Hey, you made it! Destiny Mastercard® is the light at the end of the tunnel for bad credit!

Destiny Mastercard®: Your credit building companion. Bad score? Don't worry about it!

Advertisement

Destiny Mastercard®: Build your credit without a security deposit, apply in seconds, and have the peace of mind of a fraud-protected card. Your low score is not a problem. Here is the solution!

Your new credit-building partner isn't alone; it comes with many benefits. Check out what you get with Destiny Mastercard®:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

We know that doors close when our credit scores fall. But it is in difficult times that strong allies emerge. Destiny Mastercard® will help you to regain your self-esteem.

Learn about the strengths and weaknesses of Destiny Mastercard® and see that all you need is the security of a credit builder without a security deposit.

Upsides and advantages

- No security deposit. Your money is free from chains.

- Pre-qualify without score reduction. What you least need now is to lower your score.

- Monthly reports to the country's three main credit agencies. These agencies are responsible for assigning credit scores to consumers and businesses based on a variety of factors, including payment history, debt, income, and lending history.

- Easy to apply. Receive your offer quickly directly on their website. No need to stay in line for hours to deal with paperwork.

Downsides and limitations

- No welcome bonus. We know that bonuses can often be a self-defeating move. The focus of the Destiny Mastercard® is to help you improve your credit score, not the opposite.

- There is no rewards program. Rewards programs can be a dangerous incentive to overspending, and they are incompatible with a credit-building card.

- Relatively low credit limit. Destiny Mastercard® is a credit card for people with low credit scores. The responsibility is to release credit that you can afford to pay and, with that, achieve your goal of improving your score. Then, you can be approved for higher limits. Does that make sense?

So, are you considering recruiting this partner? See how easy it is to apply and enjoy the peace of mind of a credit card that doesn't care about your bad history and doesn't ask for a deposit.

We know that, at this moment, the least important things are dubious rewards or unsafe cards. So, take advantage of Destiny Mastercard® now!

The Destiny Mastercard® is a credit-building credit card with no security deposit. It is designed to help consumers with poor credit history build a positive credit history.

To build your credit with the Destiny Mastercard®, it is important to pay your bills on time and keep your card balance low. When you pay your bills on time, you are demonstrating to the creditor that you are a good payer. When you keep your card balance low, you are demonstrating to the creditor that you have control over your credit.

You can pay your Destiny Mastercard® bill online, by phone, or by mail. To pay online, visit the Destiny Mastercard® website and log in to your account. To pay by phone, call the customer service at 1-800-583-5698. To pay by mail, send a check or wire transfer to the address listed on your bill.

See? Your credit score is not a hindrance to good options. And the Destiny Mastercard® is only one of the many options you have. Another recommendation is the Wells Fargo Reflect® Card.

This card is full of advantages for people looking to consolidate debt, as it offers an attractive 0% introductory APR period.

If that’s your case, keep reading to learn more about this financial tool to build the stairs for your higher status.

Apply for Wells Fargo Reflect® Card: 0% intro APR

Here's what you need to get 21 months of 0% interest; find out how to apply for your Wells Fargo Reflect® Card. The article is fresh!

Trending Topics

Freedom Gold Card Review: Plus $750 to your monthly budget

Discover the card that can save your monthly budget. In this review, we bring every nuance of the Freedom Gold Card!

Keep Reading

What Is a Credit Score? An In-Depth Overview

Even if you don't know what a credit score is, it's already affecting your life. It's best to learn about it in this special article!

Keep Reading

Revvi Card Review: Earn 1% cash back

Revvi Card: Cashback and points for those with bad credit! Low requirements are required, but pay attention to interest

Keep ReadingYou may also like

Reflex® Platinum Mastercard® Review: The new double credit!

Discover the power of the Reflex® Platinum Mastercard® - the new double credit! Get the credit you want, even with bad credit

Keep Reading

Petal® 1 “No Annual Fee” Visa® Credit Card Review: Build credit!

Discover our comprehensive review of the Petal® 1 “No Annual Fee” Visa® Credit Card. It's time to build credit effortlessly!

Keep Reading

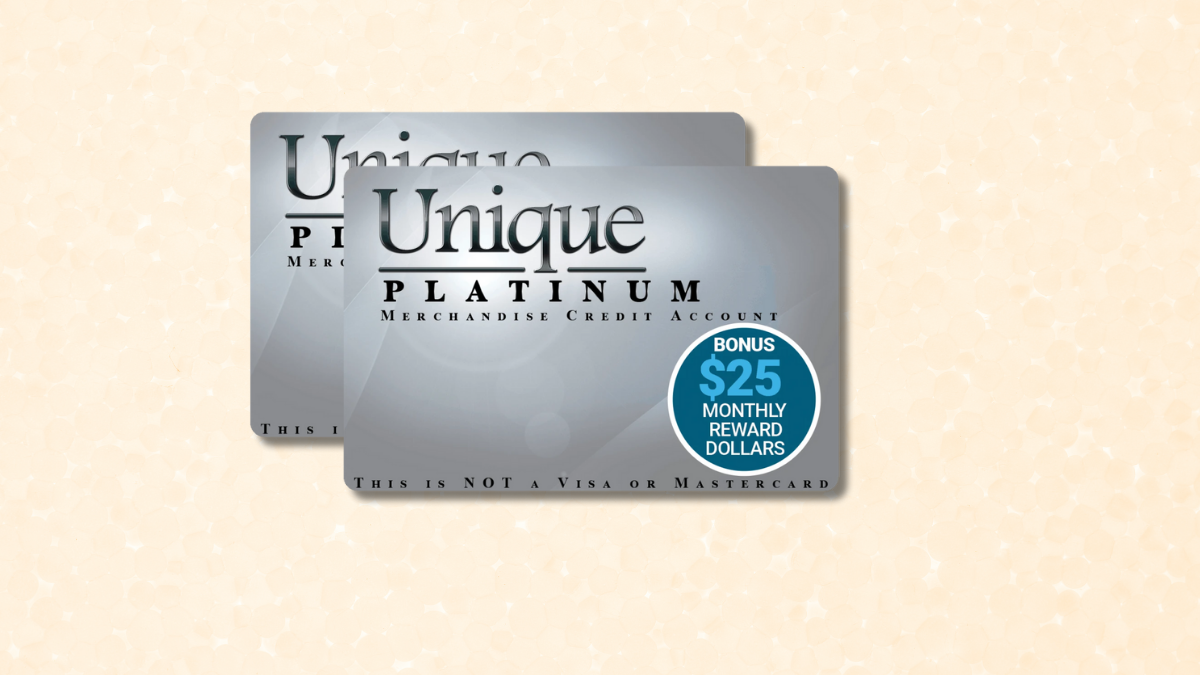

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep Reading