Debit Cards

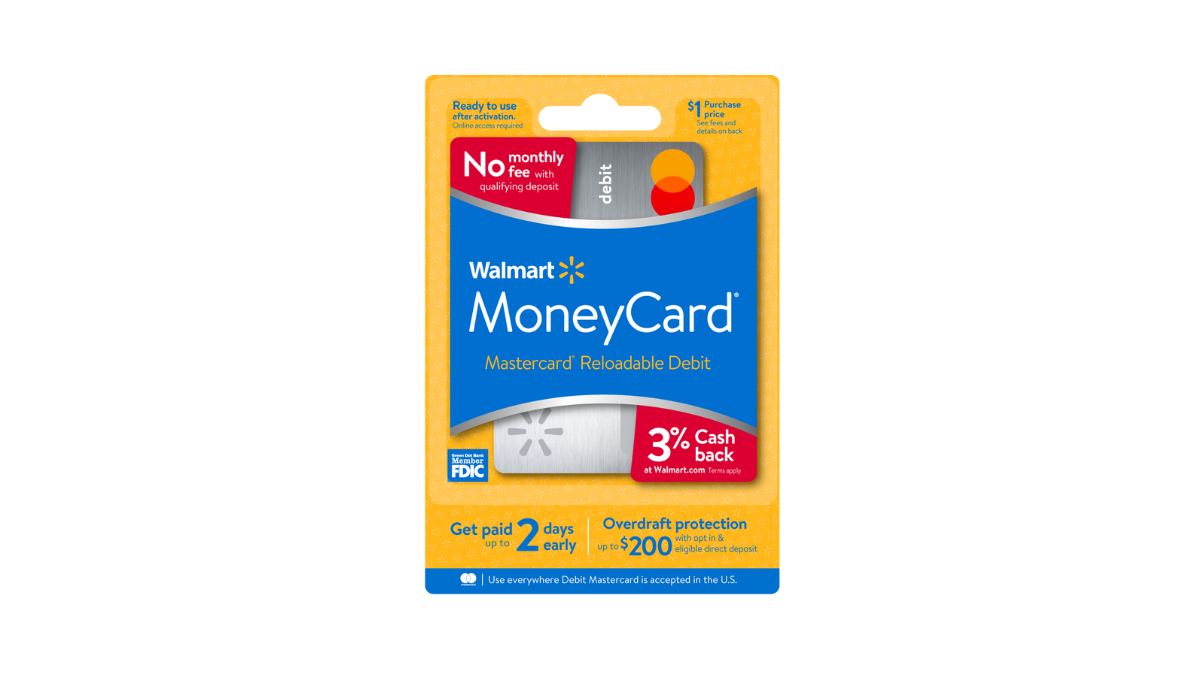

Walmart MoneyCard® Review: Cashback is in the house!

Discover the ins and outs of the Walmart MoneyCard®. This reloadable checking account offers cashback on Walmart purchases, overdraft protection, and a competitive 2% APY on savings.

Advertisement

Walmart MoneyCard®: Possibly free, certainly advantageous!

Once you have your Walmart MoneyCard® in hand, you’ll understand why so many Americans request this card daily. Follow along in this comprehensive review.

We’ve examined all aspects of this card and the associated account. Make sure to use this resource to access useful information. A straightforward yet impactful card!

| Credit Score | No required; |

| Annual Fee | $5,94 per month – the fee can be waived when you make $500+ in direct deposits in the previous monthly period; |

| Purchase APR | 0%; |

| Cash Advance APR | 0%; |

| Welcome Bonus | N/A; |

| Rewards | Earn up to 3% cash back at Walmart stores (up to $75 per year). |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Walmart MoneyCard®

More than just a card. It’s an account with everything you really need. Plus, enjoy the possibility of an annual fee waiver and cashback within the Walmart network.

The Walmart MoneyCard® is actually the tool for a reloadable checking account. This means you can deposit money into it, make purchases, and withdraw cash.

And furthermore, you gain access to various benefits. The primary one might be the refunds on purchases within the Walmart network. Also, have an ATM network at your disposal.

On the other hand, there are some limitations. Your monthly transactions will be limited to a specified amount as outlined in the contract. Pay attention to this. Also, consider the fees.

The key here is whether you’re a loyal Walmart customer or not. If you are, congratulations, this is your review. But if you’re not, then perhaps it may not be your cup of tea. Either way, it’s worth getting to know it.

Walmart MoneyCard®: is it worth it?

An easy way to decide if a card is right for you. Compare the benefits and drawbacks side by side. This way, in a clear manner, you’ll know if it’s what you’re looking for in this review.

Advertisement

Pros

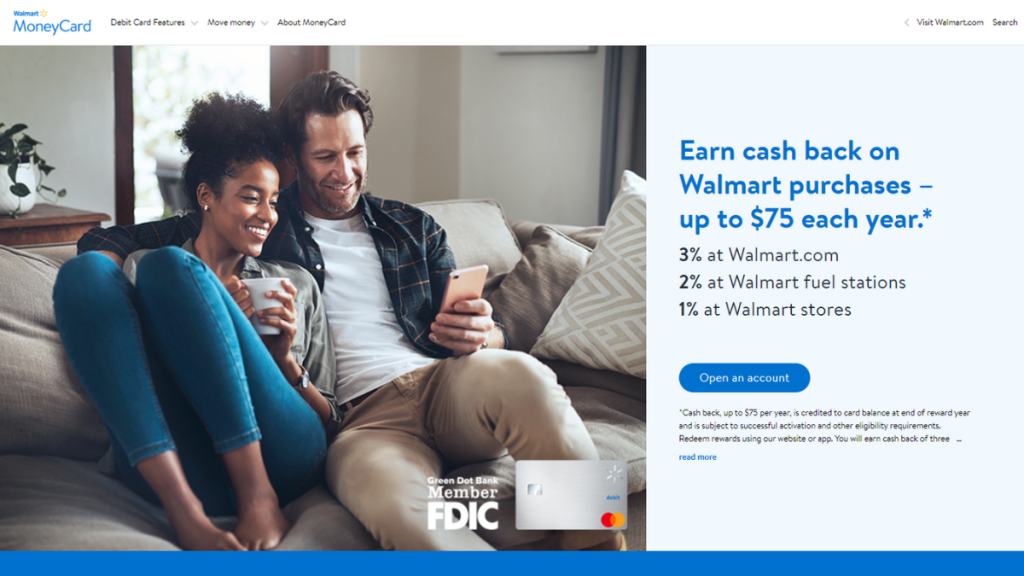

- Earn cashback on Walmart purchases: Attention to the gold in this review. The Walmart MoneyCard® offers a 3% cashback on purchases made on the official Walmart website. Also, earn 2% cashback when refueling your vehicle at Walmart’s fuel network. Additionally, get 1% cashback every time you shop at one of the numerous Walmart physical stores scattered throughout the country.

- Advance Direct Deposit: A special advantage if you need money earlier in the month. For instance, if you need to pay a bill or make a large purchase, this benefit can make all the difference. Count on this option!

- Overdraft protection up to $200 with opt-in: This feature allows you to withdraw money from your account even if you don’t have a sufficient balance. This is possible because the Walmart MoneyCard® covers up to $200 in overdraft withdrawals for eligible customers.

Cons

- Cash deposit fee: You will pay a fee of up to $4.95 for each cash deposit you make into your checking account.

- Be aware of some fees: Every time you use the overdraft, there will be a $15 overdraft fee. There is also a monthly limit for using this feature.

- Attention when using your Walmart MoneyCard® outside the U.S.: A 3% fee will be charged for each transaction made in foreign currency.

- Taxa de card replacement: Once you need to request a new Walmart MoneyCard®, you will pay a fee of $15. If you consider that you are paying to continue a service you already have, it can be somewhat uncomfortable.

Advertisement

Credit score requirements for card application

Walmart does not publicly disclose this information. It is challenging to confidently say what FICO credit score is required to open a Walmart MoneyCard® account.

We understand that this may be disappointing for you. Often, that’s precisely what you are looking for in this review. But don’t lose hope!

It is possible to make some assumptions based on the features of the Walmart MoneyCard®. Our team has reviewed this information, and here’s a verdict.

Therefore, the minimum required credit score to open a Walmart MoneyCard® account is at least 600. But don’t be discouraged if you don’t already have that score.

However, it is possible that the company accepts customers with lower credit scores, provided they have a stable work history and can afford the reload fee.

Ready to apply? Here’s how to get the Walmart MoneyCard®

You and a multitude of others want a Walmart MoneyCard®. But get ahead of the over 2.5 million people who apply for the Walmart MoneyCard® every year. How? By reading this!

Applying for your card: Online

The steps to apply for the Walmart MoneyCard® online are simple. Once you have all the documentation handy, it will certainly be a quick process.

The first step is to access the official website and start your registration. Enter all your information correctly. Take your time to avoid typing errors.

From the moment of application to the arrival of the Walmart MoneyCard® by mail, about 15 days should pass. After that, you can start making your purchases and enjoying the benefits.

The Walmart MoneyCard® also provides a temporary digital card that can be used immediately after the account is approved. You can make online purchases and shop at stores that accept contactless payments right away.

It’s also worth noting that in Walmart physical stores, you can “purchase” a Walmart MoneyCard®. So, you can also get this initial card there.

Requirements

To open a Walmart MoneyCard® account, you must be at least 18 years old and reside in the United States. You will also need to provide your name, address, Social Security number, and date of birth.

And for a complete Walmart experience, there’s one more step. Mobile or email verification and the mobile app are required to access all features.

Applying for your card: App

The account application through the app is a quick and straightforward process, but you won’t escape the bureaucracy.

You still need to provide the same information that is required for the online application.

The Walmart mobile app is available on the App Store and Google Play. Don’t miss out on the best experience by using all the available platforms. However, applying is better through the website!

Walmart MoneyCard® or Avant Credit Card?

Walmart MoneyCard® is a great choice for those seeking a simple and user-friendly debit card. But if you’re building your credit score, a helpful tool is a credit card. Then, meet a superstar!

| Walmart MoneyCard® | Avant Credit Card | |

| Credit Score | No required; | 580; |

| Annual Fee | $5,94 per month – the fee can be waived when you make $500+ in direct deposits in the previous monthly period; | Variable membership fee from $0 to $75; |

| Purchase APR | 0%; | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Cash Advance APR | 0%; | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Welcome Bonus | N/A | N/A; |

| Rewards | Earn up to 3% cash back at Walmart stores (up to $75 per year). | N/A. |

Considering this, we’ve brought the Avant Credit Card. With a credit score considered fair, you’ll likely be able to apply for yours. It’s a good ally in the financial adventure.

Apply for Avant Credit Card

Boost your credit score now! Get the Avant Card: quick approval, no credit score minimum, build real credit!

Trending Topics

Milestone Mastercard® Review: for any type of credit!

Explore the ins and outs of the Milestone Mastercard® with our comprehensive review. Navigate the credit-building journey!

Keep Reading

Total Visa® Card Review: Fast and Powerful Card!

Explore our detailed Total Visa® Card Review – your fast and powerful solution for a credit card without the hassle of credit history!

Keep Reading

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Unlock the power of rewards with the Wells Fargo Active Cash® Card! Dive into our review and explore the world of real Cashback.

Keep ReadingYou may also like

How to Build Credit: 5 Tips for Fast Results

Discover how to build credit quickly with 5 practical tips. Learn how to use credit cards wisely to boost your credit history!

Keep Reading

Credit Cards for No Credit: Find the Ideal Card in Our Selection

Explore credit cards for no credit in our selection. Discover the ideal card to build your credit history and offering tools!

Keep Reading

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep Reading