Credit Cards

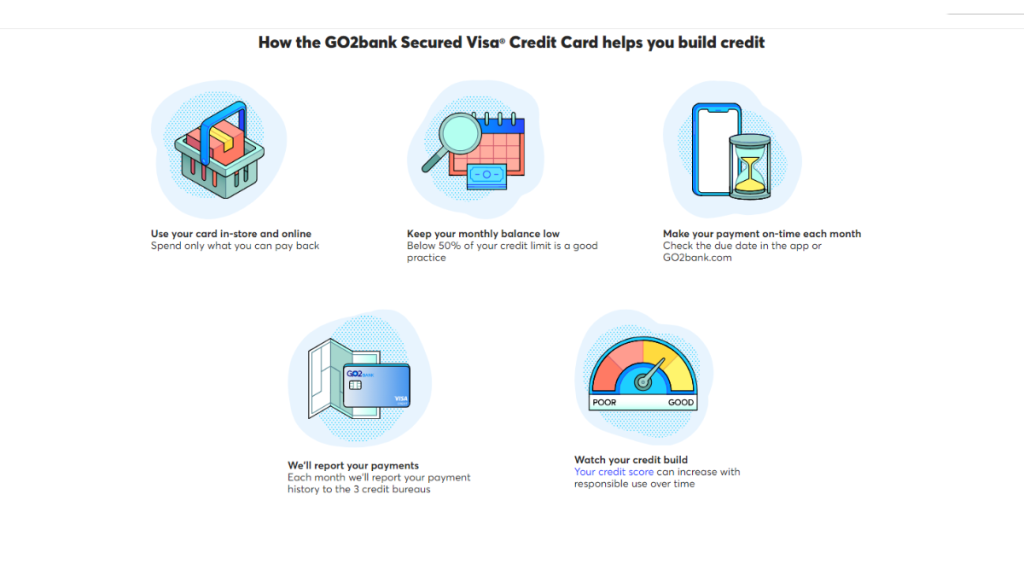

Apply for GO2bank Secured Visa® Credit Card: build credit

You can start a brilliant credit history with a simple financial product like a secured credit card. Learn how to apply for the GO2bank Secured Visa® Credit Card!

Advertisement

The $0 annual fee gets even better with no credit check to apply!

We’ll guide you through the steps to apply for a GO2bank Secured Visa® Credit Card. But you’ll see that the journey is straightforward and smooth.

Reaching your goal of having a credit to be proud of will gain a helpful ally. Keep reading and understand the application process this card.

Applying for your card: Online

Before we start, let’s remember that it’s necessary to have an account with GO2Bank. Yes, this card is an exclusive product for customers of this bank.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Open your GO2Bank account

Firstly, access the GO2Bank website or download the app. There, you can open your account to gain access to the GO2bank Secured Visa® Credit Card.

The process is quite familiar to anyone who has had to open a bank account before.

Expect to be asked for your personal and financial information. Rest assured: the process is secure.

Once your account is open, you can proceed and apply for the GO2bank Secured Visa® Credit Card.

Ask for your GO2bank Secured Visa® Credit Card!

Now that your account is active, simply transfer at least $100 to it within 3 months.

After this period, you can request the GO2bank Secured Visa® Credit Card.

But remember that you need to make a security deposit to determine your credit limit. It’s easy. Just transfer directly from your GO2Bank account!

Requirements

GO1Bank keeps it simple. The requirements to open your account and request your GO2bank Secured Visa® Credit Card are as follows:

- Be 18 years old.

- Reside in the USA.

- Provide documents for proof of identity and residence.

- Provide your SSN (as required by federal law).

Applying for your card: App

All the previous steps can be done directly through the app!

This way, you get familiar with the app that will accompany you on your financial journey.

Download the app on your mobile phone. You can find the links on the website to ensure you download the correct app.

GO2bank Secured Visa® Credit Card or FIT Mastercard® credit card?

Even with all the benefits a secured credit card can offer, some people are unwilling to pay the security deposit.

Or maybe they don’t have it right now but need credit ASAP.

If that’s the case, you can always check the market for unsecured credit cards designed for low scores. One of these options is the FIT Mastercard®.

Check the comparative table:

| GO2bank Secured Visa® Credit Card | FIT Mastercard® | |

| Credit Score | No credit check; | Accepts poor credit score |

| Annual Fee | $0; | $99 annual fee; |

| Purchase APR | 22.99%; | 22.99%; |

| Cash Advance APR | 26.99%; | 25.99%; |

| Welcome Bonus | No welcome bonus; | None; |

| Rewards | No rewards. | None. |

If this credit card alternative seems like a more favorable game for you. read our full review and get more information about it.

Apply for the FIT Mastercard®

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Trending Topics

Top Books on Financial Literacy: Invest in Your Future!

Explore the top books on financial literacy and invest in your future! Unlock the keys to financial freedom with these must-reads.

Keep Reading

Apply for Total Visa® Card: Recover with it!

Apply Total Visa® Card and elevate your credit score while earning cashback! Take the next step in your financial journey!

Keep Reading

Apply for Wells Fargo Active Cash® Card: Cashback for real

Unlock real cashback with the Wells Fargo Active Cash® Card! Whether applying online or via the app, it's simple and quick. Explore now!

Keep ReadingYou may also like

Revvi Card Review: Earn 1% cash back

Revvi Card: Cashback and points for those with bad credit! Low requirements are required, but pay attention to interest

Keep Reading

Apply for the FIT Mastercard®: The start of a new phase!

Ready for a credit transformation? Learn how to apply for the FIT Mastercard® effortlessly and embark on a journey to better credit.

Keep Reading

How to Apply for the Petal® 1 “No Annual Fee” Visa® Credit Card

Get the Petal® 1 "No Annual Fee" Visa® Card and build your credit! Pre-approval without affecting your score. Request now!

Keep Reading