Credit Cards

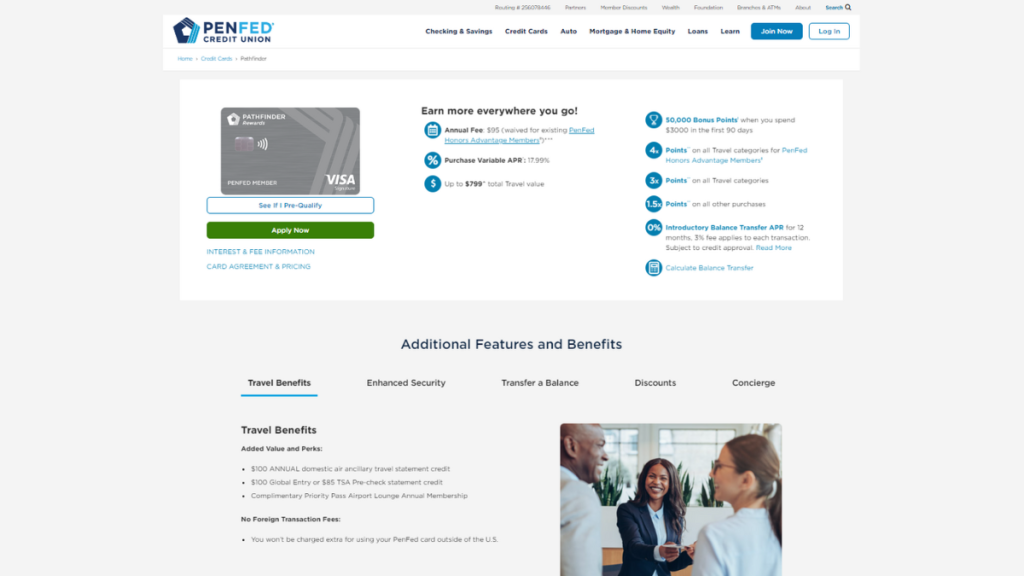

PenFed Pathfinder® Rewards Visa Signature® Card Review: Earn more

Embark on a rewarding journey with the PenFed Pathfinder® Rewards Visa Signature® Card. Earn 50K bonus points within 90 days + much more!

Advertisement

Choose the best partner – Have a nice trip!

How about a travel companion that makes a difference? Well, then don’t miss our PenFed Pathfinder® Rewards Visa Signature® Card review!

The PenFed Pathfinder® Rewards Visa Signature® Card offers perks in your daily routine, but its true impact comes into play when hitting the road. Travel and earn so much more.

| Credit Score | From 670 (Good); |

| Annual Fee | $95, it can be waived for existing PenFed Honors Advantage Members; |

| Purchase APR | 17.99%. Will vary based on Prime Rate; |

| Cash Advance APR | 17.99%; |

| Welcome Bonus | Earn 50,000 bonus points when you spend $3,000 in the first 90 days; |

| Rewards | Earn up to 4x points on all your purchases! |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the PenFed Pathfinder® Rewards Visa Signature® Card

Active in the market for over 90 years, PenFed is the second-largest credit union in the United States, boasting over 2 million members. You surely know them!

Initially, it was a credit union exclusively for Pentagon members. However, today, it has its excellent products open to the general public, offering a wide range of good options.

This is great and brings things like the PenFed Pathfinder® Rewards Visa Signature® Card to you. Explore the world of rewards with a card that justifies its annual fee.

Exclusive to PenFed members, the PenFed Pathfinder® Rewards Visa Signature® Card features a robust and diverse rewards program. You just don’t redeem cold hard cash!

But that certainly doesn’t mean you won’t be rewarded. This is because you earn 3 times more points on all travel categories, for example. Follow all the benefits below in this review.

PenFed Pathfinder® Rewards Visa Signature® Card: is it worth it?

Yes, indeed, it is a sharp tool for your purchases. Both in your daily routine and during travels.

Use your PenFed Pathfinder® Rewards Visa Signature® Card with peace of mind and reap the rewards.

Advertisement

Pros

- Above-average rewards rate;

- Versatility in redeeming your points: When using and accumulating points with your PenFed Pathfinder® Rewards Visa Signature® Card, you have various ways to redeem them. It could be in the form of a Gift Card for shopping, dining at special restaurants, and engaging in entertainment activities. Additionally, you can exchange your points for travel. You can even donate your points, showcasing your social concern;

- Zero APR on balance transfers: Introductory period with this benefit;

- No foreign transaction fee: Conduct this type of transaction with the peace of mind of not paying any fees of any kind for one year.

Cons

- Annual fee can be considered a downside: The PenFed Pathfinder® Rewards Visa Signature® Card is a highly advantageous option but comes with a cost;

- Members only: You need to be a cooperative member with an active account at Credit Union PenFed.

Advertisement

Credit score requirements for card application

Many people seek out this review for this information. The acceptance of your application depends, in fact, on various factors. The key may be a good credit score.

Review the cards you already have; is there anything similar to what we have here?

Within the FICO scale, your application should already be accepted if you’ve worked hard and achieved a good score.

But what does a “good score” mean? With a score above 670, the PenFed Pathfinder® Rewards Visa Signature® Card can already be your next buddy travel.

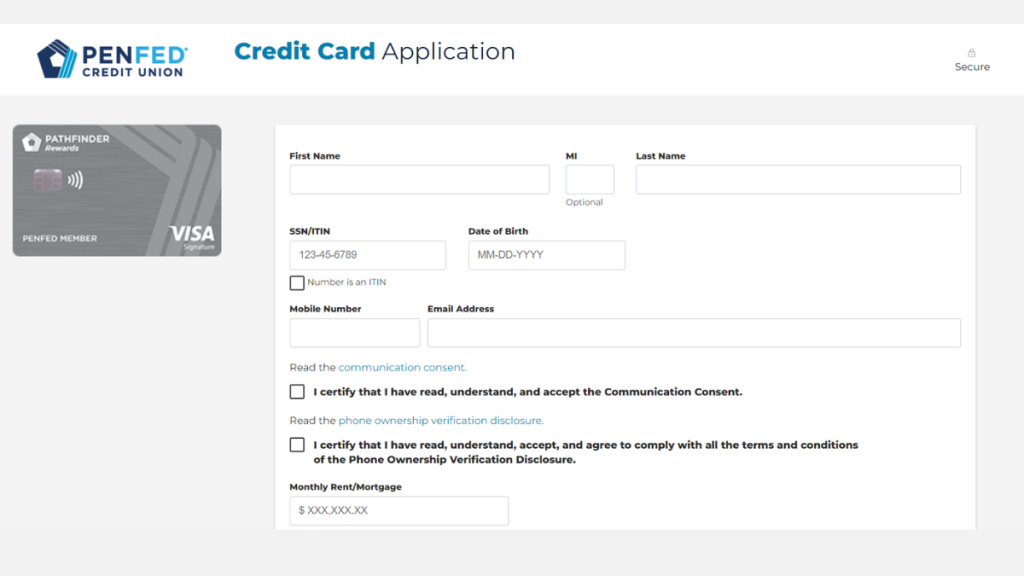

Ready to apply? Here’s how to get the PenFed Pathfinder® Rewards Visa Signature® Card

Now, let’s see how to take pleasure in adding a PenFed Pathfinder® Rewards Visa Signature® Card to your wallet.

The application process happens online. But, pay attention.

First and foremost, you need to be a PenFed customer. That’s right, there are some preliminary details.

Keep reading to know everything about how to apply for your “Pathfinder”!

Applying for your card: Online

The PenFed Pathfinder® Rewards Visa Signature® Card is exclusive to PenFed Credit Union members. If you are not a member yet, you can apply online or at a branch.

You can request your PenFed Pathfinder® Rewards Visa Signature® Card during the account opening process. If you choose to apply online, know that it is quite straightforward.

Some ways to make the process even smoother include checking your credit before applying. It helps if you have a stable income and a good credit history.

Be prepared to provide information about your income, employment, and debts. Fill out the application carefully to avoid any mistakes.

PenFed will review your application for both the account and credit card simultaneously. If approved for both, you will receive your card by mail within 10 business days.

Requirements

As mentioned, first and foremost, you need to have a PenFed account. So, it makes sense for us to discuss what it takes to have an account.

In this case, being a U.S. citizen, permanent resident, or a member of the U.S. Armed Forces. Another option is to have a relative who is already a PenFed member.

As a last resort, you should check if you work or live in an eligible area. Apart from that, the requirements are basic.

Regarding the credit score, something between good and excellent should suffice!

Applying for your card: App

The application process through the mobile app is similar to the online process.

PenFed will review your application and provide a decision shortly.

If you are approved, you will receive your card by mail within 10 business days.

If you don’t have a PenFed account yet, you can create one through the mobile app.

PenFed Pathfinder® Rewards Visa Signature® Card or Wells Fargo Active Cash® Card?

Currently, there are a variety of card options.

Not all of them are good travel companions like the PenFed Pathfinder® Rewards Visa Signature® Card. But they serve other purposes.

| PenFed Pathfinder® Rewards Visa Signature® Card | Wells Fargo Active Cash® Card | |

| Credit Score | From 670 (Good) | From 690 (Good); |

| Annual Fee | $95, it can be waived for existing PenFed Honors Advantage Members; | $0; |

| Purchase APR | 17.99%. Will vary based on Prime Rate; | 0% for 15 months, then 20.24%, 25.24% or 29.99%; |

| Cash Advance APR | 17.99%; | 29.99%; |

| Welcome Bonus | Earn 50,000 bonus points when you spend $3,000 in the first 90 days; | $200 when spending $500 in purchases in the first 3 months; |

| Rewards | Earn up to 4x points on all your purchases! | 2% Cashback on all purchases. |

An example of this is cards whose objective is Cashback. That’s certainly the case with the Wells Fargo Active Cash® Card.

Do you want real cashback? go look for one.

Apply for Wells Fargo Active Cash® Card

Unlock real cashback with the Wells Fargo Active Cash® Card! Whether applying online or via the app, it's simple and quick. Explore now!

Trending Topics

GO2bank Secured Visa® Credit Card Review: $0 annual fee

Check this review to learn how GO2bank Secured Visa® Credit Card will boost your credit score with outstanding support!

Keep Reading

How to Apply for the First Digital Mastercard®: Get score back!

Discover how to Apply First Digital Mastercard® and boost your credit score! A step-by-step guide to earning cash back!

Keep Reading

3 Different Types of Credit Cards: An In-Depth Look

Discover the types of credit cards by exploring our comprehensive guide. The perfect card for your financial lifestyle.

Keep ReadingYou may also like

How to Apply for the First Access Visa® Card: Fast and powerful!

Apply First Access Visa® Card: Rebuild your credit with fast, user-friendly approval. Start your journey to financial improvement today!

Keep Reading

Milestone Mastercard® Review: for any type of credit!

Explore the ins and outs of the Milestone Mastercard® with our comprehensive review. Navigate the credit-building journey!

Keep Reading

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep Reading