a variety of stores and restaurants. These discounts can be considered a form of cashback, as they allow you to save money on your purchases.

Cons

- Variable APR after the introductory period: The variable APR after the introductory period can be disadvantageous for cardholders who are unable to pay their balance in full before the end of that period.

- No rewards: The Wells Fargo Reflect® Card does not offer traditional rewards, such as points or miles that can be redeemed for rewards. Instead, the card offers the My Wells Fargo Deals program, which offers Wells Fargo credit cardholders discounts and special offers at a variety of stores and restaurants.

- High cash advance APR: If you need to withdraw cash with your Wells Fargo Reflect® Card, it is important to be aware of the high-interest rate that will be charged.

Advertisement

Credit score requirements for card application

The Wells Fargo Reflect® Card has a credit score requirement of 660 or higher.

This means that you have a good credit history and are considered a low-risk borrower.

If you have a credit score of 660 or higher, you have a good chance of being approved for the card.

Ready to apply? Here’s how to get the Wells Fargo Reflect® Card

Now that you’ve learned more about this relatively new option on the market, learn everything you need to know to apply for your Wells Fargo Reflect®.

We’ve made it easy for you to understand the 21 months of no APR, so read on!

Applying for your card: Online

To apply for the Wells Fargo Reflect® Card, you can visit the Wells Fargo website and follow these steps in a very intuitive way.

When entering the official Wells Fargo Reflect® Card website, locate the “Apply Now” button and provide your personal information and credit history.

Wells Fargo will review your application and make a decision within a few days.

Applying for your card: App

Download the Wells Fargo app on your mobile device. You must have an active Wells Fargo account; if you don’t have one, register.

If you’re already a member, login with your Wells Fargo account. Now, tap the “Cards” button and search for the Wells Fargo Reflect® Card.

After you submit your application, Wells Fargo will review your financial history. If you’re approved, you’ll receive a notification in the Wells Fargo app.

If you are declined, Wells Fargo will provide a notification in the Wells Fargo app explaining the reason for the denial.

You can reapply for the card after a few months if your credit improves. Easy, fast, and in the palm of your hand!

Wells Fargo Reflect® Card or Destiny® Mastercard?

Here, we have two cards for you if you’re looking to make purchases and balance transfers with better interest rates.

You can forgo rewards programs while improving your credit score. Both do not have competitive interest rates.

In comparison, the Wells Fargo Reflect® Card rates are more advantageous during its introductory period.

You can draw your own conclusions from this direct and honest comparison between two excellent options for those looking for lower rates.

| Wells Fargo Reflect® Card | Destiny® Mastercard | |

|---|---|---|

| Credit Score | 660 or higher; | 300 – 670 (Bad to Fair); |

| Annual Fee | No annual fee; | $175 in the 1st year, $49 thereafter! |

| Purchase APR | 0% for 21 months, thereafter 18.24%, 24.74% or 29.99% variable; | 35.9%; |

| Cash Advance APR | 29.99% variable; | 35.9%; |

| Welcome Bonus | None; | None; |

| Rewards | None. | None. |

Further, keep reading and discover how to apply for the Destiny® Mastercard!

Apply for Destiny Mastercard®

Learn how to apply for the Destiny Mastercard®, a simple and quick application process that can be done online.

Trending Topics

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Keep Reading

How to Build Credit: 5 Tips for Fast Results

Discover how to build credit quickly with 5 practical tips. Learn how to use credit cards wisely to boost your credit history!

Keep Reading

Net First Platinum Review: Financial Freedom at Your Fingertips

Discover in the Net First Platinum Review how this card offers $750 in credit without credit or employment checks

Keep ReadingYou may also like

How to Save Money: 7 Strategies for Financial Freedom

Discover 7 effective strategies how to save money and build wealth, from creating a budget to establishing an emergency fund.

Keep Reading

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep Reading

What Is a Credit Score? An In-Depth Overview

Even if you don't know what a credit score is, it's already affecting your life. It's best to learn about it in this special article!

Keep Reading