Credit Cards

Apply for Wells Fargo Active Cash® Card: Cashback for real

Learn to apply for the Wells Fargo Active Cash® Card and embrace genuine cashback. Quick and simple application process!

Advertisement

A guide to unlocking 2% unlimited cashback on every purchase!

The Wells Fargo Active Cash® Card is an easily applicable card. You can apply online or through the Wells Fargo Mobile® app.

Check out the definitive step-by-step guide on becoming another happy member of the Wells Fargo Active Cash® Card club. Keep reading!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Advertisement

Applying for your card: Online

Applying for the Wells Fargo Active Cash® Card online is genuinely straightforward and intuitive.

Visit the Wells Fargo website, click on the “Credit Cards” link, and look for our beloved Wells Fargo Active Cash® Card.

Next, fill out the application form with your personal and financial information! They will request only your basic information!

Next, submit the form and wait for the result! It is quick and simple! So don’t hesitate in getting your Wells Fargo Active Cash® Card!

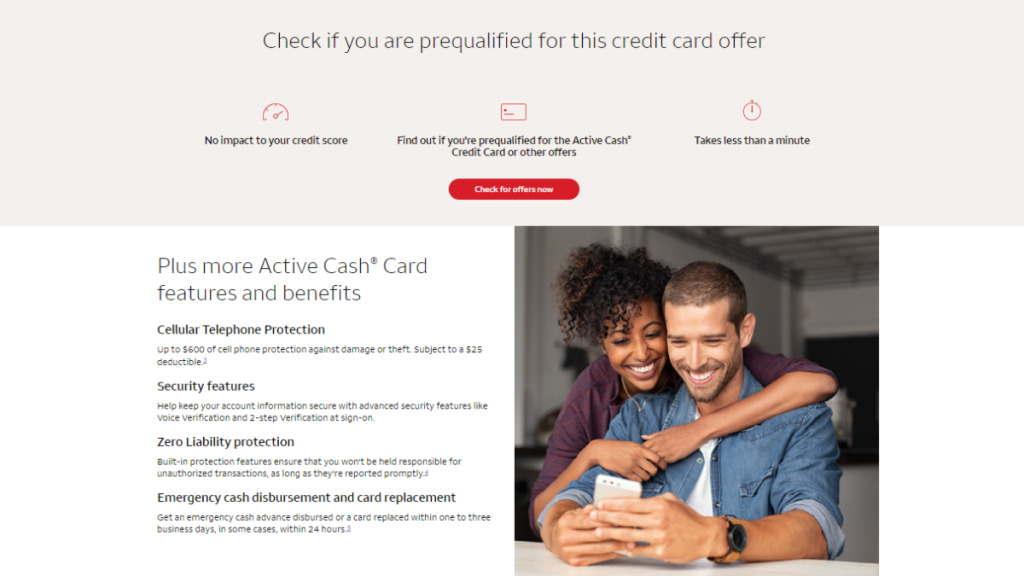

Requirements

To be approved for the Wells Fargo Active Cash® Card, you must have a credit score of at least 670.

You’ll also need a positive credit history, free of unpaid debts or payment delays.

The documentation is basic; you only need your social security number, proof of income, and address. It’s a quick and simple process.

Advertisement

Applying for your card: App

An even more agile option is to apply for the Wells Fargo Active Cash® Card through the app, available in the top app stores.

Download the Wells Fargo Mobile® app on your mobile device and follow the on-screen instructions to complete the application.

If you don’t have an account yet, you might need to create one now.

After that, the process is straightforward, and you’ll receive your feedback shortly. Good luck!

Wells Fargo Active Cash® Card or Wells Fargo Reflect® Card?

But, of course, if the Wells Fargo Active Cash® Card isn’t quite what you’re looking for, here’s another option to consider: the Wells Fargo Reflect® Card.

This card offers an ultra long intro APR on purchases! Check out a quick comparison of both credit cards!

| Wells Fargo Active Cash® Card | Wells Fargo Reflect® Card | |

| Credit Score | Good to Excellent; | 660 or higher; |

| Annual Fee | Free; | No annual fee; |

| Purchase APR | 0% for 15 months, then 20.24%, 25.24% or 29.99%; | 0% for 21 months, thereafter 18.24%, 24.74%, or 29.99% variable based on the U.S. Prime Rate; |

| Cash Advance APR | 29.99%; | 29.99% variable based on the U.S. Prime Rate; |

| Welcome Bonus | $200 when spending$500 in purchases in the first 3 months; | None; |

| Rewards | 2% Cashback on all purchases. | None. |

Up next, discover how to apply for the Wells Fargo Reflect® Card! Ensure a quick and simple application process!

Apply for Wells Fargo Reflect® Card: 0% intro APR

Here's what you need to get 21 months of 0% interest; find out how to apply for your Wells Fargo Reflect® Card. The article is fresh!

Trending Topics

Apply for Total Visa® Card: Recover with it!

Apply Total Visa® Card and elevate your credit score while earning cashback! Take the next step in your financial journey!

Keep Reading

Apply for the FIT Mastercard®: The start of a new phase!

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Keep Reading

Upgrade Life Rewards Visa® review: No annual fee!

Discover the perks and pitfalls of the Upgrade Life Rewards Visa® card in our latest review. Up to 10% cash back + up to $25K credit line!

Keep ReadingYou may also like

How to Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card

Get the Petal® 1 "No Annual Fee" Visa® Card and build your credit! Pre-approval without affecting your score. Request now!

Keep Reading

Mission Lane Visa® Credit Card Review: Put your score back on track

Mission Lane Visa® Credit Card will review your credit history before making any hard check on your score. Keep the benefits with you!

Keep Reading

Apply for Walmart MoneyCard®: Up to 3% cash back

Apply for the Walmart MoneyCard® hassle-free and enjoy a cashback experience! Discover how to escape annual fees!

Keep Reading