Credit Cards

How to Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card

The Petal® 1 "No Annual Fee" Visa® Credit Card is an ideal card for those who are starting to build their credit or have a good credit score.

Advertisement

Your score increases as you make your purchases

See now how to apply for your Petal® 1 “No Annual Fee” Visa® Credit Card. The best news is that there is a pre-approval process!

Below, we have grouped just what matters about the Petal® 1 “No Annual Fee” Visa® Credit Card for you to apply through your credit builder!

Applying for your card: Online

The Petal® 1 “No Annual Fee” Visa® Credit Card website is really very simple and dynamic.

On it, you can compare the rates and other product information and rush to request yours.

The process is basic. After filling in your details, you will be directed to a waiting page.

The turnaround is quick, and you can leave with the good news on the same day, thanks to pre-approval.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

The requirements start right away in relation to the credit score.

As much as the Petal® 1 “No Annual Fee” Visa® Credit Card is a card designed to build credit.

It is not a card for those with a bad or fair score but rather for those who are just starting their credit journey or have already achieved a good credit.

In addition, proof of income, address, identity, and other standard documents will be required.

Did you see how easy it is to apply for a Petal® 1 “No Annual Fee” Visa® Credit Card?

Applying for your card: App

You can download the Petal App from the Apple App Store and Google Play.

After locating the app and installing it on your Android smartphone or iPhone, simply log in.

If you don’t already have a WebBank account, you must create one.

After that, find Petal® 1 “No Annual Fee” Visa® Credit Card in the list of cards and ask for yours.

Registration is simple, and the form will be filled out quickly. Provide the other documentation and wait for your return.

Petal® 1 “No Annual Fee” Visa® Credit Card or Wells Fargo Active Cash® Card?

In the process of building your credit score, it is very important to choose which tool will help you in this endeavor.

That’s why we bring another option for comparison.

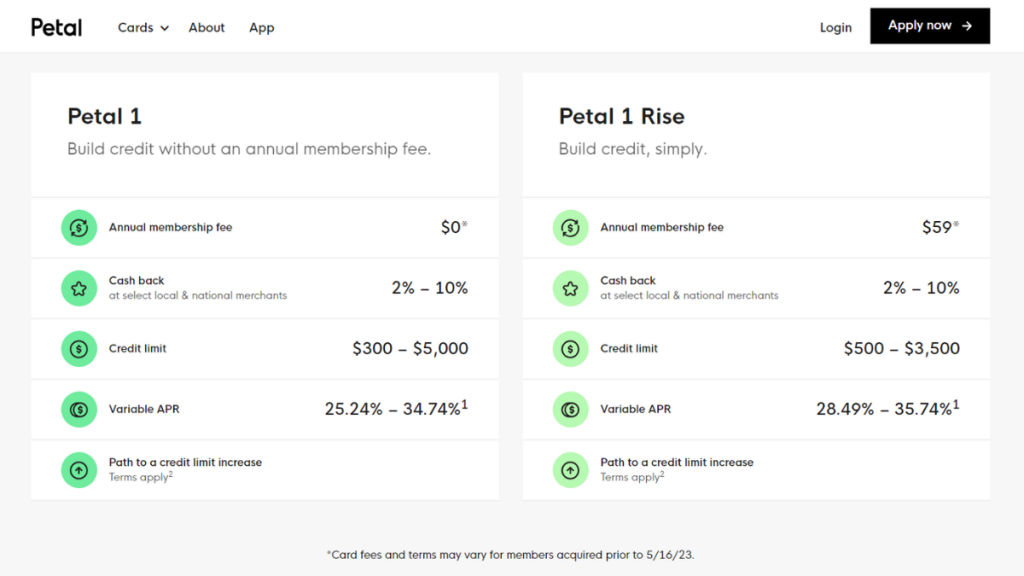

| Petal® 1 “No Annual Fee” Visa® Credit Card | Wells Fargo Active Cash® Card | |

| Credit Score | Good, from 670; | Good to Excellent; |

| Annual Fee | $0; | $0; |

| Purchase APR | From 25.24% to 34.74%; | 0% for 15 months, then 20.24%, 25.24% or 29.99%; |

| Cash Advance APR | N/A; | 29.99%; |

| Welcome Bonus | N/A; | $200 when spending $500 in purchases in the first 3 months; |

| Rewards | Cashback of 2% to 10% at select merchants. | 2% Cashback on all purchases. |

The Wells Fargo Active Cash® Card is another free option that is specially designed to help you get a better credit score.

Get 0% introductory interest for 15 months on purchases and qualifying balance transfers.

It also has a straightforward Cashback program. Find out more!

Apply for Wells Fargo Active Cash® Card

Unlock real cashback with the Wells Fargo Active Cash® Card! Whether applying online or via the app, it's simple and quick. Explore now!

Trending Topics

Apply for Reflex® Platinum Mastercard®: Free monthly credit score

Discover how to apply for the Reflex® Platinum Mastercard® and double your credit! Don't miss your chance - read now!

Keep Reading

Apply for the Revvi Card: It’s time to change your score!

Revvi Card: Application in seconds to change your score! No pain, no delay. Take it step by step! See what you need

Keep Reading

Apply for Freedom Gold Card: Solve your credit problem!

Follow the secrets behind applying for the Freedom Gold Card, see the best way to apply for $750 to your credit, and the main advantages!

Keep ReadingYou may also like

Aspire® Cash Back Reward Card Review: Utility Bill Perks

Explore our Aspire® Cash Back Reward Card review for a 3% cashback on utilities and gas, plus a credit score boost with every purchase.

Keep Reading

Chime® Debit Card Complete Review: No fees, no Hassle!

Unlock the full potential of your finances with our comprehensive Chime® Debit Card Review. Find out with our detailed insights!

Keep Reading

First Access Visa® Card Review: A Gateway to Credit Accessibility

First Access Visa® Card Review: Explore a pathway to credit accessibility with 1% cashback rewards. Is it worth it? Discover it!

Keep Reading