Credit Cards

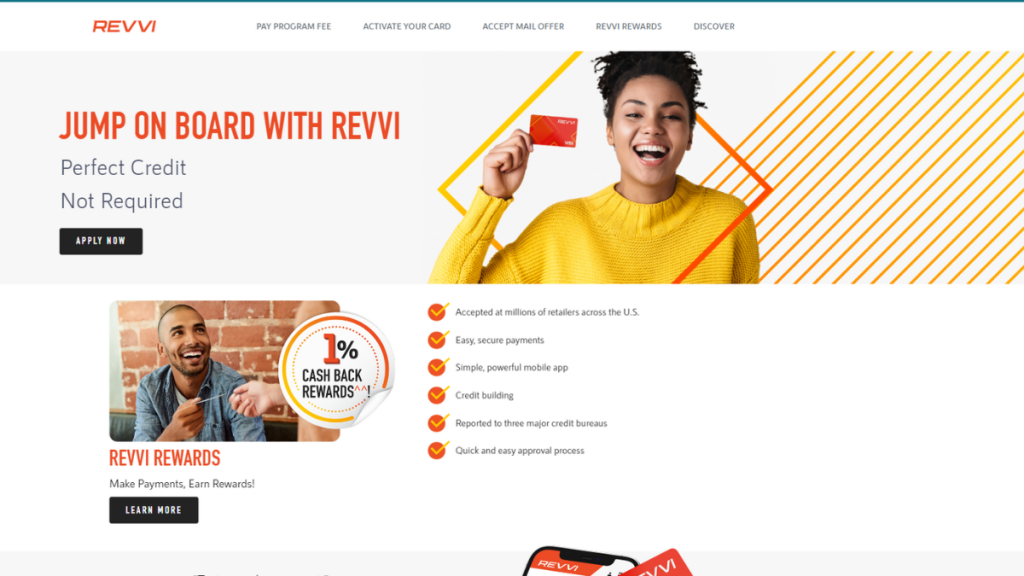

Apply for the Revvi Card: It’s time to change your score!

Are you in the mood for a Revvi Card? The application is quick, whether online or via the app! Earn 1% cash back on purchases!

Advertisement

See how surprisingly fast the application process

If you are interested in the Revvi Card, you can apply online. But before you start that application, see what we’ve separated about the process.

The official Revvi Card website promises that you can do this process in seconds. But in such a short time, it is possible that you will miss something. Not here!

Applying for your card: Online

The Revvi Card website is designed for a quick and secure experience. Buckle up and see how your journey will be.

When you access the website, you will be greeted by the application form. Fill it out carefully and pay attention to all the information.

A one-time, upfront program fee of US$ 95.00 will be required.

It must be paid in full within 60 days of your application approval and before your account is opened.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

To be approved for the Revvi Card, you must meet the following basic requirements.

In addition to being over 18 years old and having a United States address, you must provide your SSN, and your credit history will be verified.

Applying for your card: App

There is also another way to apply for your Revvi Card, through the mobile app.

The steps are very simple and intuitive. You have certainly done this step-by-step more than once.

Download the app, locate the Revvi Card and follow the instructions on the screen.

To apply for the card through the app, you will need to provide the same information that you would provide if you were applying for the card online.

In addition, you will need to take a photo of your face and a photo of your ID.

Revvi Card or Reflex® Platinum Mastercard®?

Just because you don’t have the best possible credit score doesn’t mean the credit card market doesn’t have options for you. On the contrary.

Many tools are designed exclusively to help you on your credit score journey. Check out the comparison of two excellent options.

| Revvi Card | Reflex® Platinum Mastercard® | |

| Credit Score | Fair score credit. Average approved score: 580; | Good or bad credit. Average approved score: 580; |

| Annual Fee | $75.00 for first year. After that, $48.00 annually. Plus other fees; | $75 to $125 in the 1st year – $99 to $125 after; |

| Purchase APR | 35.99%; | 29.99% (variable); |

| Cash Advance APR | 35.99%; | 29.99% (variable); |

| Welcome Bonus | None; | None; |

| Rewards | Earn 1% cash back rewards on purchases! | Not available. |

It’s important to know what’s out there before you fill out forms. With this in mind, we created our materials. Check out this grouping of useful information.

Apply for Reflex® Platinum Mastercard®

Discover how to apply for the Reflex® Platinum Mastercard® and double your credit! Don't miss your chance – read now!

Trending Topics

The Wells Fargo Reflect® Card Review: Your Financial Freedom

Miss the interest-free introductory period and see everything you need to know in the Wells Fargo Reflect® Card Review

Keep Reading

750 Credit Score: Is It Good?

Is 750 a good credit score? It can open doors to the best financial opportunities. Learn how to transform your creditworthiness!

Keep Reading

Apply for the FIT Mastercard®: The start of a new phase!

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Keep ReadingYou may also like

Avant Credit Card Review: Move Forward Towards Perfect Credit!

Meeting your new partner in credit building. Avant Credit Card also has the possibility of a zero annual fee. Check out the full review!

Keep Reading

Apply for OpenSky® Secured Visa® Credit Card: build credit

Learn how to apply for the OpenSky® Secured Visa® Credit Card with a $200 security deposit and get a chance to rebuild your credit score.

Keep Reading

Apply for GO2bank Secured Visa® Credit Card: build credit

Learn how to apply for the GO2bank Secured Visa® Credit Card and discover a better way to use your money and build a credit score!

Keep Reading