Quick sign-up, quick turnaround. Even your score grows fast!

Total Visa® Card: The Big Chance You Can Rebuild Your Credit

Advertisement

Here’s your opportunity to rebuild your credit and earn cash back on all your purchases. The Total Visa® Card provides tools for those in need of credit rebuilding. It’s also great because it doesn’t require a security deposit and is approved for those with bad credit. Sounds too good to be true? Well, it’s not. And there’s a cost for all of this. But on top of that, it’s a card that offers 1% cashback rewards on all purchases!

Here’s your opportunity to rebuild your credit and earn cash back on all your purchases. The Total Visa® Card provides tools for those in need of credit rebuilding. It’s also great because it doesn’t require a security deposit and is approved for those with bad credit. Sounds too good to be true? Well, it’s not. And there’s a cost for all of this. But on top of that, it’s a card that offers 1% cashback rewards on all purchases!

You will remain in the same website

Looking to rebuild your credit and earn cash back on all your purchases? See what else the Total Visa® Card has for you!

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Here's a fair comparison between the pros and cons of the Total Visa® Card. So that way, you can change your mind if you're still undecided. Check it out here!

Upsides and advantages

- Card Customization: Enjoy two complimentary options to personalize your Total Visa® Card, and explore an additional six designs for just $9.95.

- Rapid Response: The website guarantees an immediate reply to your application. Be attentive when completing the application form for a quick response.

- Visa Access for Poor Credit: Unfortunately, major circuit cards often remain inaccessible for those with low credit scores. This presents an opportunity to obtain a Visa card without your credit score hindering approval.

- 1% Cashback: Receive rewards on your purchases, offering a beneficial incentive for those aiming to recover their financial standing.

- 21-Day Grace Period: Avoid interest charges on new purchases by settling the full balance by the monthly due date, providing a 21-day grace period.

- Credit Score Enhancement: Utilizing your Total Visa® Card responsibly contributes to score improvement. Exercise financial responsibility and witness your credit score gradually improve over time.

Downsides and Limitations

- Fees and Charges: The Total Visa® Card imposes fees, such as a $95 enrollment fee and an annual fee of $48 starting from the second year.

- Low Credit Limit: The initial credit limit of the Total Visa® Card is typically low, potentially restricting your purchasing power.

We conclude, then, that the Total Visa® Card is a good option for those with poor credit or no credit history. However, it's important to know the fees and charges involved before applying for the card. Taking this into consideration, it will certainly be a good ally in your credit score-building journey.

The Total Visa is an unsecured credit card. In other words, to use the Total Visa® Card, simply insert it into the credit card machine when making a purchase. You can also use the card online or by phone, taking advantage of all the benefits and functionalities of Total Visa payment.

You can monitor your balance and statements on the Total Visa® Card online or through the Total Visa® app. Just log in to the Total Visa card app.

If you have any questions or issues with the Total Visa® Card, you can contact support through the Bank of Missouri website or by phone. You can get your questions answered and also track your total visa rewards score.

You can pay your Total Visa® Card bill online, by phone, or through a bank deposit. Make the most of the Total Visa app for this and other functions.

If you're a fan of well-done basic service, and by that, I mean a simple card that aims to assist. Whether it's for building your credit or being your first card ever.

On top of that, the Mission Lane Visa® Credit Card can even be free! Follow along with us for an in-depth analysis of this excellent card option. Have a range of good choices at your fingertips.

Apply for Mission Lane Visa® Credit Card

Learn how to apply for your Mission Lane Visa® Credit Card without fear of credit checks! We’ll tell you how to do it in this post!

Trending Topics

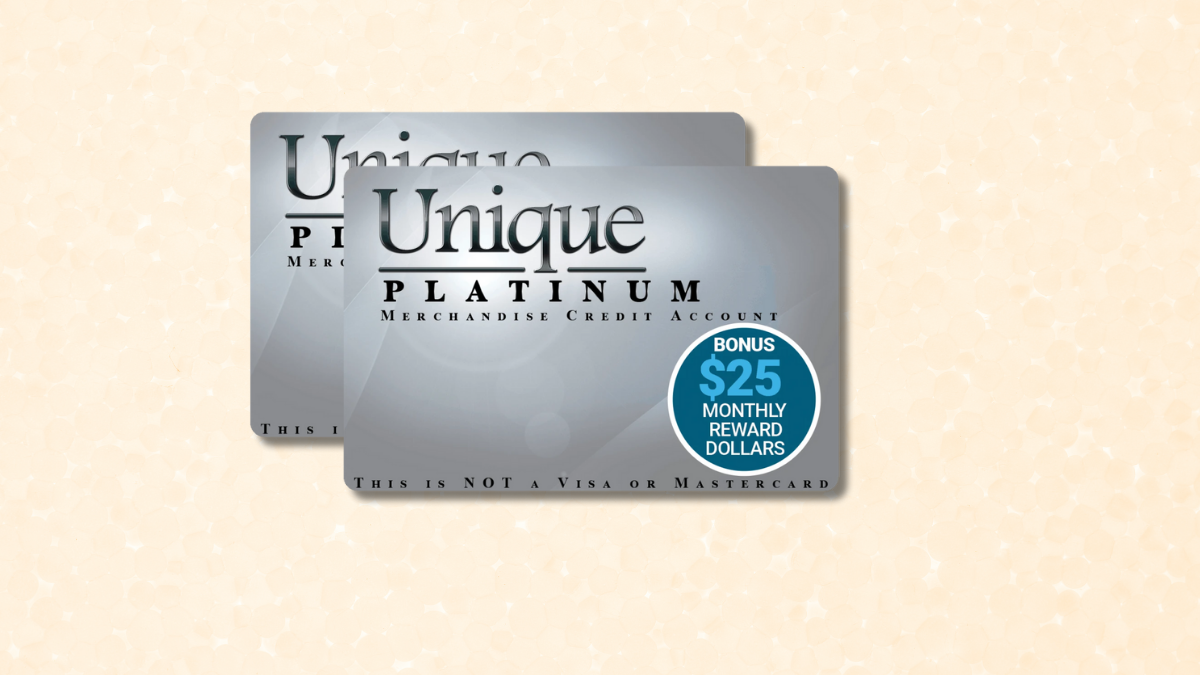

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep Reading

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep Reading

750 Credit Score: Is It Good?

Is 750 a good credit score? It can open doors to the best financial opportunities. Learn how to transform your creditworthiness!

Keep ReadingYou may also like

How to Apply for the First Access Visa® Card: Fast and powerful!

Apply First Access Visa® Card: Rebuild your credit with fast, user-friendly approval. Start your journey to financial improvement today!

Keep Reading

GO2bank Secured Visa® Credit Card Review: $0 annual fee

Check this review to learn how GO2bank Secured Visa® Credit Card will boost your credit score with outstanding support!

Keep Reading

Upgrade Life Rewards Visa® review: No annual fee!

Discover the perks and pitfalls of the Upgrade Life Rewards Visa® card in our latest review. Up to 10% cash back + up to $25K credit line!

Keep Reading