Credit Cards

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

If you plan on improving your financial situation this year and putting your credit score back in shape, take a closer look at the OpenSky® Secured Visa® Credit Card in this full review.

Advertisement

Get your OpenSky® Secured Visa® Credit Card and write a new credit history

No more begging for a credit card. Our OpenSky® Secured Visa® Credit Card review will show you a better option than those expensive unsecured credit cards.

Because if you think an unsecured credit card is not a good deal, you should think again. They are very efficient! Keep reading to understand what we’re talking about!

| Credit Score | Any credit score is accepted; |

| Annual Fee | $35; |

| Purchase APR | 25.64%; |

| Cash Advance APR | 25.64%; |

| Welcome Bonus | No bonus for new cardholders; |

| Rewards | You’ll get no rewards out of this plastic. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the OpenSky® Secured Visa® Credit Card

Let’s face reality: getting a credit card will put a spotlight on your credit history. If you haven’t done the work, you’ll get no applause from your credit issuer.

So let’s hire a good actor for this show. The OpenSky® Secured Visa® Credit Card is perfect for the role and will not review your credit score for the application.

This means you’ll get an open gate to ride the credit-score-building road. And all you have to do is pay the security deposit of at least $200. And pay the $35 annual fee.

Then, all you have to do is use your card like a responsible adult. This means paying your bills always on time to show the credit bureaus you have learned your lesson.

Moreover, this credit card has no fancy rewards programs or exclusive benefits. But you’ll get free credit score monitoring and don’t even need a bank account.

OpenSky® Secured Visa® Credit Card: is it worth it?

We understand that many people are unwilling to pay $200 upfront to get a credit card. But believe us, this might be your better and more advantageous chance to access credit.

After all, if you have a poor or no credit score, you don’t have too many good options available.

So you must review the OpenSky® Secured Visa® Credit Card benefits and weigh the possible disadvantages.

Advertisement

Pros

- Straightforward application that will take you only a couple of minutes;

- Visa® network will give you wide acceptance;

- The refundable deposit can be as low as $200 (but as high as $3,000);

- Keep an eye on your credit score without paying a cent for it;

- Add your OpenSky® Secured Visa® Credit Card to your digital wallet;

- No scratch on your credit score to apply for this card;

- No need to get a bank account, as you’ll have other methods to make payments.

Cons

- It charges an annual fee;

- The interest rate can add pretty quickly to your balance, so pay attention to it;

- Some secured cards give rewards. But that’s not the case with the OpenSky® Secured Visa® Credit Card.

Advertisement

Credit score requirements for card application

Even though you don’t need to show your credit history, there are still a few requirements, and approval is not 100% guaranteed.

But there is nothing out of this world: SSN, US residency, legal age, income, just the regular documentation.

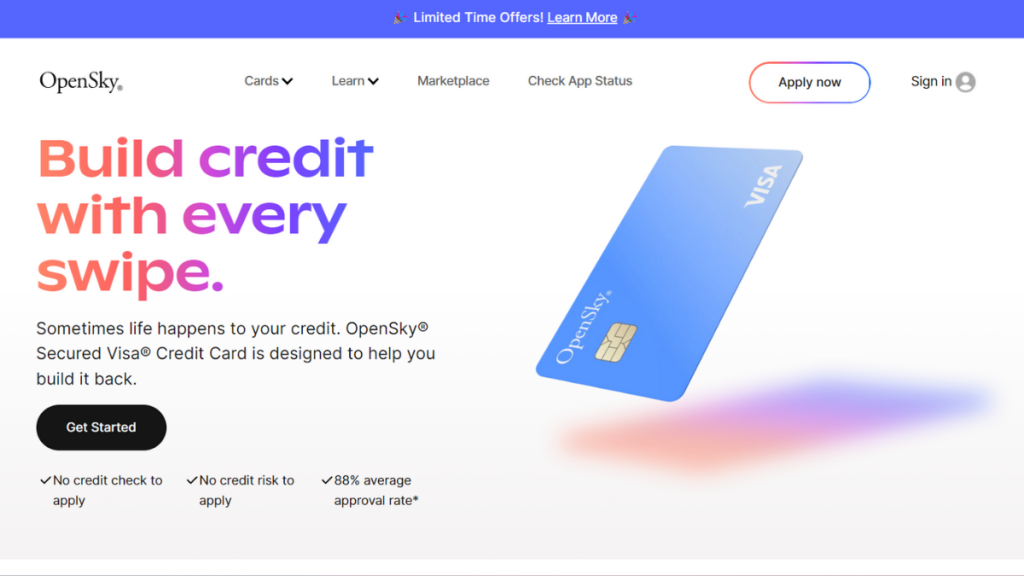

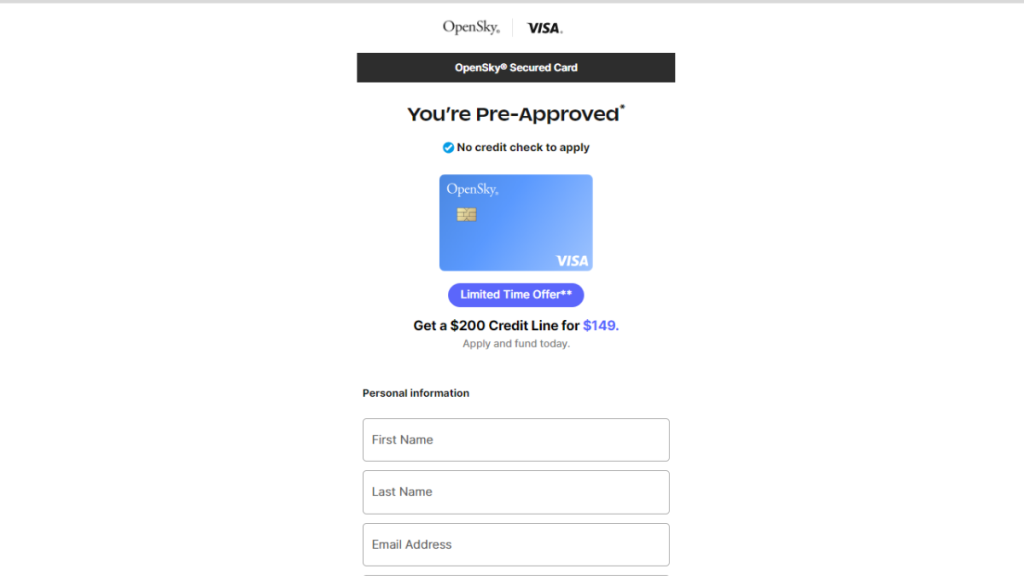

Ready to apply? Here’s how to get the OpenSky® Secured Visa® Credit Card

This post will show you how to apply for the OpenSky® Secured Visa® Credit Card in minutes. Because we know time is money, and you must save yours.

This credit card application will not touch your credit score. So you can apply without worries! Let’s see how you can do it.

Applying for your card: Online

Gone are the days when we had to walk all the way to the bank with a folder full of documents. Apply for the OpenSky® Secured Visa® Credit Card online!

First, go to the OpenSky website. Ensure you’re on the right website, as you’ll provide personal information.

Then, find the “apply now” button and get to the application form. It will be pretty intuitive, and you must answer each question.

Now, pay close attention to the info you are providing. If you have one wrong digit in your Social Security Number, OpenSky will not be able to check your identity.

Once you’ve submitted the form, your information will be reviewed. If everything is right, you can get your approval within 1 to 2 business days.

Requirements

- Proof of income;

- US residency;

- Social Security Number;

- A security deposit of at least $200 to establish your credit limit.

Applying for your card: App

Nowadays, it seems like our whole lives are inside our cell phones. And that is also true for your financial management.

Even though you can not apply for the card using the mobile app, you must for sure download it after you get approved.

After all, it will make everything easier. From checking your card balance and payments to monitoring your credit score.

The OpenSky mobile app is available for both Android and iOS phones.

OpenSky® Secured Visa® Credit Card or GO2Bank Secured Visa® Credit Card?

So, this is all we have to tell you about the OpenSky® Secured Visa® Credit Card by now. Do you think it matches your wallet?

We will give you something to compare if you need a moment to consider. Say hello to the GO2Bank Secured Visa® Credit Card. Yes, another secured credit card.

We’ll stay in the secured cards lane to show you how it can be a good move on your financial strategy. Again, you don’t need a good credit history to apply for this one.

| OpenSky® Secured Visa® Credit Card | GO2Bank Secured Visa® Credit Card | |

| Credit Score | Any credit score is accepted; | No credit check: check; |

| Annual Fee | $35; | Zero plus zero, forever; |

| Purchase APR | 25.64%; | 22.99%; |

| Cash Advance APR | 25.64%; | 26.99%; |

| Welcome Bonus | No bonus for new cardholders; | None; |

| Rewards | You’ll get no rewards out of this plastic. | GO2Bank has no rewards program for this credit card. |

But we will not leave you with so little information. The following link will take you to our GO2Bank Secured Visa® Credit Card review.

Keep learning, and keep preparing yourself to crush the credit game.

Apply for GO2bank Secured Visa® Credit Card

Learn how to apply for the GO2bank Secured Visa® Credit Card and discover a better way to use your money and build a credit score!

Trending Topics

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep Reading

How to Apply for the First Access Visa® Card: Fast and powerful!

Apply First Access Visa® Card: Rebuild your credit with fast, user-friendly approval. Start your journey to financial improvement today!

Keep Reading

Surge® Platinum Mastercard® Review: Poor score, monster benefit!

Discover the power of the Surge® Platinum Mastercard®: your solution to building credit. Up to $1,000 initial credit limit!

Keep ReadingYou may also like

Revvi Card Review: Earn 1% cash back

Revvi Card: Cashback and points for those with bad credit! Low requirements are required, but pay attention to interest

Keep Reading

650 Credit Score: Is It Good? A Guide to Credit Health

Find out if 650 is a good credit score and what type of loans and credit cards you can get with this three-digit number in your hands!

Keep Reading

Top Books on Financial Literacy: Invest in Your Future!

Explore the top books on financial literacy and invest in your future! Unlock the keys to financial freedom with these must-reads.

Keep Reading