Are you ready to start a new journey in your financial life?

Surge® Platinum Mastercard®: Build credit with double your limit!

Advertisement

Maximize your financial potential with the Surge® Platinum Mastercard®. Build a strong credit score easily and enjoy amazing advantages with this card! Ensure an initial credit limit of up to $1,000 and double it quickly! So don’t wait any longer, this is your chance to build a strong credit profille!

Maximize your financial potential with the Surge® Platinum Mastercard®. Build a strong credit score easily and enjoy amazing advantages with this card! Ensure an initial credit limit of up to $1,000 and double it quickly! So don’t wait any longer, this is your chance to build a strong credit profille!

You will remain in the same website

Discover the exclusive benefits of the Surge® Platinum Mastercard®. Increase your credit score and enjoy extraordinary benefits.

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Explore the nuances of the Surge® Platinum Mastercard®. In this review, we weigh the pros and cons to help you make informed financial decisions. It's amazing how a card considered "basic" can deliver so much.

Upsides and advantages

- Credit Building: Designed for individuals with less-than-perfect credit, the card may provide an opportunity to build or rebuild credit.

- Online Account Management: Access to online tools and mobile apps for convenient account management and payment.

- Doubled credit limit: A double credit limit can be helpful if you need more credit to make a major purchase. However, it's important to use your credit responsibly to avoid overspending;

- Mastercard Zero Liability Protection: Mastercard Zero Liability Protection is coverage that protects you from financial loss in the event of theft or loss of your card. This coverage can be helpful if you lose your card or it's stolen.

- Mastercard Benefits: Potential access to Mastercard benefits, including global acceptance and certain purchase protections.

Downsides and limitations

- High APR: Subprime credit cards often come with higher interest rates, making it important to pay the balance in full to avoid significant interest charges.

- Relatively high annual fees: The card's annual fees can be relatively high. If you're looking for a card with no annual fee, this card may not be the best option for you;

- Other fees and charges: Besides the annual fee, the card may charge other fees and charges, such as cash advance fees and foreign transaction fees. It's important to read the card's terms and conditions carefully to understand all the fees and charges that may apply.

The Surge® Platinum Mastercard® offers a gateway to financial empowerment, particularly tailored for individuals navigating the path to credit recovery or building.

By combining these features, the Surge® Platinum Mastercard® emerges as a supportive tool on the journey toward improved financial health and greater financial freedom.

The Surge® Platinum Mastercard® is issued with the Mastercard flag, ensuring global payment acceptance at millions of establishments and ATMs.

To access the Surge® Platinum Mastercard® app, log in to your Surge Credit account through the official website. There, you can find options to download the app compatible with your device.

Currently, the Surge® Platinum Mastercard® does not offer a pre-approval process. The card application is made by submitting a complete application. But don't worry, the process is quick and simple.

Paying the Surge® Platinum Mastercard® is easy and convenient. Access your account online on the Surge Credit website and follow the payment instructions. You can also set up automatic payments for added convenience.

All fees associated with the Surge® Platinum Mastercard® are clearly indicated in the contract and terms disclosure. There are no hidden fees, providing transparency to users.

Curious about other options? Also, explore the Fit Mastercard® from Continental Finance, an alternative that can even better meet your financial needs.

Apply for the FIT Mastercard®

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Trending Topics

Mission Lane Visa® Credit Card Review: Put your score back on track

Mission Lane Visa® Credit Card will review your credit history before making any hard check on your score. Keep the benefits with you!

Keep Reading

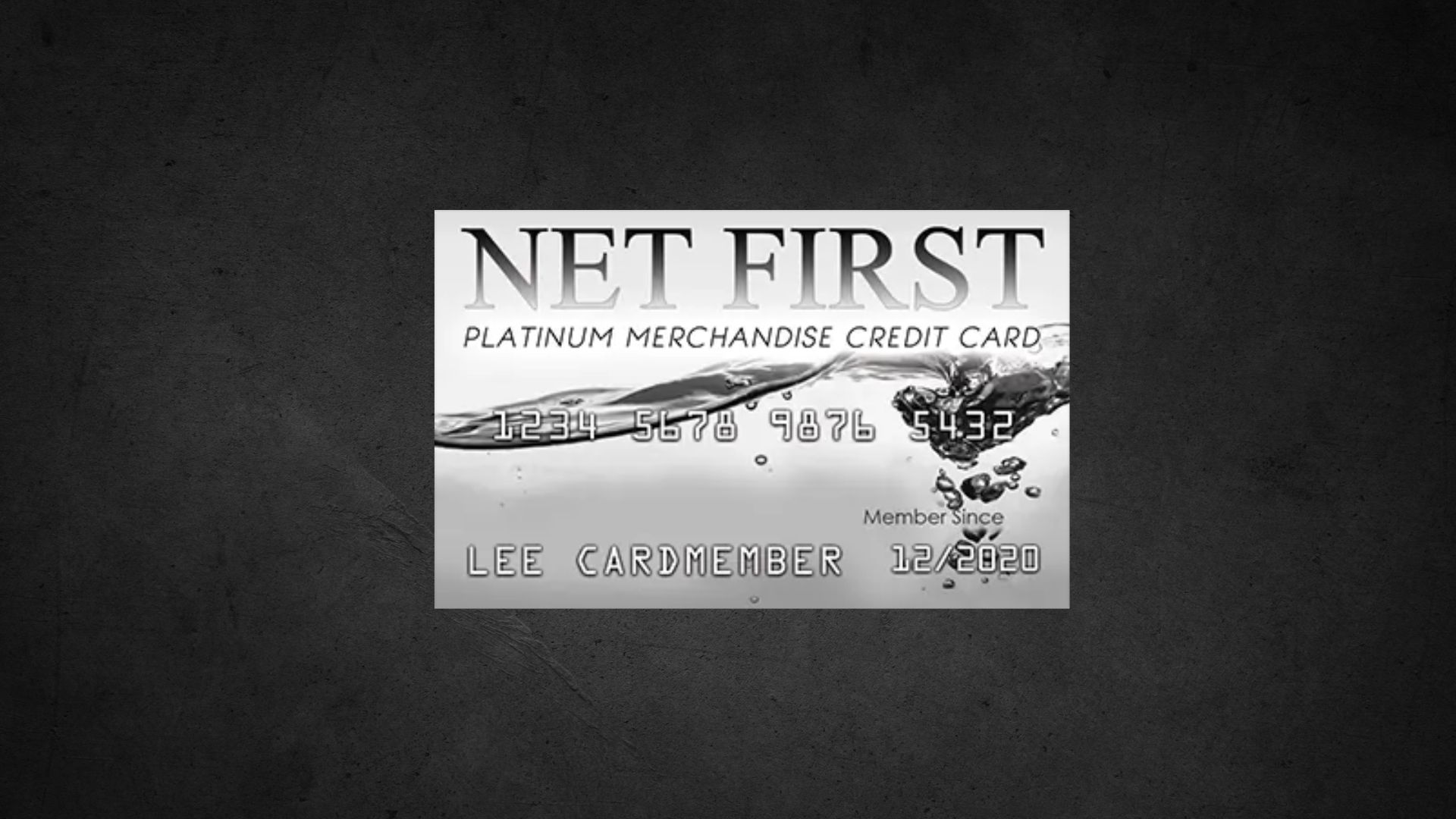

Net First Platinum Review: Financial Freedom at Your Fingertips

Discover in the Net First Platinum Review how this card offers $750 in credit without credit or employment checks

Keep Reading

How to Save Money: 7 Strategies for Financial Freedom

Discover 7 effective strategies how to save money and build wealth, from creating a budget to establishing an emergency fund.

Keep ReadingYou may also like

PenFed Pathfinder® Rewards Visa Signature® Card Review: Earn more

Discover the ultimate travel companion with our PenFed Pathfinder® Rewards Visa Signature® Card Review! Up to 4x points on purchases!

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

How to Build Credit: 5 Tips for Fast Results

Discover how to build credit quickly with 5 practical tips. Learn how to use credit cards wisely to boost your credit history!

Keep Reading