Credit Cards

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Advertisement

Upgrade Select Visa® review: No security deposits!

Embarking on the search for the perfect credit card can be both exciting and overwhelming, with countless options vying for your attention. So, you can read the Upgrade Select Visa® review!

So stick with us and discover how this credit card works and how it can help you simplify your finances! Let’s get started!

| Credit Score | Good to excellent; |

| Annual Fee | $39 annual fee; |

| Purchase APR* | 21.96% – 29.99%; Terms apply; |

| Cash Advance APR | N/A; |

| Welcome Bonus* | $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions; *Terms apply. |

| Rewards | None! |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Upgrade Select Visa®

The Upgrade card is accessible to a broad spectrum of users, from those looking to establish or rebuild their credit to those seeking a supplementary credit option with customizable limits.

Despite its advantages, potential cardholders should be mindful of certain drawbacks, such as an annual fee, variable APR based on creditworthiness, foreign transaction fees, and others.

Careful consideration of these factors in relation to individual financial needs and habits will aid in determining if the Upgrade Select Visa® card is the right fit.

Upgrade Select Visa®: is it worth it?

Even though this card offers incredible perks to its users, there are also some downsides.

Therefore, you can read our pros and cons list below to learn more and see if this card offers all the features you need!

Advertisement

Pros

- You’ll be able to get lower interest costs due to the predictable payment options this card offers;

- As a new cardholder, you’ll get an incredible welcome bonus of $200 (terms apply);

- One incredible advantage is that you won’t need to pay any late fees when you miss a card payment;

- You’ll be able to enjoy incredible Visa benefits and wide Visa brand acceptance;

- This card can be incredible for those who don’t like to pay security deposits. So, you’ll get a credit limit ranging from $500 to $2,000 with no security deposit needed.

Cons

- Unfortunately, you’ll need to pay a $39 annual fee to use this card’s features;

- The regular APR can be a bit high for some cardholders, ranging from 21.96% to 29.99%;

- If you like to travel, this card can have a considerable downside since it has a 3% foreign transaction fee or up to $30 for every $100 you spend;

- The maximum credit line can be considered low for some cardholders.

Advertisement

Credit score requirements for card application

Unfortunately, if you have a low credit score, you may not be able to find ways to qualify for this card.

Moreover, you’ll need to have a credit score of at least a good level to excellent to have more chances to qualify.

Also, you’ll need to consider that your credit score can be harmed during the application process with a hard credit check.

So, we recommend that you have a good credit score before you start the application process to get this incredible Upgrade Card!

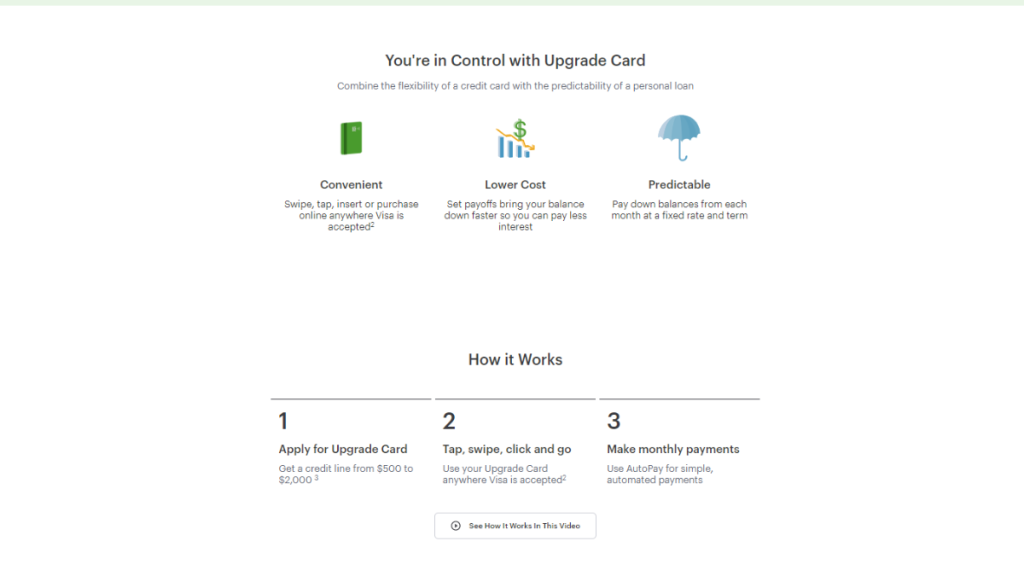

Ready to apply? Here’s how to get the Upgrade Select Visa®

Embarking on the journey to secure a credit card is a significant financial decision, and learning how to apply for Upgrade Select Visa® stands out as an enticing option for many.

Below, we will guide you through the seamless process of applying for the Upgrade Select Visa® card, unpacking the steps involved, and shedding light on the key aspects.

Apply for the card: Online

To apply online for this card, you’ll need to go to the official website and provide the personal information required on the form.

Moreover, you’ll need to search on the official website for the card you want. So, you’ll need to find the Upgrade Select Visa card to apply for the card you need.

Also, you may need to provide the personal documents required to get the best chance of qualifying.

However, you’ll need to make sure you have the right credit score to apply for this card.

In addition, you’ll need to know about the fact that your credit score may have an impact during the application due to a hard credit score check.

Requirements

Indeed, the most important requirement for this credit card is your credit score. Since it brings some exclusive benefits, good to excellent credit is a requirement.

Moreover, you’ll also need to provide your personal and financial information, including a valid SSN.

Apply for the card: Mobile App

You’ll be able to use the mobile app to manage all your finances with Upgrade and keep track of your spending.

However, you won’t be able to complete the application process through the mobile app.

So, you can read our topic above to learn all our tips about how to apply online for this incredible card!

Upgrade Select Visa® or Upgrade Life Rewards Visa®?

Indeed, the Upgrade Select Visa® brings amazing perks to cardholders. Still, you can compare other options before deciding, especially when Upgrade offers so many cards!

So meet the Upgrade Life Rewards Visa®, a card that brings up to 10% cash back, an amazing welcome bonus and $0 annual fee!

Further, compare both card’s main features and decide which is the best option for you!

| | Upgrade Select Visa® | Upgrade Life Rewards Visa® |

| Credit Score | Good to excellent; | Good to excellent; |

| Annual Fee | $39 annual fee; | No annual fee; |

| Purchase APR* | 21.96% – 29.99%; *Terms apply | 14.99% – 29.99% variable APR; |

| Cash Advance APR | N/A; | Not disclosed; |

| Welcome Bonus* | $200 bonus after opening a Rewards Checking Plus account and making 3 debit card transactions; *Terms apply | As a new cardholder, you can get a $200 bonus when you also open a Rewards Checking Plus account (valid after you make 3 debit card transactions). Terms apply; |

| Rewards | Only credit line perks. | You’ll be able to get 3% cash back on gas, grocery, health, streaming, and utilities purchases; Get 1% cash back on all other qualifying purchases you make with the card; Also, you can earn up to 10% extra cash back with Upgrade Shopping (which is powered by Dosh®); *Terms apply. |

Has the Upgrade Life Rewards Visa® got your attention? Then don’t miss the following article and learn how to apply for this card easily!

Apply for the Upgrade Life Rewards Visa®

Unlock the secrets to a rewarding financial journey with our step-by-step guide on how to apply for the Upgrade Life Rewards Visa® card!

Trending Topics

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep Reading

Net First Platinum Review: Financial Freedom at Your Fingertips

Discover in the Net First Platinum Review how this card offers $750 in credit without credit or employment checks

Keep Reading

How to Save Money: 7 Strategies for Financial Freedom

Discover 7 effective strategies how to save money and build wealth, from creating a budget to establishing an emergency fund.

Keep ReadingYou may also like

Top Books on Financial Literacy: Invest in Your Future!

Explore the top books on financial literacy and invest in your future! Unlock the keys to financial freedom with these must-reads.

Keep Reading

Total Visa® Card Review: Fast and Powerful Card!

Explore our detailed Total Visa® Card Review – your fast and powerful solution for a credit card without the hassle of credit history!

Keep Reading

Upgrade Life Rewards Visa® review: No annual fee!

Discover the perks and pitfalls of the Upgrade Life Rewards Visa® card in our latest review. Up to 10% cash back + up to $25K credit line!

Keep Reading