Debit Cards

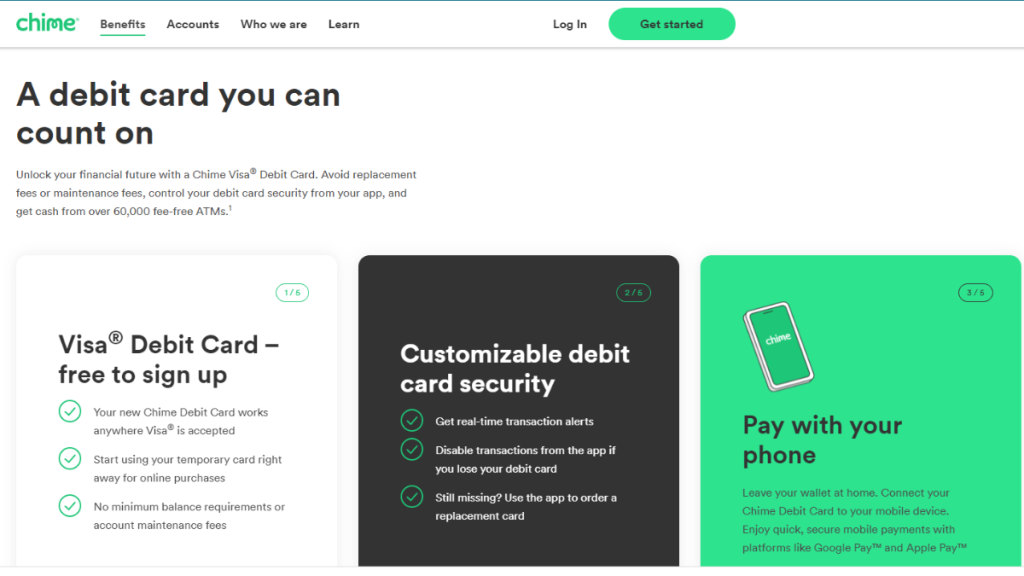

Apply for Chime® Debit Card: Ordering is easy!

Learn how to apply for the Chime® Debit Card online effortlessly. This comprehensive guide ensures a hassle-free process, eliminating fees and surprises.

Advertisement

Get rid of fees and other nuisances. It’s the real deal!

Did you discover the benefits of the Chime® Debit Card? Then, take that final look before taking it home. Here’s a how-to-apply guide without doubts and with confidence.

Forget everything you thought you knew about debit cards. This option will surprise you with its simplicity and security. Read until the end and ensure all the information.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Advertisement

Applying for your card: Online

All of this is done online and really quickly. The sign-up process can be completed in just a few minutes. Before you know it, you’ll eagerly await your Chime® Debit Card in the mail.

To apply, you must provide your name, address, date of birth, and social security number. After that, simply click proceed, and your account will be ready.

Afterward, you can jump into the app or continue through the website. Following along here? Let’s go together. Set up your account or link it to an existing checking account.

Shortly after approval, you can start using your Chime® Debit Card. That’s because, even before it arrives in the mail, a temporary online version will be available.

The physical and final version of the Chime® Debit Card will arrive within 10 days. And then you can proudly show it off in your wallet. See how easy it is to apply for the Chime® Debit Card?

Requirements

According to Chime’s information, the requirements to apply for a Chime® Debit Card are straightforward. You just need to be a U.S. citizen or resident.

The minimum age is 18, and you must provide your Social Security Number (SSN). All of this is to ensure it’s not a fraudulent application. It’s for your safety!

In addition to these requirements, Chime may also request additional information, such as proof of income or proof of residence. Therefore, have this information readily available.

Advertisement

Applying for your card: App

As mentioned earlier, after completing your registration, you can choose between the website or the app. In other words, you can apply for the Chime® Debit Card with complete convenience.

The basic documentation should be submitted as usual. Then, simply monitor your account, transactions, and other financial activities. All at your fingertips!

Chime® Debit Card or Avant Credit Card?

Now, let’s talk about another type of card. An option for those who need to build their credit score and make purchases on credit. Move a step forward in the financial game with this.

| Chime® Debit Card | Avant Credit Card | |

| Credit Score | Not required | 580; |

| Annual Fee | $0; | Variable membership fee from $0 to $75; |

| Purchase APR | 0%; | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Cash Advance APR | 0%; | From 29.24% to 35.24% Variable based on the Prime Rate; |

| Welcome Bonus | SpotMe: Up to $200 revolving credit; | N/A; |

| Rewards | None. | N/A. |

It gives you the opportunity to eliminate the annual fee. All you need to do to avoid unpleasant surprises is to use the Avant Credit Card, paying attention to the APR interest rates.

Apply for Avant Credit Card

Boost your credit score now! Get the Avant Card: quick approval, no credit score minimum, build real credit!

Trending Topics

Apply for the Upgrade Life Rewards Visa®: up to 3% cash back

Unlock the secrets to a rewarding financial journey with our step-by-step guide on how to apply for the Upgrade Life Rewards Visa® card!

Keep Reading

Upgrade Select Visa® review: Flexible credit limits!

Looking for a great card? Discover the Upgrade Select Visa® card in our comprehensive review! Amazing welcome bonus and exclusive perks!

Keep Reading

Chime® Debit Card Complete Review: No fees, no Hassle!

Unlock the full potential of your finances with our comprehensive Chime® Debit Card Review. Find out with our detailed insights!

Keep ReadingYou may also like

Apply for the Upgrade Select Visa®: No late fees!

Unlock the steps to financial empowerment with our guide on how to apply for the Upgrade Select Visa® Card! Up to $2K credit limit!

Keep Reading

First Access Visa® Card Review: A Gateway to Credit Accessibility

First Access Visa® Card Review: Explore a pathway to credit accessibility with 1% cashback rewards. Is it worth it? Discover it!

Keep Reading

Unique Platinum Review: $1000 limit, no credit check!

The Unique Platinum card will not review your credit history to give you a $1000 credit line. Quick and simple!

Keep Reading