Credit Cards

Apply for OpenSky® Secured Visa® Credit Card: build credit

If you have chills thinking about paperwork, rest easy if you decide to apply for the OpenSky® Secured Visa® Credit Card. The process will take you minutes, and you can do it from anywhere.

Advertisement

With only $200, you can already get your OpenSky® Secured Visa® Credit Card

This post will show you how to apply for the OpenSky® Secured Visa® Credit Card in minutes. Because we know time is money, and you must save yours.

This credit card application will not touch your credit score. So you can apply without worries! Let’s see how you can do it.

Applying for your card: Online

Gone are the days when we had to walk all the way to the bank with a folder full of documents. Apply for the OpenSky® Secured Visa® Credit Card online!

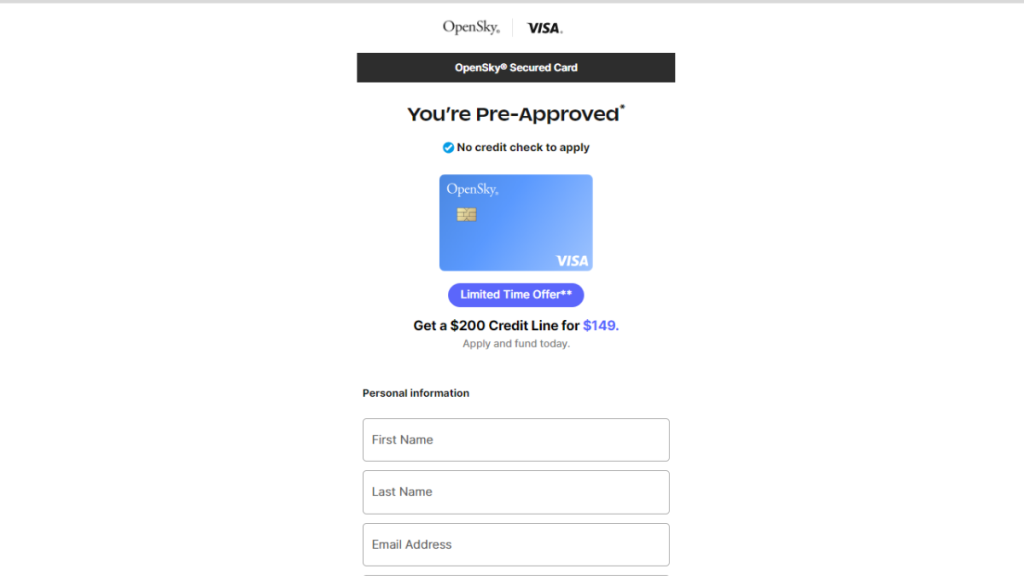

First, go to the OpenSky website. Ensure you’re on the right website, as you’ll provide personal information.

Then, find the “apply now” button and get to the application form. It will be pretty intuitive, and you must answer each question.

Now, pay close attention to the info you are providing. If you have one wrong digit in your Social Security Number, OpenSky will not be able to check your identity.

Once you’ve submitted the form, your information will be reviewed. If everything is right, you can get your approval within 1 to 2 business days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Requirements

- Proof of income;

- US residency;

- Social Security Number;

- A security deposit of at least $200 to establish your credit limit.

Applying for your card: App

Nowadays, it seems like our whole lives are inside our cell phones. And that is also true for your financial management.

Even though you can not apply for the card using the mobile app, you must for sure download it after you get approved.

After all, it will make everything easier. From checking your card balance and payments to monitoring your credit score.

The OpenSky mobile app is available for both Android and iOS phones.

OpenSky® Secured Visa® Credit Card or GO2Bank Secured Visa® Credit Card?

So, this is all we have to tell you about the OpenSky® Secured Visa® Credit Card by now. Do you think it matches your wallet?

We will give you something to compare if you need a moment to consider. Say hello to the GO2Bank Secured Visa® Credit Card. Yes, another secured credit card.

We’ll stay in the secured cards lane to show you how it can be a good move on your financial strategy. Again, you don’t need a good credit history to apply for this one.

| OpenSky® Secured Visa® Credit Card | GO2Bank Secured Visa® Credit Card | |

| Credit Score | Any credit score is accepted; | No credit check: check; |

| Annual Fee | $35; | Zero plus zero, forever; |

| Purchase APR | 25.64%; | 22.99%; |

| Cash Advance APR | 25.64%; | 26.99%; |

| Welcome Bonus | No bonus for new cardholders; | None; |

| Rewards | You’ll get no rewards out of this plastic. | GO2Bank has no rewards program for this credit card. |

But we will not leave you with so little information. The following link will take you to our GO2Bank Secured Visa® Credit Card review.

Keep learning, and keep preparing yourself to crush the credit game.

Apply for GO2bank Secured Visa® Credit Card

Learn how to apply for the GO2bank Secured Visa® Credit Card and discover a better way to use your money and build a credit score!

Trending Topics

Wells Fargo Active Cash® Card Review: Activate the rewards mode

Unlock the power of rewards with the Wells Fargo Active Cash® Card! Dive into our review and explore the world of real Cashback.

Keep Reading

Apply for the Boost Platinum Card: qualify with bad credit

Shop without fear, even with a low credit score! Learn in this article how to apply and enjoy the power of the Boost Platinum Card!

Keep Reading

How to Build Credit: 5 Tips for Fast Results

Discover how to build credit quickly with 5 practical tips. Learn how to use credit cards wisely to boost your credit history!

Keep ReadingYou may also like

Credit Cards for No Credit: Find the Ideal Card in Our Selection

Explore credit cards for no credit in our selection. Discover the ideal card to build your credit history and offering tools!

Keep Reading

750 Credit Score: Is It Good?

Is 750 a good credit score? It can open doors to the best financial opportunities. Learn how to transform your creditworthiness!

Keep Reading

Apply for Chime® Debit Card: Ordering is easy!

Apply for the Chime® Debit Card effortlessly with our quick and secure online guide. Say goodbye to fees and hassles!

Keep Reading