Loans

FinChoice Personal Loans Review: Access Loans Up to R25,000 Quickly and Easily

In need of financial assistance? FinChoice provides loans of up to R25,000 through a simple online application process. Funds can be received within 24 hours. Learn more about how to apply here.

Advertisement

Fast approval and an interest-free option for new customers

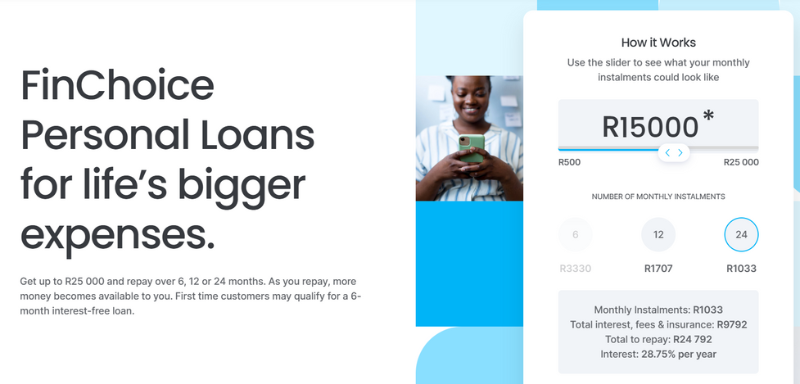

FinChoice Personal Loans are designed to cater to life’s larger expenses with loans of up to R25,000. Customers can choose repayment plans that span 6, 12, or 24 months, providing flexibility to align with their financial capabilities.

New customers might be eligible for a special 6-month loan with zero interest, offering a cost-effective borrowing option. As you repay, additional funds become available, offering continuous financial flexibility.

Apply online in just a few minutes and enjoy the convenience of having your funds transferred within 24 hours of approval. Keep reading to learn more about how FinChoice works for you.

- APR: 28.75% per year.

- Loan Purpose: For life’s bigger expenses.

- Loan Amount: Up to R25,000.

- Credit Score Requirement: Not specified.

- Origination Fee: Not specified.

Information provided by the official FinChoice website.

You will be redirected to another website

Advertisement

See the Features That Make Up the FinChoice Personal Loan

FinChoice offers flexible repayment options over three periods: 6, 12, or 24 months. Utilize the loan calculator to calculate your monthly payments and organize your finances efficiently.

For example, borrowing R15,000 for 24 months results in a monthly instalment of R1,033. Total costs, including interest, fees, and insurance, amount to R24,792.

First-time customers are eligible for a 6-month interest-free loan, allowing them to borrow without the burden of initial interest charges.

Additionally, FinChoice provides a unique “skip-a-payment” feature for tough financial months, ensuring customers maintain control during challenging times.

The Ins and Outs of Applying for the FinChoice Personal Loan

Applying for a FinChoice Personal Loan is a quick and seamless process that prioritizes customer convenience and security.

However, before we proceed, let’s examine the advantages and disadvantages of this financial product so that you can carefully consider whether it aligns with your specific needs. Please continue reading:

Advertisement

Advantages

- Quick Fund Transfer: Once approved, the loan amount is deposited into your account within 24 hours, ensuring immediate access to funds for urgent needs.

- Flexible Repayment Terms: Choose from repayment periods of 6, 12, or 24 months, allowing you to tailor your loan according to your budget and financial planning.

- Interest-Free Offer for First-Timers: First-time borrowers enjoy a 6-month interest-free loan, making it an affordable option to borrow without additional financial strain.

- Skip-a-Payment Feature: Manage unexpected financial challenges with the option to skip a payment during tough months without penalty, giving you greater financial control.

- Easy Online Application: The entire application process is 100% online, secure, and available 24/7, letting you apply from anywhere with convenience and safety.

Disadvantages

- High APR Rate: The annual interest rate is 28.75%, which may be higher compared to some other lenders, increasing the total repayment cost.

- Limited Loan Amount: The maximum loan amount is capped at R25,000, which may not suffice for borrowers needing larger sums for significant expenses.

- Origination Fee Information Missing: The website does not specify origination fees, leaving potential borrowers unsure about the total upfront costs involved.

- Credit score requirements: These are not specified, which may make it challenging for prospective borrowers to determine their eligibility before applying.

- Penalty for Delayed Documentation: While the loan approval process is quick, delays in submitting required documents can significantly postpone disbursement, which might inconvenience borrowers in urgent situations.

Advertisement

Ready to Order? Steps to Apply for FinChoice Personal Loans

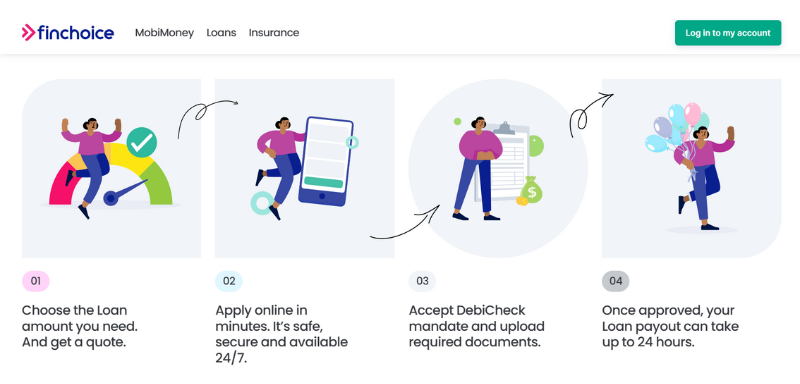

Thanks to their streamlined online application process, applying for a FinChoice Personal Loan is simple.

We’ll go over all the requirements and options for getting the loan. A step-by-step application guide will be provided at the end.

Requirements to Apply for a FinChoice Personal Loan

To qualify for a FinChoice Personal Loan, first and foremost, applicants must be South African residents aged 18 years or older. This ensures compliance with local regulations governing loan eligibility.

Additionally, applicants are required to provide a valid South African ID document. This step is crucial to verify the borrower’s identity and maintain a secure application process.

Proof of income must be submitted during the application. Acceptable documents include recent payslips or bank statements, helping FinChoice assess the borrower’s financial stability.

In addition to this, an active bank account is essential for loan disbursement. This account will also facilitate monthly repayments, ensuring seamless and efficient transaction management.

Finally, all applicants must agree to affordability checks as outlined by the National Credit Act. These measures promote responsible lending and safeguard borrowers from potential over-indebtedness.

Possible Ways to Apply for a FinChoice Personal Loan

FinChoice offers a variety of convenient ways to apply for their personal loans, ensuring accessibility and ease for all customers.

- Online Application: Visit the official FinChoice website and complete the application form by entering your details and uploading the required documents. This method is available 24/7.

- Mobile Application: Use your smartphone to apply directly on the FinChoice mobile-friendly platform. This option allows you to apply on the go, ensuring flexibility.

- Customer Support Assistance: Call the FinChoice customer service team at 0861 346 246 for help with your application. They can guide you through the process and ensure all steps are completed.

- Document Submission via WhatsApp: Send your documents, such as your ID and proof of income, via WhatsApp to 063 482 7799. This method is quick and convenient for those who prefer mobile communication.

- Email or Fax Submission: Email your application documents to [email protected] or fax them to 021 680 8257. This provides additional options for sending required documents securely.

These various methods make it easier for borrowers to apply for a FinChoice Personal Loan in a way that suits their preferences and schedules.

Follow these steps to apply for the loan

Begin by accessing the official FinChoice website to start your application. Use the loan calculator to determine the amount you need and the ideal repayment term. After choosing your loan amount, fill out the quick and easy online application, which is accessible 24/7 for your convenience.

Next, upload the required documentation, including proof of income and a valid ID document, to support your application. Accept the DebiCheck mandate, which facilitates secure monthly debit orders for seamless repayments.

Finally, upon approval, the loan amount will be deposited into your bank account within 24 hours, ensuring quick access to your funds.

FinChoice Personal Loans vs. Nedbank Loans

When comparing FinChoice Personal Loans to Nedbank Loans, FinChoice is ideal for smaller financial needs, offering loans up to R25,000 with flexible terms of 6, 12, or 24 months.

In contrast, Nedbank Loans provide amounts ranging from R2,000 to R400,000 with repayment terms of 6 months to 6 years, making them suitable for larger financial goals.

While FinChoice offers features like an interest-free loan for first-time borrowers, Nedbank stands out with cashback rewards and personalized interest rates tailored to credit profiles.

The table below highlights the primary differences between FinChoice Personal Loans and Nedbank Loans, helping you choose the option that best fits your financial needs.

| Feature | FinChoice Personal Loans | Nedbank Loans |

|---|---|---|

| Loan Amount | Up to R25,000 | R2,000 to R400,000 |

| Repayment Terms | 6, 12, or 24 months | 6 months to 6 years |

| APR | 28.75% per year | 18% to 29.25%, depending on credit profile |

| Unique Benefits | Interest-free loan for first-time borrowers, skip-a-payment option | R200 monthly cashback for Nedbank account repayments, Greenbacks rewards |

| Application Process | 100% online, with document uploads and quick approvals | Online, via Money App, or in-branch with instant feedback |

| Disbursement Time | Up to 24 hours after approval | Immediate upon approval |

| Fees | Not specified | R1,207.50 initiation fee, R69 monthly service fee |

| Eligibility | Not specified (affordability checks apply) | Proof of ID, income, and 3 months’ bank statements |

Both FinChoice Personal Loans and Nedbank Loans offer valuable solutions tailored to different financial needs. While FinChoice excels in flexibility for smaller loans, Nedbank caters to larger financial goals with competitive rates and unique rewards.

If you’re considering a loan with higher amounts and added benefits like cashback rewards, visit our next article for detailed insights about Nedbank Loans and their offerings.

Nedbank Loan

Looking for a loan with rewards? Nedbank Loans offer cashback, clear terms, and a seamless online application. Borrow up to R400,000!

The information on this page is accurate as of January 21, 2025, but some offers may no longer be available.

Trending Topics

Hippo Loans Review: financial solutions up to R$350,000

Discover how Hippo Loans simplify borrowing. Apply now for a fast, transparent, and efficient loan experience tailored for you.

Keep Reading

Boodle Loan Review: Instant Cash Loans Up to R8,000

Discover how Boodle Loan provide instant financial relief with easy online applications and responsible lending practices.

Keep Reading

Blink Finance Loans Review: Borrow Up to R8,000 with a Few Clicks

Looking for a fast, reliable loan in South Africa? Blink Finance has you covered. Apply for up to R8,000 today with no hidden surprises!

Keep ReadingYou may also like

Hoopla Loans Review: find reliable lenders and get up to R250,000

Hoopla Loans offers fast loan approvals for South Africans. Discover flexible repayment terms and secure credit access today.

Keep Reading

Nedbank Loan Review: Loans of R2,000 to R400,000

Looking for a loan with cashback benefits? Nedbank Personal Loan gives you R200 monthly cashback and flexible repayment terms.

Keep Reading

African Bank Personal Loan Review: Access up to R250,000

Learn how African Bank personal loans offer security and convenience. Find out loan features, application steps, and benefits here.

Keep Reading