Credit Cards

Surge® Platinum Mastercard® Review: Poor score, monster benefit!

The article explores the Surge® Platinum Mastercard®, an option to build credit without sacrificing big purchases!

Advertisement

Building your way to better credit

Discover the financial power of the Surge® Platinum Mastercard® in the review. Our in-depth analysis reveals the pros and cons of this card.

Recommended for those who don’t have an excellent credit but still need to make a significant purchase while taking advantage of an interest-free period.

| Credit Score | Good or bad credit. approved average score: 600; |

| Annual Fee | First year: $75 to $125. Subsequent years: $99 to $125; |

| Purchase APR | 29.99%; |

| Cash Advance APR | 29.99% to 35.99%; |

| Welcome Bonus | None; |

| Rewards | None. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Surge® Platinum Mastercard®

Indeed, the Surge® Platinum Mastercard® is a starter credit card that brings amazing benefits to those looking to build credit.

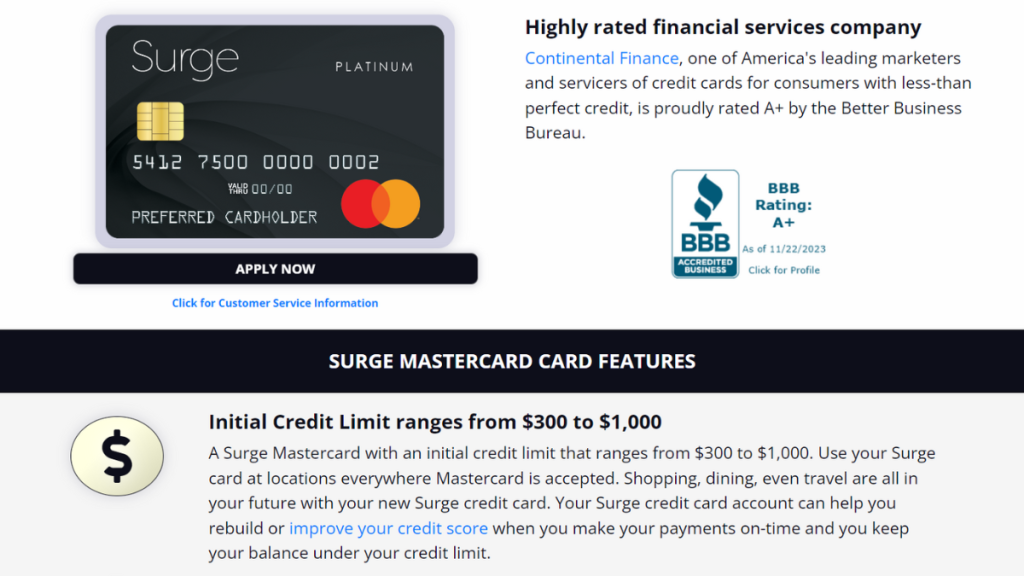

For example, cardholders will start with a credit limit of up to $1,000. And can quickly double it to up to $2,000 with good card management.

Also, since this is a credit builder card, it reports your transactions to the major credit bureaus and provides free monthly credit score access!

Isn’t it great? This way, you can monitor your advance closely and achieve your financial goals faster!

In addition to those features, you can count on Mastercard’s Zero Liability Protection for unauthorized charges!

Surge® Platinum Mastercard®: is it worth it?

Is it worth investing in the Surge® Platinum Mastercard®?

Find out if the benefits outweigh the fees and if this card is the best choice for your financial needs.

Advertisement

Pros

- Build credit quickly;

- Access your credit score monthly for free;

- Enjoy Zero Liability Protection;

- Ensure an initial credit limit ranging from $300 to $1,000;

- All types of credit are accepted.

Cons

- This card charges an annual fee;

- Potentially high APR;

- It offers no rewards or bonuses to new cardholders.

Advertisement

Credit score requirements for card application

For you to complete the journey, you can start with a good or even bad credit score.

We can say that the average approved score for the Surge® Platinum Mastercard® is 600 points.

Ready to apply? Here’s how to get the Surge® Platinum Mastercard®

Ready to transform your financial future? Discover how to apply for the Surge® Platinum Mastercard® and enjoy the benefits of building credit.

Especially for you!

Applying for your card: Online

Apply with ease online for the Surge® Platinum Mastercard®. Navigate a simple process and discover how to start your journey to better credit.

To apply online, you must access the Surge® Platinum Mastercard® website. We’ve provided the link above to help you!

There, hit the “Apply Now” button and fill out the application form. You must provide basic information such as your name, address and SSN.

Next, subimit your application and wait for the result! If approved, you’ll receive further instructions about what comes next!

Requirements

Please note that your credit score and financial history may influence your application for your Surge® Platinum Mastercard®.

In general, the requirements to apply for a credit card in the United States include a minimum age of 18 years and the ability to provide proof of income.

Applying for your card: App

Applying for the Surge® Platinum Mastercard® is only possible through their official website.

Still, they bring an amazing mobile app to help you manage your finances! Discover how convenience is within your reach while you seek a more solid credit.

Surge® Platinum Mastercard® or FIT Mastercard®?

It’s possible that the Surge® Platinum Mastercard® is still out of your reach right now. And there is an option that fits even better with your profile.

Meet the FIT Mastercard®.

| Surge® Platinum Mastercard® | Fit Mastercard® | |

| Credit Score | Good or bad creditApproved average score: 600; | The FIT Mastercard® does not require a minimum credit score for approval; |

| Annual Fee | First year: $75 to $125. Subsequent years: $99 to $125; | Free; |

| Purchase APR | 29.99%; | 22.99%; |

| Cash Advance APR | 29.99% to 35.99%; | 25.99%; |

| Welcome Bonus | None; | None; |

| Rewards | None. | None. |

A great option for those looking to build their credit with rates still within the expected for a card in this category.

It’s worth it and deserves your attention.

Apply for the FIT Mastercard®

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Trending Topics

Destiny Mastercard® Review: Rebuild Your Credit with Confidence

It’s time to reestablish your finances! Review the Destiny Mastercard® features to see how it can help - build credit quickly!

Keep Reading

First Digital Mastercard® Review: Cashback all over the country!

Dive into our comprehensive First Digital Mastercard® Review for insights on cashback rewards, credit building, and easy application!

Keep Reading

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep ReadingYou may also like

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep Reading

PenFed Platinum Rewards Visa Review: Earn Extra Cashback Points

Explore our comprehensive PenFed Platinum Rewards Visa Signature® Card Review for an in-depth look at its perks. No annual fee and Cashback!

Keep Reading

Freedom Gold Card Review: Plus $750 to your monthly budget

Discover the card that can save your monthly budget. In this review, we bring every nuance of the Freedom Gold Card!

Keep Reading