Credit Cards

Milestone Mastercard® Review: for any type of credit!

Embark on a credit-building adventure with the Milestone Mastercard®. Discover its reasonable fees, fraud protection, and credit-building capabilities.

Advertisement

A fresh start! Just pay attention to interest, and you’ll be golden

Your credit history may be a bit challenging. But that’s because it hasn’t faced a worthy opponent yet. In this review, we’ll delve into the details of the Milestone Mastercard®.

The card offers a reasonable annual fee, fraud protection, and the opportunity to build credit. Here’s an assessment to help you decide if the Milestone Mastercard® is the right fit for you.

| Credit Score | Does not have a minimum credit score requirement; |

| Annual Fee | $175 for the first year, then $49 thereafter; |

| Purchase APR | 35.9%; |

| Cash Advance APR | 35.9%; |

| Welcome Bonus | N/A; |

| Rewards | N/A. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Milestone Mastercard®

Let’s cut to the chase, shall we? This review is about a credit builder. And it doesn’t charge high annual fees to help you improve your credit history. That’s rare!

But I’m not saying the Milestone Mastercard® is a sweetheart. No, not at all. It knows how to collect interest to enjoy its perks. However, that’s only a problem for those who don’t pay the full amount on the bill.

So, it’s preferable to pay in full. After all, you’re here to build your credit score, not to sink it further, right? That’s precisely why keep reading this complete review.

And the annual fee isn’t all you’ll pay to have your Milestone Mastercard®. This is actually a spoiler, but $150 will be charged annually starting from the second year of the contract.

There are also other fees, like late fees and over-limit fees. But frankly, aside from all that, it delivers what it promises. In other words, it builds your credit and keeps you focused.

Milestone Mastercard®: is it worth it?

To truly get to know a card, it’s not enough to just look at its perks. For this reason, in this review, we also bring you the downsides and potential challenges of the Milestone Mastercard®.

Advertisement

Pros

- Affordability of the annual fee: The annual fee for accessing the benefits of the Milestone Mastercard® stands at $175 in the initial year. The noteworthy aspect is that, from the second year onward, this cost reduces significantly to only $49.

- Protection against fraud: The Milestone Mastercard® ensures fraud protection, guaranteeing coverage if someone uses your card without authorization.

- Credit Bureau Reporting: When you utilize the Milestone Mastercard®, your monthly payments will be reported to the top 3 credit bureaus in the country.

- No need for a security deposit: Indeed, you don’t have to entrust anything to Milestone to use this valuable credit-building tool.

Cons

- High-interest caution: Brace yourself for a hefty 35.9% annual interest rate! That’s seriously steep, so it’s essential to clear the entire balance every month to avoid those exorbitant interest charges.

- Rigorous approval criteria: Milestone Mastercard® means business when it comes to approval. You’ll be required to demonstrate a minimum monthly income of $1,000.

Advertisement

Credit score requirements for card application

The Milestone Mastercard® doesn’t have a minimum credit score requirement.

However, the bank considers various factors when assessing your application, including your credit history, income, debts, and employment.

Ready to apply? Here’s how to get the Milestone Mastercard®

Indeed, the Milestone Mastercard® website is quite easy and intuitive. Right from the start, you’ll see the apply button. But is there a way to do it through the app?

What’s the best way to place your order? Oh, you’ll find all of that below. It’s worth checking out!

Applying for your card: Online

During this process, you’ll basically have two options. You can either start your registration from scratch or have already received an offer from Milestone Mastercard®. This is crucial for the rest.

But in general, access the official website and request yours. To initiate the application process, you’ll fill out a form. At this stage, you input all your information.

Pay attention to doing this correctly. If you make a mistake at this stage, you could jeopardize the entire application process. So, stay alert!

After submitting your application, you’ll receive a response from the bank in a few days. If approved, only a few more days will separate you from your Milestone Mastercard®.

Overall, the online application process for the Milestone Mastercard® is a positive experience. It’s a convenient and easy way to apply for a credit card, even if you have a challenging credit history.

Requirements

Since this credit card is built to help you achieve your dream credit score, it doesn’t have a minimum credit requirement.

You’ll only need to provide valid personal and financial information, including your name, address, contact and SSN.

Applying for your card: App

You cannot apply for a Milestone Mastercard® through the app. In other words, to request a card, you must visit the official Milestone Mastercard® website or call the customer service hotline.

However, the Milestone Mastercard® app is a handy tool for cardholders. This is because it allows you to manage your account with ease and convenience.

Milestone Mastercard® or Destiny Mastercard®?

There are gems for those in need of building credit. Anyone who thinks all doors will be shut when applying for the Milestone Mastercard® is in for a surprise. The same goes for the Destiny Mastercard®.

| Milestone Mastercard® | Destiny Mastercard® | |

| Credit Score | Does not have a minimum credit score requirement; | You may apply even with a bad credit score. |

| Annual Fee | $175 for the first year, then $49 thereafter; | $75 during your first year, then $99 after. |

| Purchase APR | 35.9%; | 24.9% |

| Cash Advance APR | 35.9%; | 24.9% |

| Welcome Bonus | N/A; | N/A; |

| Rewards | N/A. | N/A. |

This alternative for credit builders comes with a lower annual fee for the first year. However, in contrast to its counterpart, it cranks up the cost for the following years. But they are very similar.

Choices are choices, right? And with this comparison between options, making your decision should be a breeze, we’re sure.

Apply for Destiny Mastercard®

Learn how to apply for the Destiny Mastercard®, a simple and quick application process that can be done online.

Trending Topics

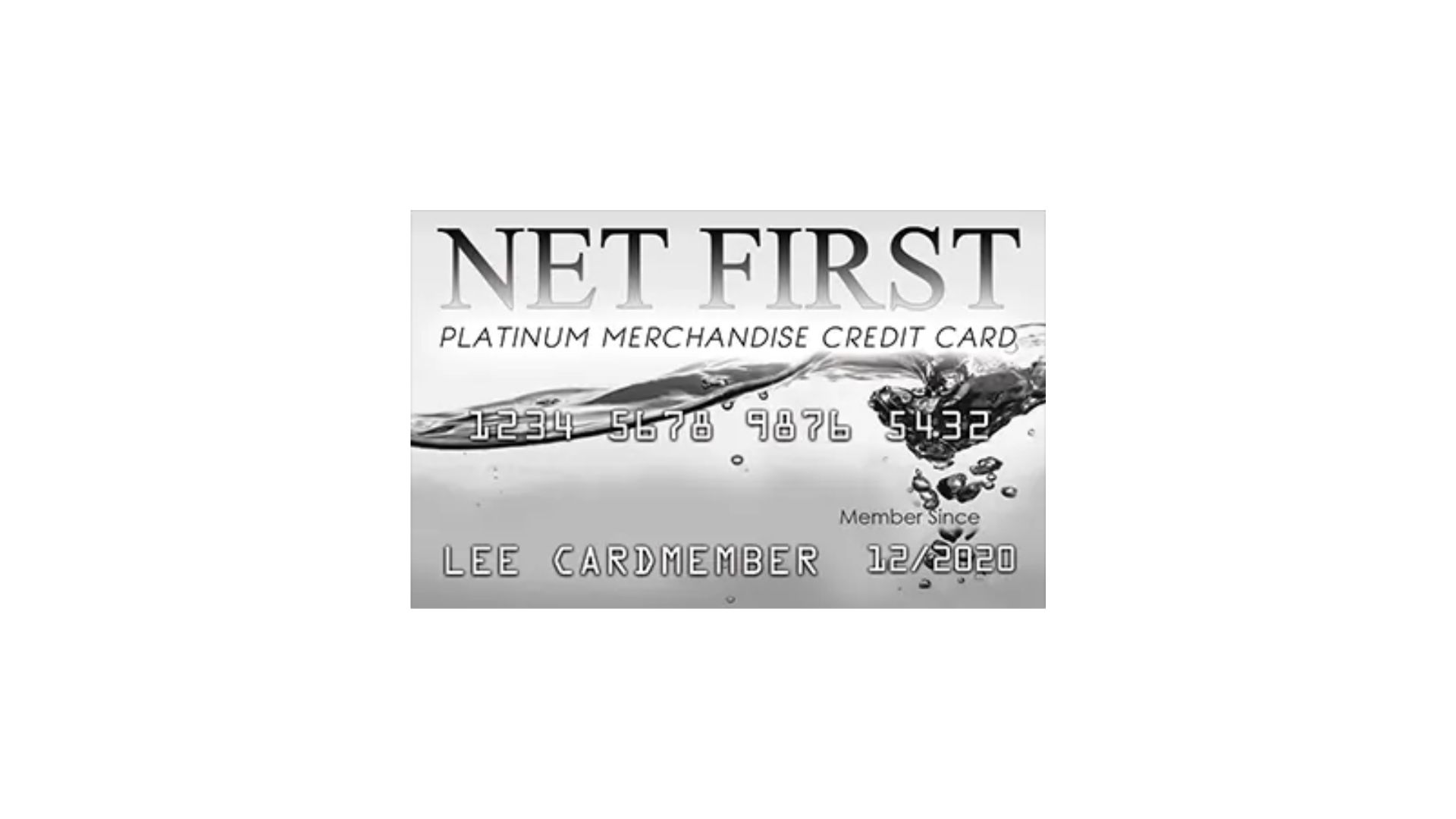

How to Apply for Net First Platinum: A New Beginning for You

Ready to transform your financial future? Apply Net First Platinum today and unlock a $750 credit limit with no credit or employment checks!

Keep Reading

PenFed Platinum Rewards Visa Review: Earn Extra Cashback Points

Explore our comprehensive PenFed Platinum Rewards Visa Signature® Card Review for an in-depth look at its perks. No annual fee and Cashback!

Keep Reading

PenFed Credit Union Personal Loan Review: Affordable Financing up to $50,000

Learn how to pre-qualify for a PenFed Credit Union Personal Loan without hurting your credit score! Check the application requirements.

Keep ReadingYou may also like

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Unlock the power of rewards with the Wells Fargo Active Cash® Card! Dive into our review and explore the world of real Cashback.

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

Boost Platinum Card Review: Purchasing power on your horizon!

Boost Platinum Card. Review of The Horizon Outlet's merchandise card. Qualify with any type of credit score! Quick and simple application!

Keep Reading