Credit Cards

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Discover the Wells Fargo Active Cash® Card – your gateway to unparalleled rewards. Enjoy a 2% cashback on all purchases and much more!

Advertisement

Uncover all about real Cashback: 2% unlimited cashback on every purchase!

This was certainly an easy review to write – Wells Fargo Active Cash® Card is a no-annual-fee Cashback credit card that offers 2% cashback on all purchases.

Now, let’s delve into everything about how the Wells Fargo Active Cash® Card became a great option for those seeking ease of use and meaningful rewards.

| Wells Fargo Active Cash® Card | |

| Credit Score | Good to Excellent; |

| Annual Fee | None; |

| Purchase APR | 0% for 15 months, then 20.24%, 25.24% or 29.99%; |

| Cash Advance APR | 29.99%; |

| Welcome Bonus | $200 when spending $500 in purchases in the first 3 months; |

| Rewards | 2% Cashback on all purchases. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Wells Fargo Active Cash® Card

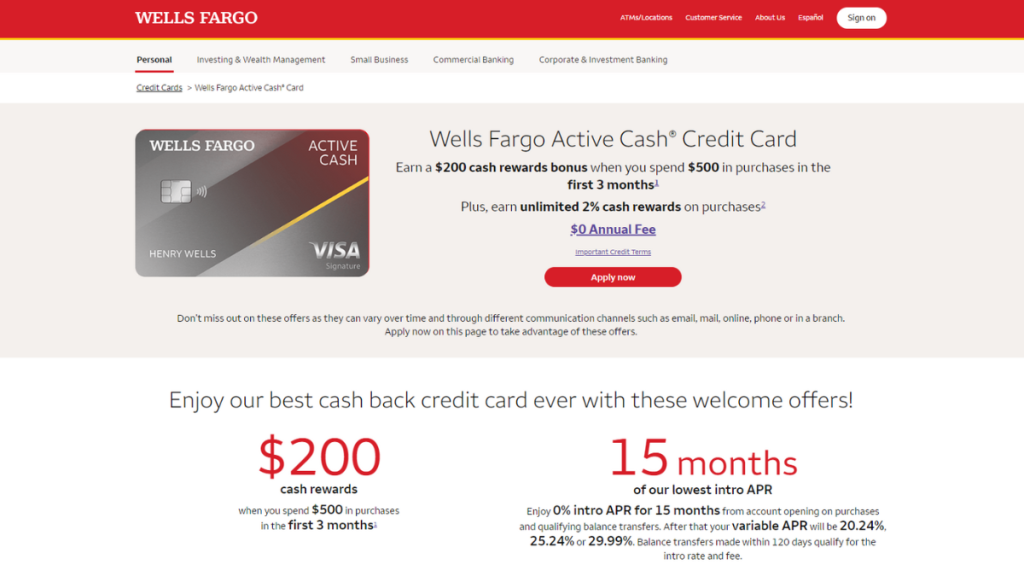

The Wells Fargo Active Cash® Card brings amazing benefits to those looking to save money! Firstly, it brings 2% unlimited cash back on purchases!

In addition, you can enjoy 0% intro APR for 15 months on purchases and qualifying balance transfers.

And there is more! The Wells Fargo Active Cash® Card also provides a $200 signup bonus after spending $500 on purchases in the first three months.

And, of course, there are some additional features, including zero liability protection, phone protection, and much more!

No doubt, the Wells Fargo Active Cash® Card is the right credit card for those who want to make the most of their spending!

Wells Fargo Active Cash® Card: is it worth it?

With so many advantages, it’s easy to overlook the drawbacks of the Wells Fargo Active Cash® Card.

That’s why we took the initiative to address these concerns. Thus, we bring you a secure and truthful analysis.

See for yourself how the Wells Fargo Active Cash® Card earned accolades from important finance portals.

Advertisement

Pros

- 2% cash back on all purchases;

- $200 signup bonus;

- No annual fee;

- 0% introductory interest for 15 months on purchases and qualifying balance transfers;

- Cell phone protection.

Cons

- High standard interest rate (20.24%, 25.24%, or 29.99%) after the intro period;

- No special reward categories.

Advertisement

Ready to apply? Here’s how to get the Wells Fargo Active Cash® Card

To apply for the Wells Fargo Active Cash® Card, you can visit the Wells Fargo website or download the Wells Fargo Mobile® app.

The Wells Fargo Active Cash® Card is an excellent choice for those seeking a simple and easy-to-use credit card that offers meaningful rewards.

If you’re looking for a credit card to help you save money, the Wells Fargo Active Cash® Card is a great option. Discover how to get yours in your hands now.

Applying for your card: Online

Applying for the Wells Fargo Active Cash® Card online is genuinely straightforward and intuitive.

Visit the Wells Fargo website, click on the “Credit Cards” link, and look for our beloved Wells Fargo Active Cash® Card.

Next, fill out the application form with your personal and financial information! They will request only your basic information!

Next, submit the form and wait for the result! It is quick and simple! So don’t hesitate in getting your Wells Fargo Active Cash® Card!

Requirements

To be approved for the Wells Fargo Active Cash® Card, you must have a credit score of at least 670.

You’ll also need a positive credit history, free of unpaid debts or payment delays.

The documentation is basic; you only need your social security number, proof of income, and address. It’s a quick and simple process.

Applying for your card: App

An even more agile option is to apply for the Wells Fargo Active Cash® Card through the app, available in the top app stores.

Download the Wells Fargo Mobile® app on your mobile device and follow the on-screen instructions to complete the application.

If you don’t have an account yet, you might need to create one now.

After that, the process is straightforward, and you’ll receive your feedback shortly. Good luck!

Wells Fargo Active Cash® Card or Wells Fargo Reflect® Card?

But, of course, if the Wells Fargo Active Cash® Card isn’t quite what you’re looking for, here’s another option to consider: the Wells Fargo Reflect® Card.

This card offers an ultra long intro APR on purchases! Check out a quick comparison of both credit cards!

| Wells Fargo Active Cash® Card | Wells Fargo Reflect® Card | |

| Credit Score | Good to Excellent; | 660 or higher; |

| Annual Fee | Free; | No annual fee; |

| Purchase APR | 0% for 15 months, then 20.24%, 25.24% or 29.99%; | 0% for 21 months, thereafter 18.24%, 24.74%, or 29.99% variable based on the U.S. Prime Rate; |

| Cash Advance APR | 29.99%; | 29.99% variable based on the U.S. Prime Rate; |

| Welcome Bonus | $200 when spending$500 in purchases in the first 3 months; | None; |

| Rewards | 2% Cashback on all purchases. | None. |

Up next, discover how to apply for the Wells Fargo Reflect® Card! Ensure a quick and simple application process!

Apply for Wells Fargo Reflect® Card: 0% intro APR

Here's what you need to get 21 months of 0% interest; find out how to apply for your Wells Fargo Reflect® Card. The article is fresh!

Trending Topics

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep Reading

GO2bank Secured Visa® Credit Card Review: $0 annual fee

Check this review to learn how GO2bank Secured Visa® Credit Card will boost your credit score with outstanding support!

Keep Reading

Surge® Platinum Mastercard® Review: Poor score, monster benefit!

Discover the power of the Surge® Platinum Mastercard®: your solution to building credit. Up to $1,000 initial credit limit!

Keep ReadingYou may also like

Milestone Mastercard® Review: for any type of credit!

Explore the ins and outs of the Milestone Mastercard® with our comprehensive review. Navigate the credit-building journey!

Keep Reading

PenFed Pathfinder® Rewards Visa Signature® Card Review: Earn more

Discover the ultimate travel companion with our PenFed Pathfinder® Rewards Visa Signature® Card Review! Up to 4x points on purchases!

Keep Reading

Revvi Card Review: Earn 1% cash back

Revvi Card: Cashback and points for those with bad credit! Low requirements are required, but pay attention to interest

Keep Reading