Loans

African Bank Personal Loan Review: Access up to R250,000

Explore the benefits of African Bank personal loans, including amounts up to R250,000 and customizable repayment terms. Learn more today!

Advertisement

Customizable repayment options and attractive interest rates tailored to suit your requirements

An African Bank personal loan allows you to borrow as much as R250,000, offering repayment periods ranging from 7 to 72 months to suit your needs. Applying online is quick and hassle-free.

Additionally, African Bank prioritizes customer convenience and offers tools like a loan calculator to determine how much you may qualify for, ensuring an informed decision-making process.

Their credit life insurance provides added security, covering retrenchment, disability, and loss of income. Read on to learn about the features, application steps, and benefits of African Bank loans.

- APR: 15% to 24.5%

- Loan Purpose: Personal expenses, debt consolidation, tech purchases

- Loan Amount: R2,000 to R250,000

- Credit Score Requirement: Not specified

- Origination Fee: Up to R1,197

Information provided by the official African Bank website.

You will be redirected to another website

Advertisement

See the Features that Make Up the African Bank Personal Loan

African Bank personal loans cater to diverse financial needs, offering amounts between R2,000 and R250,000. With these flexible options, you can address personal expenses, consolidate debt, or even purchase tech gadgets.

Repayment terms can be customized, allowing you to select a duration ranging from 7 to 72 months. This flexibility enables borrowers to tailor monthly installments to their budget, promoting manageable financial planning.

Competitive interest rates from 15% to 24.5% ensure affordability. Fixed rates provide stability, letting borrowers confidently plan their expenses throughout the loan term.

Credit life insurance adds security, covering unforeseen events like retrenchment or disability, ensuring your obligations are met without financial strain on your loved ones.

The Ins and Outs of Applying for the African Bank Personal Loan

When considering a financial solution, understanding the advantages and disadvantages of a product is crucial. African Bank Personal Loans offer flexibility and security, but come with associated costs and conditions.

By evaluating both the benefits and potential drawbacks, you can make an informed decision about whether this loan aligns with your financial needs and capabilities. Let’s see it:

Advertisement

Advantages

- High Loan Amounts: Borrow up to R250,000 to cover various financial needs, such as debt consolidation, home improvement, or personal expenses, ensuring flexibility for diverse requirements.

- Flexible Repayment Terms: Choose repayment periods between 7 and 72 months, allowing you to customize monthly payments to suit your financial situation and budget.

- Fixed Interest Rates: Enjoy predictable monthly installments with competitive interest rates ranging from 15% to 24.5%, ensuring you can confidently plan your finances without unexpected increases.

- Credit Life Insurance: Safeguard your finances with coverage for retrenchment, disability, or death, ensuring that your loan repayments are managed during challenging life events.

- Quick Application Process: Apply online, via phone, or at a branch. Receive a prompt review of your application and quick disbursement of funds upon approval.

Disadvantages

- Credit Score Uncertainty: The specific credit score required for approval is not disclosed, which can create uncertainty for applicants unsure of their eligibility.

- Origination Fees: A once-off initiation fee (up to R1,197) applies, which may add to the overall cost of borrowing. Ensure you factor this into your loan planning.

- Insurance Costs: The credit life insurance rate ranges from 5.04% to 5.4%, which adds an extra cost to your monthly repayments, impacting affordability.

- Repayment Conditions: The first repayment is due within seven days after receiving the funds, which may require applicants to quickly adjust their financial plans.

- Administrative Charges: A monthly admin fee of R69 applies, further increasing the cost of maintaining the loan over its repayment term.

These detailed pros and cons provide a comprehensive view of African Bank Personal Loans.

Advertisement

Requirements to Apply for African Bank Personal Loan

Applicants need to be South African citizens or permanent residents and possess a valid ID to be eligible for an African Bank personal loan.

You must also present proof of a consistent income, such as recent payslips or bank statements, and provide a utility bill or similar document as proof of residence, dated within the last three months.

Applicants also must meet the minimum age requirement of 18 years.

While credit score requirements are not explicitly stated, a good credit history improves approval chances. Finally, all necessary documentation must be submitted during the application.

Possible Ways to Apply for an African Bank Personal Loan

African Bank makes the loan application process simple and accessible through various channels to suit your preferences and convenience. Here are the possible ways to apply:

- Online Application: Go to African Bank’s official website and access the personal loans section. Provide complete and correct personal and financial details in the application form. Use the loan calculator to estimate repayments and ensure your loan amount aligns with your needs.

- Phone Application: Contact African Bank’s customer service line and speak directly with a representative. They will guide you through the application process and answer any queries about loan terms or requirements.

- In-Person Application: Stop by the nearest African Bank branch to receive tailored assistance. Speak with a loan officer who will help you fill out the application and submit the necessary documents.

- Mobile Banking App: African Bank’s mobile app may offer a streamlined application process. Log in, navigate to the loans section, and follow the on-screen instructions to apply for a loan.

Each of these options ensures a seamless process, giving you the flexibility to apply for an African Bank Personal Loan in the most convenient way for you.

Ready to Order? Check Out the Steps to Apply for African Bank Personal Loan

The process of applying for an African Bank Personal Loan is simple and hassle-free. Begin by visiting their official website or contacting a branch to initiate the process.

Complete the application form by entering accurate personal and financial details. Utilize the loan calculator to determine suitable repayment terms and loan amounts.

Submit the necessary documentation, including identification, proof of income, and proof of residence. After review, your application will be approved, and the funds deposited directly into your account.

Repayments can be made through payroll deductions, stop orders, or direct debit from your bank account on scheduled dates.

African Bank Personal Loan vs. FinChoice Personal Loans

Comparing different lenders helps ensure you select the loan that best fits your budget and requirements. So, discover below how African Bank compares to FinChoice Personal Loans

African Bank provides personal loans of up to R250,000, featuring flexible repayment options from 7 to 72 months, making them suitable for significant financial requirements. Their fixed interest rates ensure predictable monthly payments and include credit life insurance for added security.

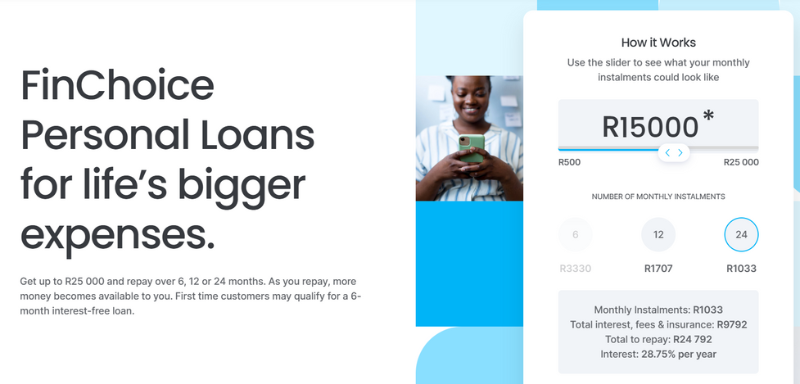

In contrast, FinChoice caters to smaller financial requirements with loans up to R25,000. They feature a fast online application process, flexible repayment terms of 6 to 24 months, and a unique interest-free offer for first-time borrowers.

For a detailed comparison, review the table below to better understand the differences between African Bank and FinChoice Personal Loans. This will help you select the product that best suits your needs.

| Feature | African Bank Personal Loans | FinChoice Personal Loans |

|---|---|---|

| Loan Amount | Up to R250,000 | Up to R25,000 |

| Repayment Terms | 7 to 72 months | 6, 12, or 24 months |

| APR Range | 15% to 24.5% | 28.75% |

| Unique Features | Credit life insurance, flexible terms | Interest-free loan for first-timers, skip-a-payment feature |

| Approval Time | Quick approval | Funds within 24 hours |

To learn more about FinChoice Personal Loans, visit the next article for a deep dive into their features, application process, and benefits.

FinChoice Personal Loans

In need of financial assistance? FinChoice provides loans of up to R25,000 through a simple online application process. Funds can be received within 24 hours. Learn more!

The information on this page is accurate as of January 22, 2025, but some offers may no longer be available.

Trending Topics

Boodle Loan Review: Instant Cash Loans Up to R8,000

Discover how Boodle Loan provide instant financial relief with easy online applications and responsible lending practices.

Keep Reading

Blink Finance Loans Review: Borrow Up to R8,000 with a Few Clicks

Looking for a fast, reliable loan in South Africa? Blink Finance has you covered. Apply for up to R8,000 today with no hidden surprises!

Keep Reading

ABSA Personal Loan: Affordable and Flexible Loans for Your Needs

Discover how the ABSA Personal Loan can help you achieve your goals with flexible terms and competitive rates. Learn how to apply!

Keep ReadingYou may also like

FinChoice Personal Loans Review: Access Loans Up to R25,000 Quickly and Easily

Discover FinChoice Personal Loans for life's bigger expenses; borrow up to R25,000 with flexible terms. Learn how it works and apply today!

Keep Reading

Nedbank Loan Review: Loans of R2,000 to R400,000

Looking for a loan with cashback benefits? Nedbank Personal Loan gives you R200 monthly cashback and flexible repayment terms.

Keep Reading

Hoopla Loans Review: find reliable lenders and get up to R250,000

Hoopla Loans offers fast loan approvals for South Africans. Discover flexible repayment terms and secure credit access today.

Keep Reading