Loans

Hippo Loans Review: financial solutions up to R$350,000

Discover how Hippo Loans offers tailored financial solutions for South Africans. Learn about features, requirements, and application steps!

Advertisement

Hippo Loans is a trusted name in personal finance solutions.

Are you looking for reliable loan options? Hippo Loans offers tailored solutions to meet your financial needs. Whether you need to consolidate debt or fund personal projects, this service ensures flexibility and transparency.

With an extensive range of personal and consolidation loans, Hippo provides options designed to help individuals achieve financial stability while maintaining peace of mind.

- APR: 27.25% per annum (typically, but not always).

- Loan Purpose: Personal and consolidation.

- Loan Amount: R1,000 to R350,000.

- Credit Score Requirement: Good credit score recommended.

- Origination Fee: R69.00 service fee.

Information provided by the official Hippo Loans website.

You will be redirected to another website

Advertisement

See the features that make up the Hippo Loans

Hippo Loans simplifies borrowing by offering competitive interest rates, ensuring manageable repayments. With a focus on affordability, clients can budget effectively without unnecessary stress.

The platform emphasizes user convenience, providing an easy-to-navigate application process. Borrowers can secure funding in minutes, making Hippo personal loans an efficient choice.

Additionally, transparency is key. Hippo ensures borrowers fully understand loan terms, avoid hidden fees, and offer peace of mind throughout repayment.

The flexibility in loan terms allows individuals to choose repayment periods that align with their financial capabilities, a highlight of Hippo consolidation loans. This feature ensures borrowers can manage repayments without compromising their daily financial needs.

Hippo Loans also offers an optional financial counseling service for applicants who wish to better understand their financial standing before committing to a loan.

By leveraging technology, Hippo Loans has introduced automated reminders to inform borrowers about upcoming payments, enhancing the overall borrowing experience.

The ins and outs of Applying for the Hippo Loans

Applying for Hippo Loans is straightforward. The platform is designed to guide users through each step efficiently, ensuring an accessible process. Let’s see the pros and cons:

Advertisement

Advantages:

- Competitive interest rates (27.25% per annum, typically);

- Flexible repayment terms (7 to 72 months);

- User-friendly online platform;

- Quick approval process;

- Optional financial counseling;

- No upfront fees charged by providers.

Disadvantages:

- Not available outside South Africa;

- Requires proof of income and credit score verification;

- Origination fee details not always disclosed upfront.

Advertisement

Requirements to Apply for Hippo Loans

Applicants must reside in South Africa to qualify for Hippo Loans. Local residency ensures access to this tailored financial solution.

A valid South African ID is necessary to verify identity and ensure compliance with lending regulations.

Additionally, proof of income is required to demonstrate repayment capacity, ensuring borrowers can manage their loan commitments effectively.

Applicants need a functional bank account for seamless fund transfers and repayment automation. This is a non-negotiable requirement to maintain the efficiency of the loan process.

Also, good credit standing is essential, as it influences approval and the interest rate offered. Applicants can check their credit score for free once a year to prepare for the application.

For applicants needing additional assistance, Hippo Loans offers support via customer care to answer any queries regarding the application process.

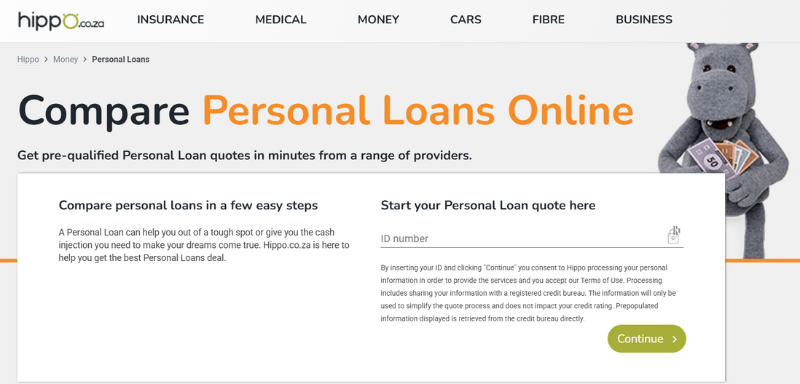

Ready to order? Check out the steps to apply for Hippo Loans

You can apply online through the official Hippo Loans website! The platform ensures a seamless user experience.

Borrowers can also contact customer support for guidance, making the process inclusive and accessible to all users.

Steps to Apply:

- Visit the official Hippo Loans website.

- Enter your South African ID number to begin.

- Choose the desired loan type and amount.

- Fill out the application form with accurate details.

- Submit required documentation, such as ID and proof of income.

- Review personalized loan offers from providers.

- Await approval and review the loan terms carefully.

- Accept the loan offer to finalize the process.

Hippo Loans vs Hoopla Loans

When comparing Hippo Loans and Hoopla Loans, both offer competitive options for borrowers. So, Hippo prioritizes flexibility and transparency, while Hoopla highlights alternative benefits tailored to different needs.

While Hippo Loans is ideal for South African borrowers seeking personal or consolidation loans, Hoopla Loans offers global accessibility with varied loan structures.

Additionally, Hoopla provides a wider range of loan amounts, making it an attractive option for diverse financial needs.

Finally, Hoopla Loans specializes in fast approvals and caters to diverse financial needs. It provides a broader range of loan amounts and tailored repayment plans. With Hoopla, global borrowers can find an effective solution for their financial goals.

Curious about Hoopla Loans? Discover more in our next article to find the right financial fit for your goals!

Hoopla Loans Review

See now how to apply for your loan in a simplified and quick way with approval rate of 84%.

The information on this page is accurate as of January 10, 2025, but some offers may no longer be available.

Trending Topics

FinChoice Personal Loans Review: Access Loans Up to R25,000 Quickly and Easily

Discover FinChoice Personal Loans for life's bigger expenses; borrow up to R25,000 with flexible terms. Learn how it works and apply today!

Keep Reading

Nedbank Loan Review: Loans of R2,000 to R400,000

Looking for a loan with cashback benefits? Nedbank Personal Loan gives you R200 monthly cashback and flexible repayment terms.

Keep Reading

ABSA Personal Loan: Affordable and Flexible Loans for Your Needs

Discover how the ABSA Personal Loan can help you achieve your goals with flexible terms and competitive rates. Learn how to apply!

Keep ReadingYou may also like

African Bank Personal Loan Review: Access up to R250,000

Learn how African Bank personal loans offer security and convenience. Find out loan features, application steps, and benefits here.

Keep Reading

Hoopla Loans Review: find reliable lenders and get up to R250,000

Hoopla Loans offers fast loan approvals for South Africans. Discover flexible repayment terms and secure credit access today.

Keep Reading

Blink Finance Loans Review: Borrow Up to R8,000 with a Few Clicks

Looking for a fast, reliable loan in South Africa? Blink Finance has you covered. Apply for up to R8,000 today with no hidden surprises!

Keep Reading