Credit Cards

GO2bank Secured Visa® Credit Card Review: $0 annual fee

The GO2bank Secured Visa® Credit Card is the smooth road that takes you to a next-level credit score - no surprises, just good customer service, and efficient features.

Advertisement

Get GO2bank’s support to build a great credit score!

A simple card. That’s what we will talk about in this GO2bank Secured Visa® Credit Card Review. You don’t have time to waste on the credit-building journey.

The truth is that building a solid credit is crucial. You’ll notice the impact these three digits can have on your life. So, keep reading and find out more!

| Credit Score | No credit check: check! |

| Annual Fee | Zero plus zero, forever. |

| Purchase APR | 22.99%; |

| Cash Advance APR | 26.99%; |

| Welcome Bonus | None; |

| Rewards | GO2Bank has no rewards program for this credit card. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the GO2bank Secured Visa® Credit Card

We already know that having a minimally decent credit is basic. But this history needs a “Once upon a time” to begin the journey. It all starts with a credit line.

Enter the scene: the GO2Bank Secured Visa® Credit Card that we’ll have the chance to review. A secured card is a surefire choice for building credit without headaches.

This is because the card is easy to obtain and even easier to manage. With the security deposit, you determine – and guarantee! – your credit limit. And the best part: no annual fee.

But pay attention to one detail: there is a monthly fee. However, the amount is almost symbolic – $5 – and will only be charged if you make no transactions in the previous month.

Furthermore, GO2Bank isn’t a rewards card. And it doesn’t need to be. GO2Bank’s focus is on expanding consumers’ accessibility to good financial products.

GO2bank Secured Visa® Credit Card: is it worth it?

Having a secured card is an advantage for those who are newcomers to the credit card game.

But is the GO2bank Secured Visa® worth your security deposit?

Advertisement

Pros

- Annual Fee: No more spending money on an annual fee. This card has zero fees!

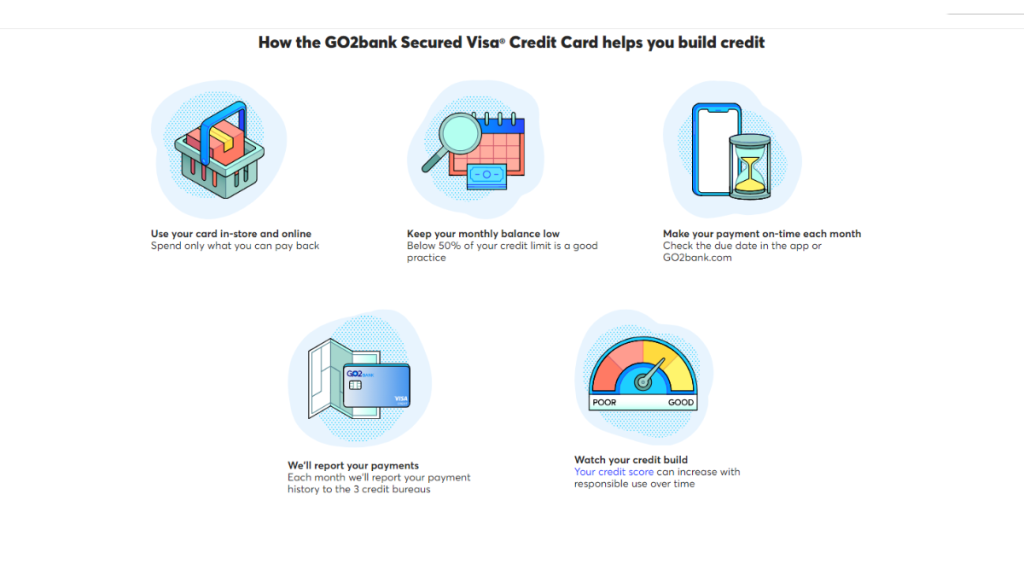

- Healthy Limit: A secured credit card gives you the confidence to spend without the risk of creating debt.

- Credit Score: You don’t need a good or excellent credit score to apply for this card.

- Build a Successful Financial History: Go2Bank reports all your activities to credit bureaus, which is great for building a good credit score – if you use the card responsibly, of course.

- Full Support: Educational support to optimize your usage for credit score building.

Cons

- Security Deposit: Your credit limit is tied to the security deposit, so if you don’t have a good reserve of money for this, you’ll have to manage a low credit limit for your purchases.

- Rewards: We will consider the absence of a rewards program as a “con,” as many people consider it essential in a credit card. However, for those rebuilding credit, it might be better not to have the temptation to spend money just to earn rewards.

Advertisement

Credit score requirements for card application

This is where the secured card shines above the competitors.

For those tired of begging for a credit card, the answer is the GO2Bank Secured Visa® Credit Card.

Since you’re paying a collateral, there’s no need to prove you have a good credit history.

Ready to apply? Here’s how to get the GO2bank Secured Visa® Credit Card

As you can see, this card is straightforward and has a well-defined purpose.

This makes everything easier: for credit building, this card is a 5-star choice.

Keep reading to see how simple it is to apply for a GO2Bank Secured Visa® Credit Card!

Applying for your card: Online

Before we start, let’s remember that it’s necessary to have an account with GO2Bank. Yes, this card is an exclusive product for customers of this bank.

Open your GO2Bank account

Firstly, access the GO2Bank website or download the app. There, you can open your account to gain access to the GO2bank Secured Visa® Credit Card.

The process is quite familiar to anyone who has had to open a bank account before.

Expect to be asked for your personal and financial information. Rest assured: the process is secure.

Once your account is open, you can proceed and apply for the GO2bank Secured Visa® Credit Card.

Ask for your GO2bank Secured Visa® Credit Card!

Now that your account is active, simply transfer at least $100 to it within 3 months.

After this period, you can request the GO2bank Secured Visa® Credit Card.

But remember that you need to make a security deposit to determine your credit limit. It’s easy. Just transfer directly from your GO2Bank account!

Requirements

GO1Bank keeps it simple. The requirements to open your account and request your GO2bank Secured Visa® Credit Card are as follows:

- Be 18 years old.

- Reside in the USA.

- Provide documents for proof of identity and residence.

- Provide your SSN (as required by federal law).

Applying for your card: App

All the previous steps can be done directly through the app!

This way, you get familiar with the app that will accompany you on your financial journey.

Download the app on your mobile phone. You can find the links on the website to ensure you download the correct app.

GO2bank Secured Visa® Credit Card or FIT Mastercard® credit card?

Even with all the benefits a secured credit card can offer, some people are unwilling to pay the security deposit.

Or maybe they don’t have it right now but need credit ASAP.

If that’s the case, you can always check the market for unsecured credit cards designed for low scores. One of these options is the FIT Mastercard®.

Check the comparative table:

| GO2bank Secured Visa® Credit Card | FIT Mastercard® | |

| Credit Score | No credit check; | Accepts poor credit score |

| Annual Fee | $0; | $99 annual fee; |

| Purchase APR | 22.99%; | 22.99%; |

| Cash Advance APR | 26.99%; | 25.99%; |

| Welcome Bonus | No welcome bonus; | None; |

| Rewards | No rewards. | None. |

If this credit card alternative seems like a more favorable game for you. read our full review and get more information about it.

Apply for the FIT Mastercard®

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Trending Topics

Walmart MoneyCard® Review: Cashback is in the house!

Unlock cashback rewards and potential fee waivers with the Walmart MoneyCard®! Dive into our comprehensive review to discover it!

Keep Reading

Apply for Mission Lane Visa® Credit Card: for all types of credit

Learn how to apply for your Mission Lane Visa® Credit Card without fear of credit checks! We’ll tell you how to do it in this post!

Keep Reading

750 Credit Score: Is It Good?

Is 750 a good credit score? It can open doors to the best financial opportunities. Learn how to transform your creditworthiness!

Keep ReadingYou may also like

Chime® Debit Card Complete Review: No fees, no Hassle!

Unlock the full potential of your finances with our comprehensive Chime® Debit Card Review. Find out with our detailed insights!

Keep Reading

How to Apply for the First Digital Mastercard®: Get score back!

Discover how to Apply First Digital Mastercard® and boost your credit score! A step-by-step guide to earning cash back!

Keep Reading

How to Build Credit: 5 Tips for Fast Results

Discover how to build credit quickly with 5 practical tips. Learn how to use credit cards wisely to boost your credit history!

Keep Reading