Credit Cards

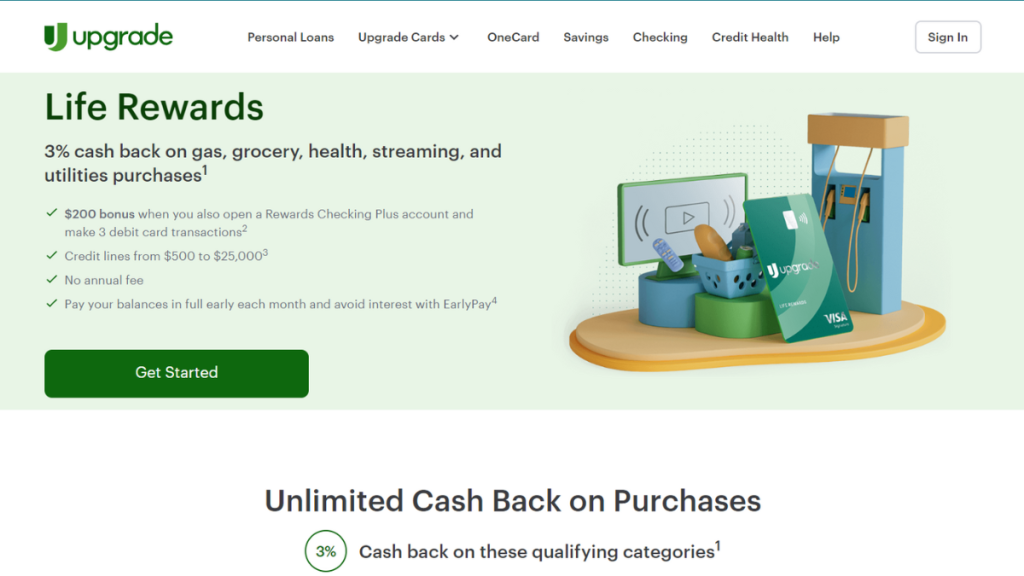

Upgrade Life Rewards Visa® review: No annual fee!

Uncover the secrets behind the Upgrade Life Rewards Visa® card – a credit card promising cashback rewards, impressive perks, and a few caveats.

Advertisement

Upgrade Life Rewards Visa®: Earn big!

Welcome to our in-depth review of the Upgrade Life Rewards Visa® card – a financial tool that promises a blend of rewards and benefits designed to enhance your everyday spending experience.

This card brings a wide range of features that will help you achieve your financial dreams! So keep reading and learn more about the amazing tool!

| Credit Score | Good to excellent; |

| Annual Fee | There is no annual fee; |

| Purchase APR | 14.99% – 29.99% variable APR; |

| Cash Advance APR | Not disclosed; |

| Welcome Bonus | As a new cardholder, you can get a $200 bonus when you also open a Rewards Checking Plus account (valid after you make 3 debit card transactions). Terms apply; |

| Rewards | You’ll be able to get 3% cash back on gas, grocery, health, streaming, and utilities purchases; Get 1% cash back on all other qualifying purchases you make with the card; Also, you can earn up to 10% extra cash back with Upgrade Shopping (which is powered by Dosh®); *Terms apply. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Upgrade Life Rewards Visa®

In a world filled with credit card options, the Upgrade Life Rewards Visa® card has emerged as a contender, offering a generous reward rate.

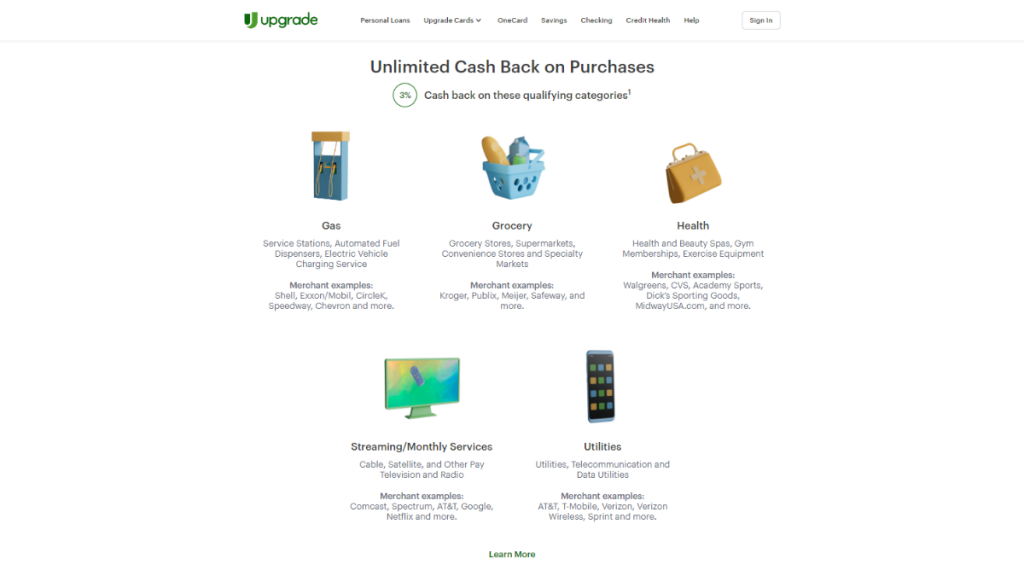

So you’ll earn 3% back on grocery, gas, health, streaming, and utility purchases. Plus, get 1% back on all other qualifying purchases and 10% back with Upgrade Shopping powered by Dosh®.

Yes, there is more! Upgrade also offers an amazing welcome bonus of $200 when you open a Rewards Checking Plus account and make 3 debit card transactions.

The Upgrade Life Rewards Visa® is indeed an amazing addition to your wallet, especially when it brings so many perks, a credit line of up to $25,000 and a $0 annual fee!

No complications! That’s the card that will revolutionize your spending in no time!

Upgrade Life Rewards Visa®: is it worth it?

Although this card offers incredible perks to its cardholders, you may find that there are also downsides.

Therefore, you can read the pros and cons list below!

Advertisement

Pros

- You’ll find that this card offers some incredible rewards rates that can go from 1% to 10% cash back depending on the perks and terms;

- As a new cardholder, you’ll be able to find an incredible welcome bonus of up to $200 after following the terms and requirements;

- You’ll be able to get all of this card’s great features for no annual fee;

- The APRs this card offers can be incredible for some people since they range from 14.99% to 29.99%;

- You’ll be able to find an incredible travel insurance option;

- This card offers great additional credit card benefits, such as emergency help, extended warranty protection for purchases, and much more.

Cons

- Unfortunately, you won’t be able to find rewards to earn on every purchase you make with this card;

- If you like to travel, you’ll need to reconsider getting this card and think of all the features because there is a 3% foreign transaction fee;

- You’ll need to pay to make balance transfers. So, there is a balance transfer fee of 5%.

Advertisement

Credit score requirements for card application

This credit card offers some incredible perks to its cardholders. However, to get all these perks, you’ll need to have a high credit score.

So, to have more chances of getting this card, you’ll need to have a credit score ranging from good to excellent.

Also, your credit score can decrease during the application process since there is a hard credit check during the application.

Ready to apply? Here’s how to get the Upgrade Life Rewards Visa®

You can easily learn how to apply for this card online. Also, you’ll be able to do it from anywhere with a computer and internet connection.

However, make sure you have your personal information and documents with you before you start the application process. Read our blog post below to see how to apply for this card!

Apply for the card: Online

The Upgrade Life Rewards Visa® card is a compelling financial tool that combines attractive rewards with various benefits.

Boasting a generous reward rate of up to 3x on eligible purchases, this card appeals to individuals who prioritize maximizing their cashback earnings.

Therefore, to apply online for this card, you’ll need to make sure that you have at least a good credit score to have more chances to qualify.

Also, you’ll need to go to the official website to click on the right credit card you want and then start the application.

Then, you’ll need to provide the personal information required and personal documents they may need.

After all of that, you’ll be able to complete the application and wait for a quick response about it!

Requirements

To get the Upgrade Life Rewards Visa®, you’ll good to excellent credit. This is because this card brings a wide range of premium benefits to cardholders.

Also, you’ll need to provide your personal information and have a valid SSN.

Apply for the card: Mobile App

You’ll be able to use the mobile app to keep track of your finances with Upgrade and much more.

However, you won’t be able to complete the application process through the mobile app.

So, read the topic above to see tips on how to apply online through the website.

Upgrade Life Rewards Visa® or PenFed Platinum Rewards Visa Signature® Card?

If you’re not so sure about getting the Upgrade Life Rewards Visa card, you can try applying for the PenFed Platinum Rewards Visa Signature® Card!

Also, with the PenFed card, you’ll be able to get up to 5x points on gas and more points on other useful and everyday purchases, such as tv, restaurants, supermarkets, and more!

Moreover, this card has a reasonable variable APR and no annual fee to get all these perks!

So, read the comparison table below to learn even more about these cards to see which is the best option for your needs!

| Upgrade Life Rewards Visa® | PenFed Platinum Rewards Visa Signature® Card | |

| Credit Score | Good to excellent; | At least 690; |

| Annual Fee | There is no annual fee; | No annual fee; |

| Purchase APR | 14.99% – 29.99% variable APR; | 17.99%; |

| Cash Advance APR | Not disclosed; | 17.99%; |

| Welcome Bonus | As a new cardholder, you can get a $200 bonus when you also open a Rewards Checking Plus account (valid after you make 3 debit card transactions). Terms apply; | 15,000 bonus points (you must spend $1,500 during your first 3 months as a cardmember); |

| Rewards | You’ll be able to get 3% cash back on gas, grocery, health, streaming, and utilities purchases; Get 1% cash back on all other qualifying purchases you make with the card; Also, you can earn up to 10% extra cash back with Upgrade Shopping (which is powered by Dosh®); *Terms apply. | 5x points on gas, 3x on useful categories like TV, restaurants, supermarkets Also, streaming services and 1x point on everything else. |

Therefore, if you love the PenFed card option, you can read our blog post below to learn more about it and find out how to apply!

Apply for PenFed Platinum Rewards Visa Signature®

Unlock the allure of a Visa Signature® with no annual fee! Discover how to apply for the PenFed Platinum Rewards Visa Signature® Card!

Trending Topics

Walmart MoneyCard® Review: Cashback is in the house!

Unlock cashback rewards and potential fee waivers with the Walmart MoneyCard®! Dive into our comprehensive review to discover it!

Keep Reading

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep Reading

What Is a Credit Score? An In-Depth Overview

Even if you don't know what a credit score is, it's already affecting your life. It's best to learn about it in this special article!

Keep ReadingYou may also like

Milestone Mastercard® Review: for any type of credit!

Explore the ins and outs of the Milestone Mastercard® with our comprehensive review. Navigate the credit-building journey!

Keep Reading

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep Reading

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep Reading