Credit Cards

Freedom Gold Card Review: Plus $750 to your monthly budget

The light at the end of the bad credit score tunnel could be the flame of card freedom that will take you to the Horizon Outlet universe!

Advertisement

The flame of freedom for the bad score!

It is insufficient to access all credit sites with bad credit scores desperately. There are review tools that provide guidance in this situation.

The Freedom Gold Card Review has some hidden secrets, but it is very simple to understand. So read on and learn more!

| Credit Score | 300 – 600; |

| Annual Fee | $177.24 for a Membership Fee; |

| Purchase APR | N/A; |

| Cash Advance APR | N/A; |

| Welcome Bonus | N/A; |

| Rewards | N/A. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Advertisement

The ins and outs of the Freedom Gold Card

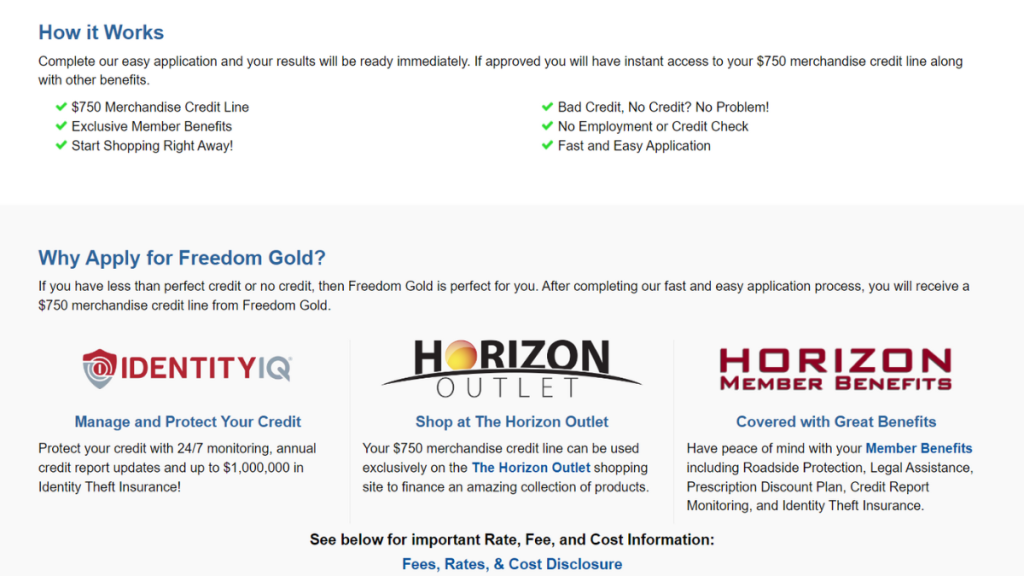

This card is a credit card belonging to the Horizon Outlet program. There is a membership fee of $177.24 per year that will be charged monthly.

The card does not have rewards benefits, but it does give entry to Horizon Members benefits.

The excellent point is that you will get an extra $750 limit on your monthly budget to make purchases and meet your family’s needs.

You will have access to clothes, toys, household items, in short, a multitude of items that will be available for you to buy with your new Freedom Gold Card.

Furthermore, within the Horizon Outlet universe and the Horizon Member Benefits program, with Roadside Assistance, Legal Assistance, and Universal Rx.

Freedom Gold Card: is it worth it?

As it is a very peculiar card, it is important to analyze the main points of the Freedom Gold Card and then proceed to the next application stage.

Enjoy the full review!

Advertisement

Pros

- Travel assistance insurance;

- My Universal Rx: up to 50% discount at pharmacies;

- No credit check;

- Considers applicants with fair credit;

- Up to $750 extra limit on your budget without a credit check;

- You have 7 days to test Freedom Gold’s services;

- Quick and easy application.

Cons

- Annual rate considered high;

- The card cannot be used for purchases outside Horizon Outlet;

- Your credit history will not be reported;

- Does not offer a bonus welcome;

- Does not offer a Cashback program.

Advertisement

Credit score requirements for card application

The Freedom Gold Card actually seeks to free you from the prison of having your credit applications denied multiple times.

Therefore, a low or no score will not be a problem.

On specialized websites, there is talk of something between 300 and 600 points needed to have a Freedom Gold Card.

Ready to apply? Here’s how to get the Freedom Gold Card

Before continuing on your way to the diverse menu of purchases that you’ll have with your Freedom Gold Card, note how easy it is to apply via the website or telephone.

We took the trouble to separate these steps and guide you in the best way so that this process is even smoother. So keep reading and learn more!

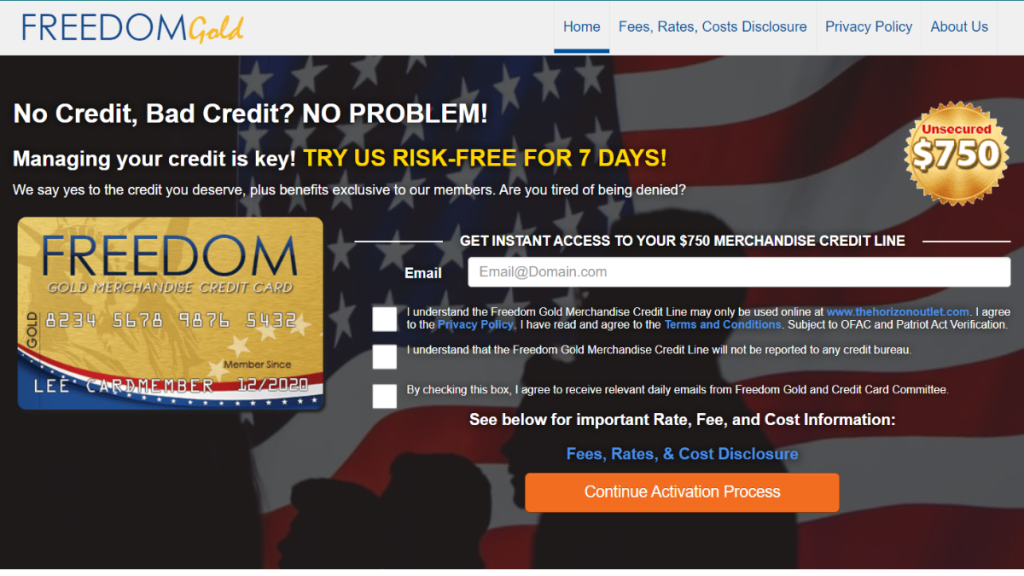

Applying for your card: Online

When you enter the Freedom Gold Card website, you will see that there are 4 steps to request your new extra cash for your monthly budget.

The first step is to provide your best email address and agree that you understand a few important things.

Another crucial point is to be aware that the Freedom Gold Merchandise Credit Line will not be reported to any credit bureau.

Finally, it’s time to fill in your information and complete your registration. After submitting your information, just confirm.

In a few moments, you will receive your login and password, and everything will be ready for $750 to be added to your household budget to meet your needs.

Requirements

To apply for the Freedom Gold Card, it is extremely important that the partnership is clear and understood by you.

You will be required to fulfill your end of the bargain, which is simple.

Keep your account in good standing by making at least the minimum monthly payments on time, and always keep your account up to date with your details. updated.

There will be no confirmation of your credit score, and the process we guarantee is Fast and Easy to make the Application for your beloved Freedom Gold Card.

Applying for your card: App

According to our research, although you can download the Horizon Outlet app to make your purchases and make some payments, you cannot request your Freedom Gold Card through the app.

Follow the instructions mentioned above on how to apply for your Freedom Gold Card through the official website.

It is the safest and most reliable way to access this credit tool.

Freedom Gold Card or FIT Mastercard®?

It is important always to be aware of credit market options. There will always be doors open, even for the worst score cases.

Here, we bring a comparison between the two of them.

| Freedom Gold Card | FIT Mastercard® | |

| Credit Score | No Credit Score Check | The FIT Mastercard® does not require a minimum credit score for approval |

| Annual Fee | $177.24 for a Membership Fee | $99 |

| Purchase APR | N/A | 22.99% |

| Cash Advance APR | N/A | 25.99% |

| Welcome Bonus | N/A | N/A |

| Rewards | N/A | N/A |

However, if you really need a card to make purchases more freely, then check the FIT Mastercard® and draw your conclusions.

Apply for the FIT Mastercard®

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Trending Topics

Credit Cards for No Credit: Find the Ideal Card in Our Selection

Explore credit cards for no credit in our selection. Discover the ideal card to build your credit history and offering tools!

Keep Reading

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Keep Reading

750 Credit Score: Is It Good?

Is 750 a good credit score? It can open doors to the best financial opportunities. Learn how to transform your creditworthiness!

Keep ReadingYou may also like

Revvi Card Review: Earn 1% cash back

Revvi Card: Cashback and points for those with bad credit! Low requirements are required, but pay attention to interest

Keep Reading

OpenSky® Secured Visa® Credit Card Review: poor credit accepted!

Get a credit card with a $200 credit limit with no credit check. Check our OpenSky® Secured Visa® Credit Card review!

Keep Reading

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Unlock the power of rewards with the Wells Fargo Active Cash® Card! Dive into our review and explore the world of real Cashback.

Keep Reading